[ad_1]

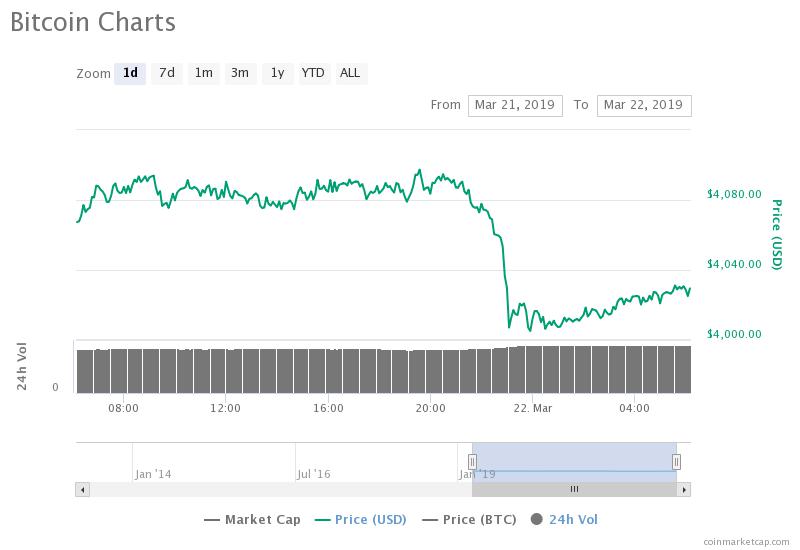

After achieving $4,097 in global average price according to data provided by Coinmarketcap.com, the bitcoin price has retraced to $4,027 and below the $4,000 mark in some major markets.

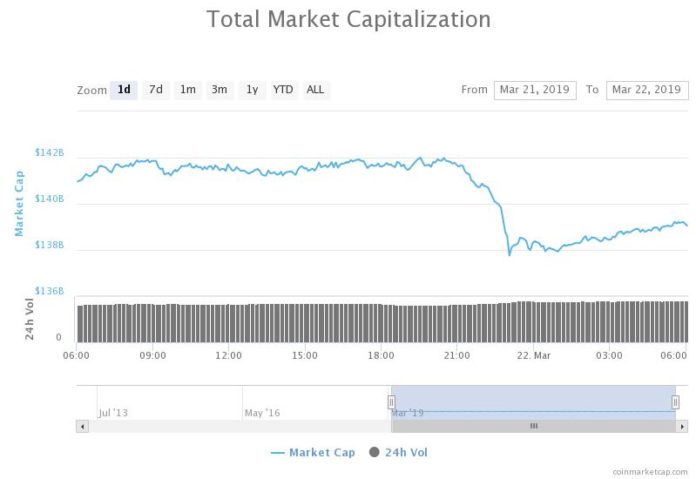

As bitcoin fell by just over 1 percent against the U.S. dollar, the valuation of the crypto market declined from nearly $142 billion to $139 billion in a matter of hours.

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click here to sign up.

Speaking to CCN, a widely recognized cryptocurrency trader known to the community as “The Crypto Dog” said that bitcoin could still hit the $3,500 mark in the short-term and that the conditions of the market haven’t changed in the past several days.

“I think we could still see $35XX,” the trader said, adding, it [bitcoin] hasn’t changed much. It wasn’t a particularly significant move. It bounced at a clear support, but there’s been no positive reaction yet. If this support holds, I expect a sweep of the highs near $4,100-$4,140.”

Why Bitcoin to Mid-$3,000 is Expected

Earlier this week, the trader noted that despite the momentum of bitcoin and its recent upside movement, the dominant cryptocurrency could still fall to mid-$3,000.

He said:

Decent chance we just saw that ‘one more leg up.’ I greatly reduced exposure up here above $4,000. Waiting for $3,5XX for long entries. I’d love an opportunity to short $4,1XX, but not sure if we’ll see it.

The cautious optimism towards the price trend of bitcoin by many traders and technical analysts likely comes from the performance of BTC in recent months.

Since late 2018, bitcoin has struggled to sustain momentum following an extended period of stability. In November, for instance, after remaining relatively stable in a tight range from September to November, the bitcoin price plunged from $6,395 to $3,236 within a month.

As such, from a technical standpoint, an increasing number of traders have begun to be cautious about the upside movement of the cryptocurrency market, unsure whether bitcoin can sustain its momentum in the weeks to come.

Previously, in an interview with CCN, cryptocurrency technical analyst DonAlt explained that a break out of at least the $4,600 resistance level is necessary to conclude that the bear market is over and that a full trend reversal is in play.

“Volume isn’t what will convince me that the bear market is over, a bullish market structure along with a break of at least $4.6k (Favorably $6k) is. It’s interesting that we’ve had so many altcoin pumps while the general market cap hasn’t really changed. That makes me think there is very little new money coming in,” the analyst said.

Industry Is In an Ideal Position

On Thursday, The Block exclusively reported that Bakkt, a cryptocurrency exchange operated by ICE, the parent company of the New York Stock Exchange, is being valued at $740 million after its Series A funding round.

“From a cash-flow perspective, Bakkt will not be earning much based on their proposed contract fees, so they really need a lot of volume. A lot of things will need to line up for investors to receive returns that they would typically expect for a Series A,” one source reportedly said.

Considering that the futures trading platform of Bakkt has not launched yet due to the delay in the approval by the U.S. authorities and is expected to launch in the second quarter of 2019, the $740 million valuation for Bakkt at such an early phase in development demonstrates the confidence of investors in both the company and the industry.

Click here for a real-time bitcoin price chart.

[ad_2]

Source link