[ad_1]

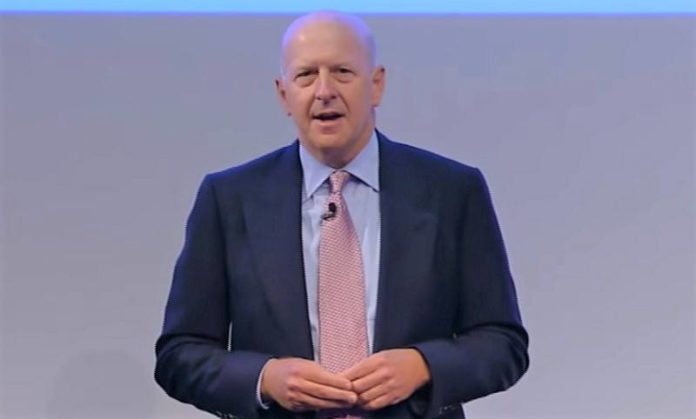

Goldman Sachs is not opening an institutional crypto trading desk, despite rampant rumors suggesting otherwise. That’s what Goldman Sachs CEO David Solomon told the House Financial Services Committee this week.

The Congressional hearing gathered the CEOs of the seven largest banks in the United States. They were grilled about the bloated executive pay packages of Wall Street bankers and whether the institutions have become more responsible in the decade since the massive taxpayer-funded bank bailout of 2009.

‘We Never Had Plans to Open a Crypto Desk’

During the hearing, David Solomon claimed that Goldman never had any concrete plans to launch a crypto trading desk. Solomon blamed the speculation on a news report by Bloomberg from December 2017.

Perhaps not surprisingly, that Bloomberg story came out at the height of the bitcoin bull market, when the bitcoin price approached $20,000.

“That Bloomberg article was not appropriate. Like others, we are watching, plus doing work to try and understand the cryptocurrency marketplace as it develops.”

“We have some clients that have certain functionality that we’ve engaged with on clearing physically-settled futures. But other than that, we never had plans to open a cryptocurrency desk.”

Goldman CEO: We May Launch Crypto Desk in Future

Solomon added that Goldman Sachs may open a crypto desk in the future, but now is not the right time because the digital currency industry is new and fraught with shady con artists.

“We might at some time [open a desk] in time. But it’s a new area.”

“There are a plenty of issues. It’s unclear from a regulatory viewpoint, and it’s not clear in the long run that those currencies will be viable.”

— iShook (@ishookinc) April 11, 2018

Was Goldman Sachs a Fair-Weather Fan?

Bitcoin fans everywhere were thrilled when they first heard reports in the fall of 2017 that Goldman Sachs — which has $1.5 trillion in assets under management — was hopping on the cryptocurrency bandwagon.

Having an established Wall Street investment bank would have lent legitimacy to the nascent industry. However, there were signs that the mythical “Goldman crypto desk” was an illusion after all.

In September 2018, CCN reported that Goldman had abandoned the idea but would focus on a cryptocurrency custody product.

Goldman Sachs is Abandoning Plans for a Bitcoin Trading Desk, For Now https://t.co/pudPT9VjsD

— CCN.com (@CCNMarkets) September 5, 2018

Not surprisingly, Goldman’s backpedaling occurred during the prolonged bitcoin bear market of 2018, when the crypto industry was roiled by mass lay-offs.

ConsenSys CEO Joseph Lubin on Layoffs: ‘Sky’s Not Falling, Future Is Very Bright’ https://t.co/rcEsq6TTbf

— CCN.com (@CCNMarkets) December 23, 2018

Bitcoin Bulls: Chill Out, the Crypto Winter Is Over

Since the Crypto Winter unfolded, large investment banks have taken an even more skeptical approach toward cryptocurrencies.

Meanwhile, bitcoin evangelists are thrilled with the recent rally, with many declaring that the brutal Crypto Winter is officially over.

As CCN reported, fund manager Travis Kling feels confident that the bear market is behind us. Kling — the founder of Ikigai Asset Management — claims that the recent bitcoin rally was triggered by growing public distrust of the Federal Reserve and its manipulation of interest rates.

In fact, Kling predicts that more people will increasingly flock to bitcoin as they lose faith in the Federal Reserve for its “irresponsible” fiscal policies.

“I would say broadly it was central banks [that caused the recent rally]. [Bitcoin] has become a hedge against irresponsible monetary and fiscal policy.”

Bitcoin Is a Hedge Against ‘Irresponsible’ Federal Reserve: Asset Manager https://t.co/FuO6dee7K3

— CCN.com (@CCNMarkets) April 4, 2019

[ad_2]

Source link