[ad_1]

Cryptocurrency trading, by its ever-changing, quick and volatile nature is a matter of timing. The winners are the one continuously watching the markets — and the losers the casual investors who buy on top of the trend. Automated your crypto trading can help you avoid these losses and trade on real techniques.

Auto Crypto Trading Tools Earn While You Sleep

In this market that never closes, trading is no easy task.

For a year now, all long term holding has been destined to lose. To get profits, you need to continuously watch the market for short term opportunities. Some of those are obvious, like a 30-periods bullish breakthrough on the 2h chart, following an abnormal downtrend and announcing the beginning of a bullish correction.

By watching the market every 5 minutes, you could have spotted it. However, when would you exit? You could do a bit of guesswork and place limit sell orders, but what if the trend stops a little lower than where you placed your orders? Could you go to sleep knowing the perfect time to sell might be during this night?

You know the feeling that exiting a trade too late by greed creates, deep inside you. You’re a human, have emotions and need to sleep. That’s why you need tools to rest on.

Kaktana, An Automated Crypto Trading Solution

The solution we will investigate here is to automate trading by giving our strategy to a bot, trading on our behalf using our exchange account’s API keys.

For this short, introductory how-to, we’ll be using Kaktana, a tool created to automate all kind of trading (even yours, regardless of its randomness).

You don’t need to code to use it, just to know how to click a few buttons. You enter the buy and sell conditions, give your API keys and your bot will enter and exit trades whenever the conditions you gave him are valid — whether you sleep or not.

What Crypto Trading Strategies To Automate

Manual profitable strategies are also profitable when automated.

And even more profitable, as they’re never sleeping and continuously watching the market.

For instance, we know that exponential moving averages and the relative strength index are pretty reliable indicators.

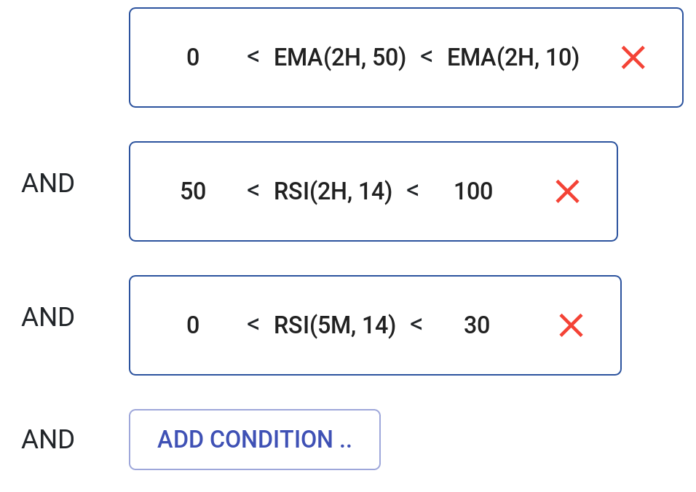

A very simple strategy using them would be to buy when:

- The EMA 10 is above the – EMA 50 on the 2h chart

- The RSI 14 is above 50 on the 2h chart

- The RSI 14 on their 5 min chart is below 30 so that we know we have a good short term buying price

When selling, we would just look if the EMA 10 is below the EMA 50 on the 2h chart

One cool thing about Kaktana is that it lets you backtest your strategies, to see how they would have behaved on past data (personal advice for your ego: don’t compare those results with your manual trading’s ones)

Here are the results of our strategy trading XRP/BTC from Dec 30, 2017, to Dec 30, 2018:

91% profit. Not bad for a 5 minutes long implementation of our manual trading

Crypto Auto Trading Pitfalls to avoid

Before you start automating your trading strategies, I’ll give you a few rules that you should follow in order to avoid losing everything:

-

Beware of overfitting

When backtesting, you shouldn’t only compare your strategy’s net profit with a classic buy and hold.

Before you start burning your Binance account, you should also use the portfolio evolution graph and answer by a firm yes those few questions

- Is the strategy constantly doing good trades, maybe at a slow pace?

- Is the strategy never losing a lot in a short time?

- Is the strategy not doing only one miraculous trade that masks a globally losing strategy?

Overfitting is the art of improving a strategy in its slightest details to improve its performance in one backtest, only to crush your head on the table while live trading because the market will be different from the one you backtested on.

For that, you should always ensure yourself that your strategy works well on the majority of time frames and on the majority of markets.

Avoid certain markets

Certain markets are true devil’s caves. Avoid at all costs low-liquidity markets: you don’t want to execute your enter order 5% higher than the last trade’s price because of a too large spread (the difference between the price buyers are willing to buy at and the price sellers are willing to sell at).

Also, you don’t want your stop loss to be triggered whenever someone sells his small bags with a market order and there’s no one to buy with, causing a huge momentaneous drop in price. Also, Cryptocurrency/Cryptocurrency markets are way harder to do technical analysis on than Cryptocurrency/Stablecoin markets.

The reason for that is that technical analysis bases itself on prices, themselves based on human sentiment.

Humans want to maximize their profits in a stablecoin (because, for the moment, there aren’t many places that sell bread for bitcoin) therefore their irrational decisions (like buying on top of the trend) are most noticeable — and profitable from — using Cryptocurrency/Stablecoin markets

Don’t trade too frequently

When you’re sending a market buy or market sell order, you’re paying two things:

- The spread (that we defined earlier)

- The exchange’s fees, that they force you to pay (0.1% for Binance, 0.075% for Bitmex)

Trading too frequently will make you pay out for those fees and spreads.

In the top left corner of your backtest results, you should enter your exchange’s fees and check if your net profits aren’t much smaller than your raw profits. If so, try trading on a longer time period (as a general rule, avoid less than 30 min time frames for your main indicator).

In a nutshell, automated trading is a powerful tool to have. Like any tool, it can be used as greatly as it can be used badly. Always try your strategies in a sandbox, and never put more funds than what you are willing to lose.

Those precautions taken with a proper strategy can help your automated trading system provide great profit.

Conclusion

Kaktana has opened auto crypto trading up for the masses. Sign-up takes under 5 minutes as does linking your Binance or other crypto trading account. From there, you can backtest, monitor profits from trades, and test out new bots for auto crypto trading.

[ad_2]

Source link