[ad_1]

What is Forex?

The market for foreign exchange, or forex (FX) for short, is the largest financial market in the world and involves the buying and selling of currency.

Without knowing it, you have probably already participated in the foreign exchange market by ordering imported shoes, or more obviously, buying foreign currency when on vacation. Traders are drawn to forex for several reasons, including:

- The size of the FX market

- A wide variety of currencies to trade

- Differing levels of volatility

- Low transaction costs

- 24 hour a day trading during the week

This article will benefit traders of all levels. Whether you’re brand new to forex trading or looking to build on your existing knowledge, this article seeks to provide a solid foundation to the foreign exchange market.

Forex Market Explained

In a nutshell, the foreign exchange market works like most other markets in that it is subject to demand and supply. Using a very basic example, if there is a strong demand for the US Dollar from European citizens holding Euros, they will exchange their Euros into Dollars. The value of the US Dollar will rise while the value of the Euro will fall. Keep in mind that this transaction only affects the EUR/USD currency pair and will not for example, cause the USD to depreciate against the Japanese Yen.

What Moves the Forex Market?

In reality, the above example is only one of many factors that can move the FX market. Others include broad macro-economic events like the election of a new president, or country specific factors such as the prevailing interest rate, GDP, unemployment, inflation and the debt to GDP ratio, to name a few. Top traders make use of an economic calendar to stay up to date with these and other important economic releases that can move the market.

What Makes Forex so Attractive?

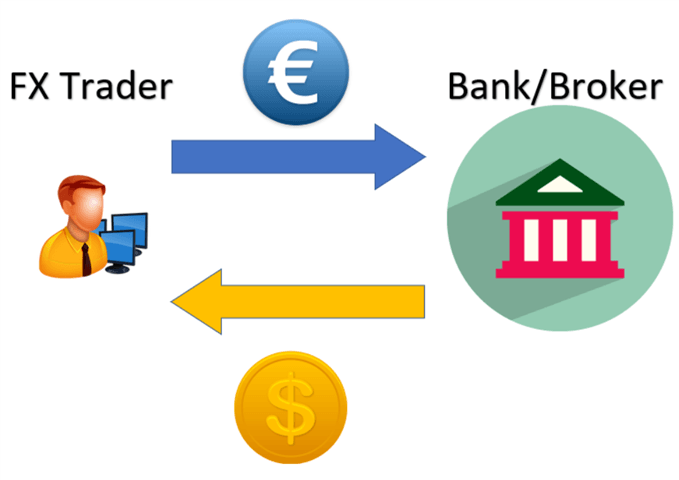

The foreign exchange market allows large institutions, governments, retail traders and private individuals to exchange one currency for another. This takes place over the counter (OTC) via the interbank market instead of on a centralized exchange.

The benefit of having forex trade between global banks is that forex can be traded around the clock (during the week). As the trading session in Asia comes to a close, the European and UK banks come online before handing over to the US. The full trading day ends when the US session leads into the Asian session for the following day.

What makes this market even more attractive to traders is that it is by far the most liquid market in the world, with an average daily trading volume of $5.1 trillion according to BIS Triennial Survey 2016. This means that traders can easily enter and exit positions as there are many willing buyers and sellers for foreign exchange.

Find out more about the size and liquidity of the forex market.

What is forex trading and how does it work?

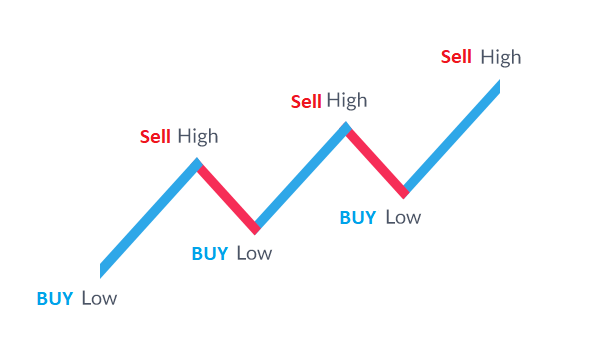

Many people wonder how to make money trading forex. Fortunately, the basics behind forex trading are quite straight forward. If you think the value of a currency is going to go up (appreciate), you buy the currency. This is known as going “long”. If you feel the currency is going to go down (depreciate), you sell that currency. This is known as going “short”.

Who Trades Forex?

There are essentially two types of traders in the foreign exchange market: hedgers and speculators. Hedgers are always looking to avoid extreme movements in the exchange rate. Think of big conglomerates like Exxon and how they look to reduce their exposure to foreign currency movements.

Speculators, on the other hand, are risk seeking and always looking for volatility in exchange rates to take advantage of. These include large trading desks at the big banks and retail traders.

Reading a Forex Quote

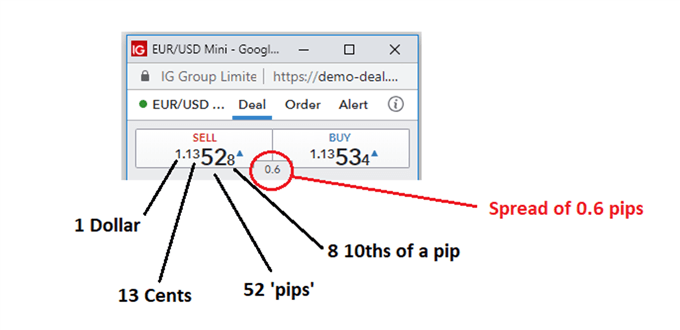

All traders need to understand how to read a forex quote as this is will determine the price you enter and exit the trade. Looking at the currency quote below, the first currency in the EUR/USD pair is known as the base currency, which is the Euro, while the second currency in this pair (the USD) is known as the variable or quote currency.

For most FX markets, prices are offered up to five decimals but the first four are the most important. The number to the left of the decimal point indicates one unit of the variable currency, in this example, it is the USD and therefore is $1. The following two digits are the cents, so in this case 13 US cents. The third and fourth digits represent fractions of a cent and are referred to as pips.

It’s key to note that the number in the fourth decimal place is known as a ‘pip’. Should the EUR depreciate against the USD by 100 pips, the new sell price will reflect the lower price of 1.12528 as it will cost less in USD to buy 1 Euro.

Why trade forex?

Trading forex has many advantages over other markets as explained below:

- Low transaction costs: Typically, forex brokers make their money on the spread provided the trade is opened and closed before any overnight funding charges are applied. Therefore, forex trading is cost effective when weighed up against a market like equities, which attracts a commission charge.

- Low spreads: Bid/Ask spreads are extremely low for major FX pairs due to their liquidity. When trading, the spread is the initial hurdle that needs to be overcome when the market moves in your favor. Any additional pips that move in your favor is pure profit.

- More opportunities to profit: Forex trading allows traders to take speculative positions on currencies going up (appreciating) and going down (depreciating). Furthermore, there are many different forex pairs for traders to spot profitable trades.

- Leverage trading: Trading forex involves the use of leverage. This means that a trader need not pay the full cost of the trade but instead only put down a fraction of the cost. This has the potential to magnify your profits but also your losses. At DailyFX we suggest a disciplined approach to risk management by restricting your effective leverage to 10 to one or less.

New to forex trading? We have a comprehensive guide designed with you in mind to learn the basics of trading.

Key forex terms to takeaway

Base currency: This is the first currency that appears when quoting a currency pair. Looking at EUR/USD, the Euro is the base currency.

Variable/quote currency: This is the second currency in the quoted currency pair and is the US Dollar in the EUR/USD example.

Bid: The bid price is the highest price that a buyer (bidder) is prepared to pay. When you are looking to sell a forex pair this is the price you will see, usually to the left of the quote and is often in red.

Ask: This is the opposite of the bid and represents the lowest price a seller is willing to accept. When you are looking to buy a currency pair, this is the price you will see and is usually to the right and in blue.

Spread: This is the difference between the bid and the ask price which represents the actual spread in the underlying forex market plus the additional spread added by the broker.

Pips/points: A pip or point refers to a one digit move in the 4th decimal place. This is often how traders refer to movements in a currency pair, i.e. GBP/USD rallied 100 points today.

Leverage: Leverage allows traders to trade positions while only putting up a fraction of the full value of the trade. This allows traders to control larger positions with a small amount of capital. Leverage amplifies gains AND losses.

Margin: This is the amount of money needed to open a leveraged position and is the difference between the full value of your position and the funds being lent to you by the broker.

Margin call:When the total capital deposited, plus or minus any profits or losses, dips below a specified level (margin requirement).

Liquidity: A currency pair is considered to be liquid if it can easily be bought and sold due to there being many participants trading the currency pair.

Free resources and guides to learn forex trading

- If you are just starting out on your trading journey it is essential to understand the basics of forex trading in our free New to Forex trading guide.

- We also offer a range of trading guides to supplement your forex knowledge and strategy development.

- Our research team analysed over 30 million live trades to uncover the traits of successful traders. Incorporate these traits to give yourself an edge in the markets.

- Traders often look to retail client sentiment when trading popular FX markets. DailyFX provides such data, based on IG client sentiment

- The forex market has evolved over centuries. For a summarised account of the most important developments shaping this $5 trillion a day market read ourHistory of Forex article.

[ad_2]

Source link