[ad_1]

By CCN: Gold may have a value of $7.8 trillion, but it isn’t happy about giving any of that up to bitcoin, the latter of which has a market cap of $97.2 billion. A day after Grayscale unleashed its “Drop Gold promotion, a TV commercial that garnered 100,000 views in less than 24 hours, the World Gold Council is clapping back. Gold’s reputation as a store of value has gone pretty much uncontested for thousands of years – until bitcoin, which has earned the reputation as digital gold in addition to its use case as a currency.

In a tweet, the Council stated:

“Cryptocurrencies are no replacement for gold.”

The team at the World Gold Council probably didn’t know what hit them when the phones most likely started ringing off the hook with calls from people wanting to learn more about this digital gold called bitcoin.

‘Cryptocurrencies are no replacement for gold’. Read more from our Manager of Investment Research, Adam Perlaky, on our #Goldhub blog: https://t.co/i2lMxZrMEF pic.twitter.com/KKFAB2u3b7

— World Gold Council (@GOLDCOUNCIL) May 2, 2019

David vs. Goliath

The World Gold Council didn’t stop there and published a blog outlining the features differentiating the precious metal from cryptocurrencies. They state:

“Although cryptocurrencies and blockchain technology look promising as a whole, they clearly do not represent a substitute for gold either in theory or in practice.”

Basically, they suggest gold is better for the following reasons:

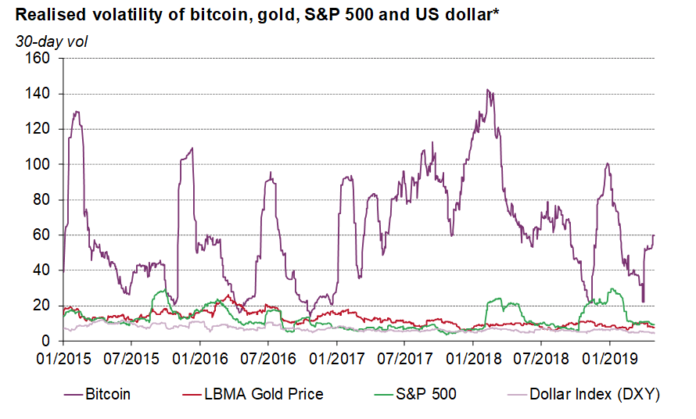

- less volatility

- greater liquidity

- a more “established regulatory framework.”

Touche. Yet they acknowledge bitcoin only has a 10-year history while gold has been around since 600 B.C. Bitcoin’s share of the store-of-value pie is only going to expand. Meanwhile, volatility remains a function of the extreme views surrounding the digital currency, both for its ascent and its demise.

Hitting the Council Where It Hurts

By acknowledging crypto as a competitor to gold, however, the Council just revealed that it considers bitcoin as a threat. Some in the crypto community believe that bitcoin and gold can coexist. Nonetheless, Grayscale is hitting the Council where it hurts with its “Drop Gold Campaign.

— CornCash (@TechnoVikingCas) May 1, 2019

Grayscale Managing Director Michael Sonnenshein was featured in an interview on Cheddar, where he explained that bitcoin’s uncorrelated nature to other asset classes is a home run for investors seeking to diversify their portfolio. He points to a “shift in wealth” that will see some $68 trillion passed down from baby boomers to younger generations.

“The way that money is currently postured won’t stay the same as it moves down to younger generations. We believe some portion of that will flow into digital currencies like bitcoin,” he said.

The “Drop Gold” campaign has clearly struck a nerve with the World Gold Council. But gold isn’t going anywhere. There’s room for the digital version of gold, bitcoin, and the precious metal to coexist, both in investors’ portfolios and on TV.

[ad_2]

Source link