[ad_1]

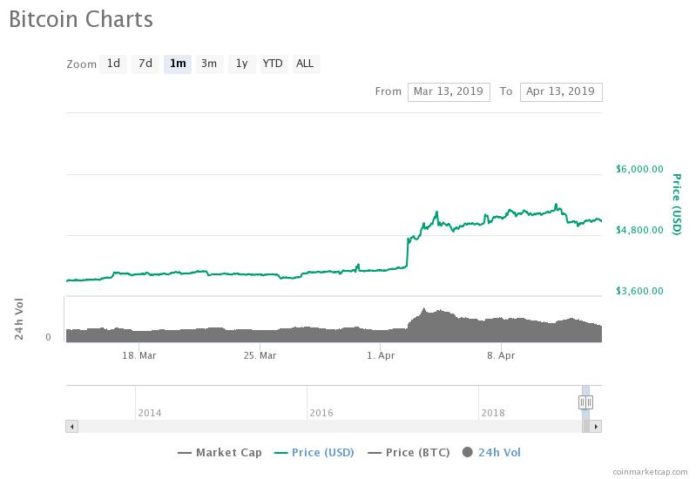

In the past 24 hours, the bitcoin price has remained relatively stable at $5,000, at one point briefly surpassing $5,100 following a rebound from $4,900.

On April 12, bitcoin experienced an 8 percent fall from over $5,400 to around $4,950 in most major crypto markets, demonstrating a relatively large retracement.

However, the 8 percent correction in the price of bitcoin comes after a strong 28.5 percent rally from $4,200 to $5,400, which many analysts including Alex Krüger have said pulled bitcoin out of its 16-month bear market.

“This is not a call. Not a matter of aging well or not. A break above $4,200 technically ends the bear trend that started Jan 2018. Facts don’t care about opinions. If strong selling resumes later on, that would represent a different trend,” Krüger said.

Why Some Analysts are Positive About the Short-Term Trend of Bitcoin

According to a cryptocurrency trader known to the community as “Satoshi Flipper,” many investors still expect bitcoin to go through a “capitulation” period and find a bottom in a low price range.

The trader said that the dominant cryptocurrency most likely saw a bottom already and the anticipated capitulation may not come in the coming months.

“Many of you still talking about ‘the’ capitulation event we need to have & the accumulation period that BTC still must go through. For some of you, it’s just going to take a few more months of PA to develop for it to finally sink in that these things have already occurred,” he said.

While analysts often disregard the volume of the crypto exchange market because the overwhelming majority of it is reported to be inflated or fake, the real volume of the market has been on the rise.

OnChainFX, which calculates the real volume of the crypto exchange market based on the data provided by Bitwise, reports the daily bitcoin spot volume to be around $341 million. That is, around 25 percent higher than the daily volume in March.

2/ First, key takeaways:

A. 95% of reported BTC spot volume is fake

B. Likely motive is listing fees (can be $1-3M)

C. Real daily spot volume is ~$270M

D. 10 exchanges make up almost all real trading

E. Most of the 10 are regulated

F. Spreads are <0.10%. Arb is super efficient— Bitwise (@BitwiseInvest) March 22, 2019

With real volume on the rise and the demand for investment vehicles targeted at accredited or institutional investors such as Grayscale’s Bitcoin Investment Trust (GBTC) also increasing noticeably, the general sentiment around the cryptocurrency market seems to be gearing towards positivity.

“Personally, I’m leaning towards BTC grinding up this weekend. Of course, I could always be wrong, another slip through $5k and this whole market is going to slide. Don’t overexpose, have fiat ready to BTFD,” one trader said.

Technical Indicators

As the bitcoin price surged past $5,000, many technical indicators such as the 200-day moving average and the exponential moving average essentially reversed, suggesting a change in sentiment.

1/ Bitcoin’s 200-day and 200-week moving averages. So simple.

The former has the word on bull-bear dynamics; the latter seems to stand as one of the best bottom-catchers around. pic.twitter.com/w6Oc56Po2h

— David Puell (@kenoshaking) April 13, 2019

While some investors like Multicoin Capital’s general partner Vinny Lingham believe bitcoin would have to achieve key resistance levels above $6,000 to confirm the materialization of a proper bull run, a fairly high number of technical analysts have said that the bottom of bitcoin was likely established at $3,122.

“That said, if we can break $6200 for BTC, it will likely mark the start of another major bull run and could run hot and high, but if it’s pure speculation and other assets benefit disproportionately to value created, it’s likely not going to end well again,” Lingham said.

[ad_2]

Source link