[ad_1]

Over the past several days, there has been much debate within cryptocurrency circles about a series of videos and images allegedly showing Chinese crypto mining firms dumping bitcoin miners on the street.

BRUTAL: this is what’s happening now in a China based mining site …. 😨😨 pic.twitter.com/gcN4lVTyBt

— Dovey Wan 🦖 (@DoveyWan) November 20, 2018

To some observers, the video and images demonstrated that crypto miners — even those located in China, where low energy rates provide greater profit margins — were beginning to feel the pinch from bitcoin’s prolonged bear market. If miners were dumping ASICs on the street, it not only meant that the bitcoin price had reached their “shutdown-mark,” the point at which miners can no longer turn a profit running the machines, but also that they didn’t think these devices would ever be profitable again.

Others alleged that the pictures had actually been taken in July following a flood that destroyed thousands of mining rigs hosted in China’s Sichuan province and that the original posters were spreading them to stir up FUD. However, as tends to be the case, the truth is likely a bit more complicated.

Speaking in an interview with Asia Crypto Today, Hu Jie of Si Hua Mining — a local ASIC supplier — said that the pictures appeared to be genuine but depicted miners dumping older-generation devices such as the Antminer S7 and V9. When ASIC rigs become obsolete, he explained, it is common for large Chinese mining farms to sell them as scrap metal.

“Of course old models are out of the game, like the picture shows. But that doesn’t represent the majority,” he said in translated remarks. “Electronics become outdated easily. For example, smartphones like iPhone 3, 4, of course they can be sold by the pound. It’s normal life cycle.”

That’s one downside to ASIC mining. Unlike GPU chips, which can be repurposed when mining ceases to be profitable, ASIC chips are programmed exclusively for a single application. Consequently, they are rendered obsolete much more quickly, and once that happens, their use cases become more or less limited to expensive doorstop or oversized paperweight.

Bitcoin Network Hash Rate Down 25 Percent from Peak

But though these bitcoin miners were fated for relocation to the scrap heap one way or another, there’s no denying that 2018’s massive crypto market decline hastened their obsolescence.

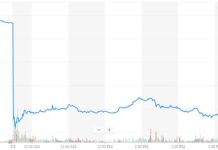

Indeed, since peaking at an all-time high near 55EH in early October, the Bitcoin network’s average weekly hashrate has dropped by nearly 25 percent to 42EH as of Nov. 21, suggesting that profit-driven miners at the margins are being forced out of the market.

Even so, eToro Senior Market Analyst Mati Greenspan said that the hash rate decline is a healthy development, given how sharply it had risen in response to last year’s bull market.

“Bitcoin’s hash rate has indeed dropped in the last few weeks but this is not at all concerning,” Greenspan said in daily market commentary shared with CCN. “It’s actually comforting as the rate has risen so sharply over the course of the year and is now returning to normalized levels.”

Featured Image from Shutterstock

[ad_2]

Source link