[ad_1]

SBI Holdings, a major financial and banking giant in Japan, has formally announced the launch of SBI Mining Chip Co., Ltd., officially entering the bitcoin mining industry.

In recent months, the most dominant forces in the global bitcoin mining industry in the likes of Bitmain, Cannan, and Japanese internet conglomerate GMO have struggled to adjust to market conditions.

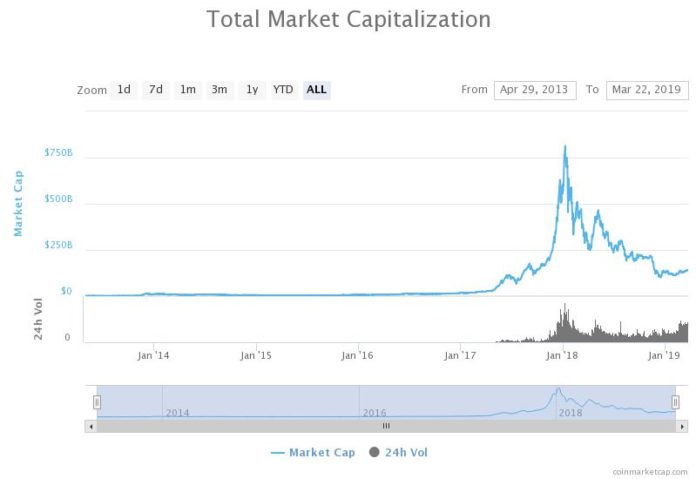

As the bitcoin bear market extended to a 15-month correction, despite the gradual increase in hash power, the demand for bitcoin mining due to the general decline in profitability of mining noticeably dropped.

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click here to sign up.

The entrance of SBI Holdings into the mining market at this phase of the correction suggests that the company has confidence in the long-term growth of bitcoin and the cryptocurrency market.

Timing of SBI’s Bitcoin Mining Business is Essential

In the months to come, with semiconductors expert Adam Traidman as the head of its mining venture, SBI Holdings is set to establish a strategic partnership with a major U.S.-based semiconductor enterprise to develop and manufacture bitcoin mining chips.

The official announcement of SBI read:

The SBI Group strongly promote on a wide range of businesses based on the digital asset, including cryptocurrency exchange business and other blockchain related businesses. The Group has practiced its cryptocurrency mining business at overseas and has now decided to expand its business scope to the manufacturing of mining chip itself and development of mining systems, through SBIMC.

Since April 2017, within a two-year span, the hashrate of the Bitcoin network has increased from 4 exahash to 48.5 exahash, by more than 12 fold.

The exponential increase in the hashrate of the Bitcoin network indicates the rise in computing power that is used to protect the Bitcoin blockchain protocol, allowing the network to become more resilient against attacks.

While the hashrate of the Bitcoin network dipped quite substantially in late 2018 due to the Bitcoin Cash and the Bitcoin SV hashrate war during which both camps concentrated computing power into the two networks to gain control over their respective blockchain networks, in a larger time frame, the hashrate of Bitcoin has risen by a big margin.

On a yearly basis, the hashrate of the Bitcoin network remains higher than where it was a year ago. In fact, since April 2018, the hashrate of the Bitcoin network as nearly doubled from 25 exahash to 48.5 exahash.

Despite the overall increase in the computing power supporting Bitcoin, it is risky to commit to the cryptocurrency mining sector during a period in which dominant players in the sector have started to struggle.

But, it can also be said that SBI Holdings may see an opportunity to evolve into a major company in the global cryptocurrency mining industry as competitors have started to demonstrate signs of fallout and decline.

GMO Pulled Out

Japanese multi-billion dollar internet conglomerate GMO reportedly lost 1.3 billion yen in 2018 amidst one of the worst bear markets in the history of the cryptocurrency sector and announced that it would stop manufacturing mining chips.

The GMO team wrote:

The profitability of the in-house mining business of GMO Internet Group decreased as the cryptocurrency price declined and our mining share did not increase as expected due to the rise of the global hash rate, which went beyond our initial assumption.

After taking into consideration changes in the current business environment, the Company expects that it is difficult to recover the carrying amounts of the in-house-mining-related business assets, and therefore, it has been decided to record an extraordinary loss.

SBI is likely well aware of the unsuccessful attempt of GMO to win over the cryptocurrency mining industry and for the corporation to enter the highly competitive market at this juncture shows the firm’s belief in the long-term performance of the industry.

[ad_2]

Source link