[ad_1]

According to a report by Goldman Sachs, Brexit has cost the UK well more than £600 million ($785 million) a week, around $3.4 billion per month since the monumental 2016 referendum vote.

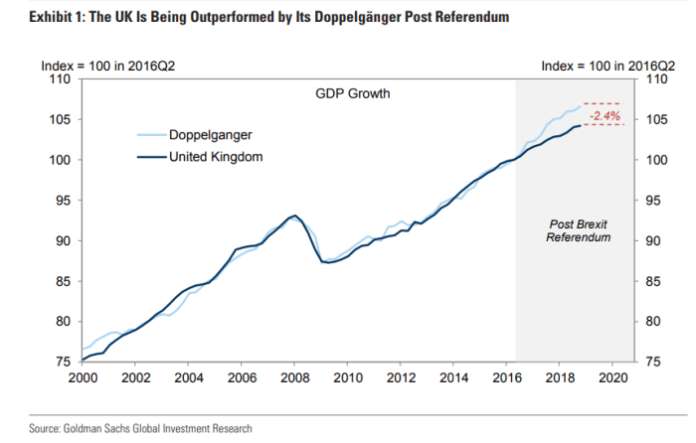

A chart by Goldman Sachs Global Investment Research published by FT shows that the GDP of the UK declined by 2.4 percent as a result of Brexit talks.

The data presented by Goldman Sachs essentially presents the opportunity cost involved with Brexit and the investment opportunities the country has lost due to political and geopolitical uncertainty.

Brexit En Route to a Soft Deal, Which May Be Disastrous

Currently, according to Goldman Sachs, the UK has two options to recover from the impact of Brexit on the economy of the UK since 2016.

The government can either secure a conventional transition deal for Brexit with the European Union or remain in the EU to regain the confidence of businesses.

“Both would provide a meaningful boost, mainly to the UK economy. Under our ‘no deal’ scenario, the UK suffers large output losses, in conjunction with a substantial global confidence shock marked by a sharp sterling depreciation,” the report of Goldman Sachs read.

A soft Brexit deal or what is referred to as “no deal” by the government of the UK would be worse than staying in the EU.

While the recent global economic downturn is mainly said to have been caused by the weakening eurozone economy, Goldman Sachs analyst Jari Stehn said that leading eurozone economies such as Germany and France suffered as a result of its exposure to the UK.

Emphasizing that the UK may have contributed to the struggle of the eurozone throughout the first quarter of 2019, Stehn said:

“We find that the drag from weaker UK growth has been felt most strongly in countries with larger export exposure to the UK such as Germany and France. The global confidence shock, on the other hand, had the largest impact on Italy and Spain — on account of the pronounced sell-off in risk assets. The effects of the global confidence shocks have also reached further afield, with Japan, the US and Canada experiencing a GDP drag.”

The Brexit proposal of the UK prime minister Theresa May has been rejected three times already by the parliament.

Earlier this week, Julian Smith, a British Conservative Party politician serving as the party’s Chief Whip, openly criticized May and claimed that the prime minister should have gone for a soft Brexit deal following the third rejection by the parliament.

Speaking to BBC, Smith said that May made a “fundamental” mistake by pushing ahead with the same Brexit deal with which May lost her Commons majority in 2017.

Based on the statement of Treasury chief secretary Liz Truss, it is becoming more likely that May will once again move forward with an iterated version of her most recent proposal, for a full Brexit deal.

“It would mean control of our trade policy sat with the EU when we were no longer a member. We wouldn’t be able to sign our own independent trade deals. I think we need to carry on trying to find ways to get support for the prime minister’s deal. It remains the most popular option that has been presented so far,” Truss said.

Would a Full Brexit Deal Benefit the UK Stock Market?

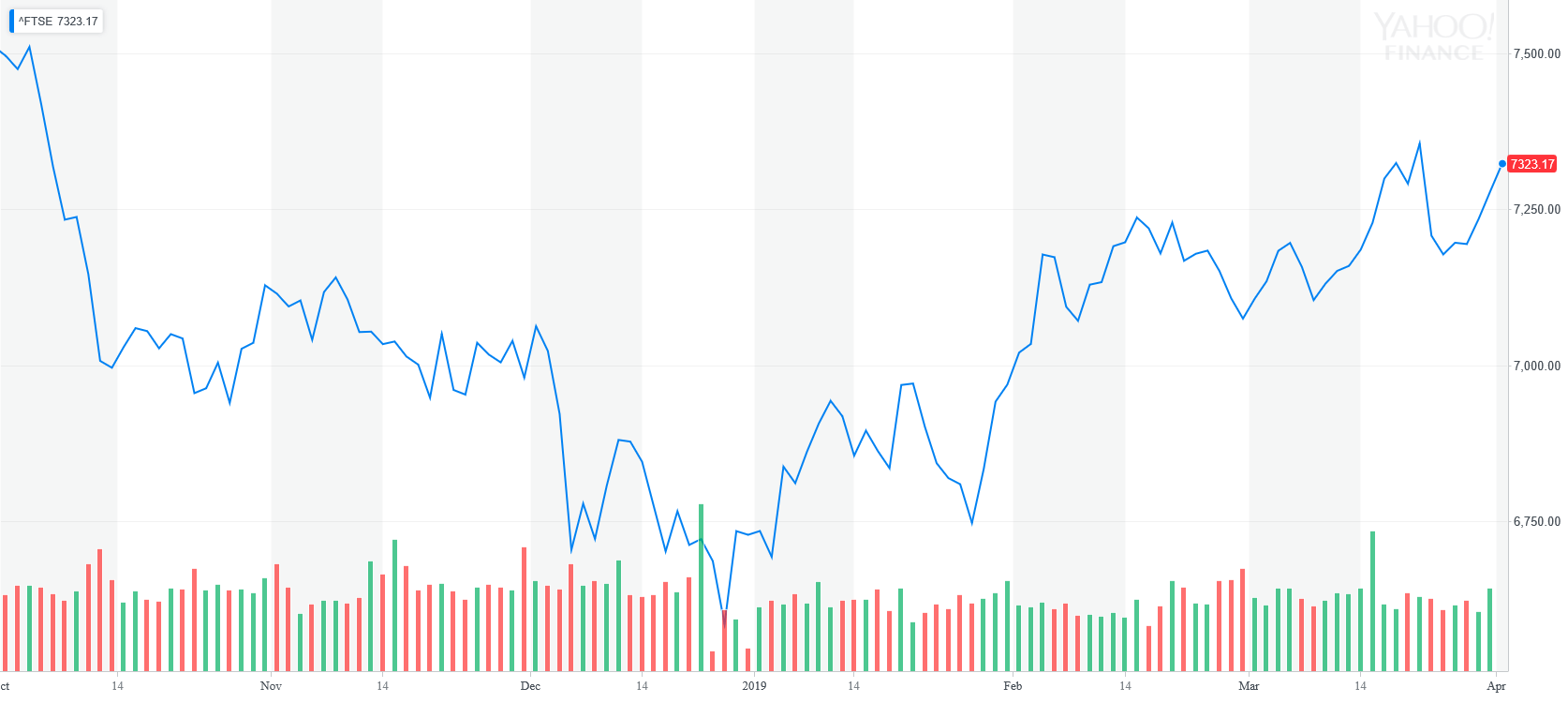

In recent months, despite the worsening economy of Germany, France, and the rest of the eurozone, the FTSE 100, which represents 100 companies on the London Stock Exchange, has performed almost identically to the CAC 40 of France and DAX Performance Index of Germany.

A full Brexit deal may lead investors to perceive the UK as a safe haven amidst the slowdown of the eurozone economy.

[ad_2]

Source link