[ad_1]

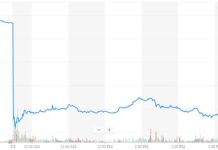

New research from Diar has revealed that while the price of bitcoin remains 40 percent higher than a year ago, and bitcoin miners have achieved record revenues of $4.7 billion this year, a host of factors including increased competition and computing power have combined to make bitcoin mining less profitable than before. The report says that this creates a situation that imperils smaller mining operations and places larger mining pools at an advantage in the struggle to survive.

Role of Equipment and Energy Costs

According to the research, China remains one of the few countries which offers retail energy price packages that make commercial sense for bitcoin mining, with a midpoint cost of about $0.08/kWH. That notwithstanding, rents, salaries, equipment, and other overheads could quickly render an amateur mining enterprise insolvent.

All of this adds up to a market situation that favors the survival of large mining pools such as those owned by Bitmain over smaller mine operators. Bitmain on its part recently released data showing that it is, in fact, more dependent on sales of its Antminer ASIC mining devices than anything else, with 95 percent of its H1 2018 revenues coming from miner sales.

The data also shows that Bitmain’s mining strategy is directly linked to its sales strategy for its mining units. According to Diar, Bitmain’s 11 mining facilities in China along with its soon-to-be-opened facilities in Tennessee, Texas and Washington State could see the company position itself as a swing producer controlling a significant portion of the bitcoin blockchain’s hashrate with the ultimate goal of ensuring that mining remains profitable for all miners. When miners make money the reasoning goes, they will be more likely to buy more mining hardware.

As a by-product of this, of course, Bitmain’s mining pools also remain profitable, which is especially important for its new North American operations which are substantially more expensive to run than its Chinese installations due to higher energy costs.

Giving a verdict on the current state of the bitcoin mining market the report says:

“It’s unlikely then that the recent tapering out of the Hash power to last. With big mining operations on low electricity costs running at anywhere between 50-60% gross profit from Bitcoin revenues, the market has a lot of room left to grow and, profits to squeeze. But Bitcoin mining has, at least for now, and most likely in the future, moved into the court of bigger players with deep pockets.”

The full Diar report is available here.

Featured image from Shutterstock.

Follow us on Telegram or subscribe to our newsletter here.

• Join CCN’s crypto community for $9.99 per month, click here.

• Want exclusive analysis and crypto insights from Hacked.com? Click here.

• Open Positions at CCN: Full Time and Part Time Journalists Wanted.

Advertisement

[ad_2]

Source link