[ad_1]

Learn how to trade using support and resistance levels

Support and resistance is a powerful pillar in trading and most strategies have some type of support/resistance (S/R) analysis built into them. Support and resistance tends to develop around key areas that price has regularly approached and rebounded thereafter. This article explains what support and resistance is and covers top support and resistance trading strategies.

At DailyFX, we have a dedicated support and resistance page showing areas of support and resistance for top currency pairs, commodities, indices and cryptocurrencies

What is Support and Resistance?

Support and resistance is one of the most widely followed technical analysis techniques in the financial markets. It is a simple method to analyze a chart quickly to determine three points of interest to a trader:

- The direction of the market

- Timing an entry in the market

- Establishing points to exit the market at either a profit of loss

If a trader can answer the three items above, then they essentially have a trading idea. Identifying levels of support and resistance on a chart can answer those questions for the trader.

Support

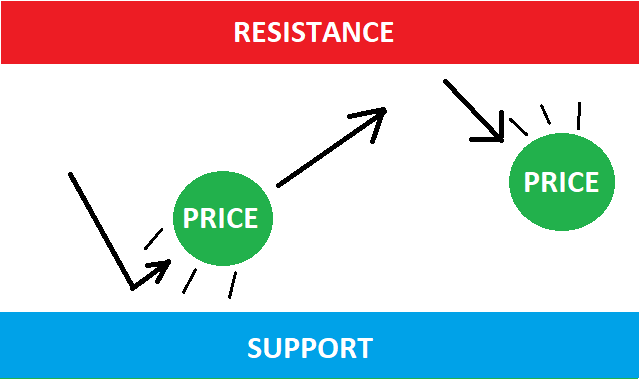

Support is an area on a chart that price has dropped to but struggled to break below. The chart above shows how price drops down to the area of support and subsequently ‘bounces’ sharply from this level.

In theory, support is the price level at which demand (buying power) is strong enough to prevent the price from declining further. The rationale is that, as the price gets closer and closer to support, and becomes cheaper in the process, buyers see a better deal, and are more likely to buy. Sellers become less likely to sell, since they are getting a worse deal. In that scenario, demand (buyers) will overcome supply (sellers) and that will prohibit price from falling below support.

Resistance

Resistance is an area on a chart that price has risen to but struggled to break above. The chart above shows how price rises up to the area of resistance and subsequently “bounces” sharply from this level.

Resistance is the price level at which supply (selling power) is strong enough to prevent the price from rising further. The rationale behind this is that as the price gets closer and closer to resistance, and becomes more expensive in the process, sellers are more likely to sell and buyers become less likely to buy. In that scenario, supply (sellers) will overcome demand (buyers) and that will prohibit price from going above resistance.

For a comprehensive guide, read our page on Forex Support and Resistance Explained.

Top 4 Support and Resistance Trading Strategies

Below are four top strategies for trading with support and resistance:

1) Range trading

Range trading takes place in the space between the support and resistance as traders aim to buy at support and sell at resistance. Think of the area between support and resistance as being a room. Support is the floor and resistance the ceiling. Ranges tend to appear in sideways trading markets where there is no clear indication of a trend.

Pro Tip – Levels of support and resistance are not always perfect lines. Sometimes price will bounce off a particular area, rather than a perfect straight line.

Traders need to identify a trading range and therefore, need to identify areas of support and resistance. The area of support and resistance can be identified and is shown in the chart below:

When the market is range-bound, traders tend to look for long entries when price bounces off support and short entries when price bounces off resistance.

It is clear to see that price has not always respected the bounds of support and resistance which is why traders should consider setting stops below support when long, and above resistance when going short.

When price does break out of the defined range, this can either be due to a breakout or a false breakout, also known as a “fakeout”. It is essential to adopt sound risk management to limit downside risk when markets breakout of the trading range.

2) Breakout strategy (pullback)

It is often the case that after a period of directional uncertainty that price will breakout and begin trending. Traders often look for such breakouts below support or above resistance in order to capitalize on further increasing momentum in one direction. If this momentum is strong enough it will have the potential to start a new trend.

However, in an attempt to avoid falling into the trap of trading the false breakout, top traders tend to wait for a pullback (towards support or resistance) before committing to a trade.

For example, the chart below shows a strong level of support before sellers pushed the price down below support. Many traders might get carried away and rush to place a short trade prematurely. Instead, traders should wait for the response in the market (buyers attempting to gain control) to break down before executing a short trade.

In the below scenario, traders should wait for the market to continue moving down, after the pullback, before looking for entry points.

3) Trendline strategy

The trendline strategy utilizes the trendline as either support or resistance. Simply draw a line connecting two or more highs in a downtrend, or two or more lows in an uptrend. In a strong trend, price will bounce off the trendline and continue to move in the direction of the trend. Therefore, traders should only be looking for entries in the direction of the trend for higher probability trades.

4) Using Moving averages as support and resistance

Moving averages can double up as dynamic support and resistance. Popular moving averages to include are the 20 and 50 period moving averages, which can be altered slightly to 21 and 55 period moving averages to make use of Fibonacci numbers. It is not uncommon for traders to incorporate the 100 and 200 MAs and ultimately, it is up to the trader to find a setting that they are comfortable with.

From the chart below, it is clear to see that the 55 MA initially tracks above the market as a line of resistance. The market then bottoms and reverses and the 55 MA then becomes the dynamic level of support. Traders can use these trendlines to make informed decisions about markets likely to continue trending and those susceptible to a breakout.

Support and Resistance Trading Key Takeaways

- Support and resistance is a powerful pillar in trading and most strategies have some type of support/resistance analysis built into them.

- Support and resistance strategies can either be based on price respecting these levels (range bound strategy) or anticipating the break of support and resistance (Breakout and pullback strategies).

- Price will not respect support and resistance forever. Bearing this in mind, traders need to adopt sound risk management to limit losses if there is a breakout.

Learn More About Technical Analysis in Forex Trading

[ad_2]

Source link