[ad_1]

While the Dow struggles to maintain a tenuous grip on growth, President Donald Trump recklessly thrust the economy toward a recession – and the US stock market toward an all-out meltdown.

Trump Callously Disregards Impact of His Reckless Tweets

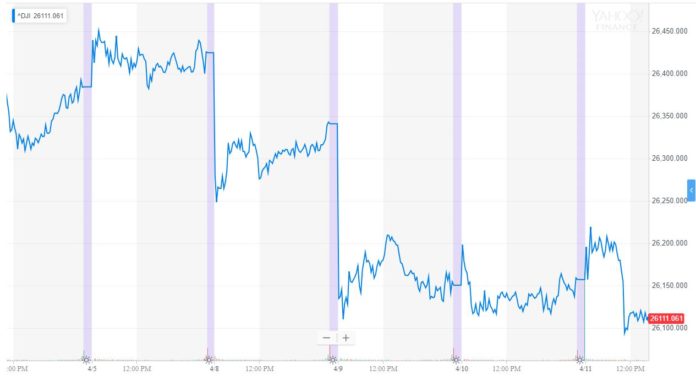

The Dow Jones Industrial Average Index (DJI) slid this week on continued fears of a looming recession and lower earnings reports (though the latter are primarily due to inflated figures of last year, which benefited from the one-off immediate impact of Trump’s corporate tax cuts).

The Dow has endured a rough week. Trump isn’t helping. | Source: Yahoo Finance

Yet fears of recessionary signals amid a slowing global and domestic economy and the overhanging trade tensions between the US and China and Japan didn’t stop the brazen administration from targeting Europe for its next round of protectionist trade measures.

Trump’s new threats to use tariffs against Europe are retaliatory moves against what the administration has long labeled unfair subsidies the Europeans provide Airbus SE. In the corner of his eye, Trump has the working class base that voted him into power to appeal to, just as he has Europe in his sights.

The World Trade Organization finds that the European Union subsidies to Airbus has adversely impacted the United States, which will now put Tariffs on $11 Billion of EU products! The EU has taken advantage of the U.S. on trade for many years. It will soon stop!

— Donald J. Trump (@realDonaldTrump) April 9, 2019

Boeing employs over 140,000 people worldwide, with a significant number of those in the US. It is Washington State’s biggest private employer. While Washington is a blue state, the embattled airline’s employees look very much like Trump’s supporter base.

The Dow slid 175 points on April 8 as orders for Boeing’s 737s nosedived by a staggering 49 percent. The anti-Airbus play looks increasingly like the form of protectionism that has historically been proven to be ill-conceived – the type that props up bad companies at the expense of consumers.

IMF Warns of Trump-Imposed Uncertainty – Dow Bulls Should Watch Out

The IMF’s relationship with the Trump administration has always been tumultuous, with the body concerned with Trump’s attacks on the Federal Reserve, as well as the destabilizing impact of Trump’s stance toward China. Starting a new trade war with Europe is likely to concern the IMF that Trump stands, once again, as a risk to business sentiment and global financial stability.

The Europeans will respond to any tariffs the Trump administration imposes on them. Per EU trade chief Cecilia Malmstrom:

“It’s very unfortunate that the U.S., once the great advocate and architect of global alliances, seems today to be moving in a different direction. We see a broad withdrawal from multilateralism by the U.S. It would be the rule of the jungle and only the most strong would survive. And maybe not even them.”

Jo Leinen, the German member of the European Parliament, assured Bloomberg that Europe would match Trump tariffs dollar-for-dollar, saying negotiations with the Trump administration have been “under pressure” and “with a pistol on the chest of EU negotiators.”

Trump’s 1950s-style physical bullying tactics against Hillary Clinton during the 2016 general election campaign – celebrated by his fans and sickening to his detractors – forewarned of how the accidental president might be likely to engage in trade negotiations: crudely, crassly, and without the manicured caress of a more seasoned diplomat.

Racing for the doors of protectionism may not only risk a global recession and a Dow Jones collapse, but it smacks of the retrograde economic policies of the seventies and early eighties – policies that almost as many economists agree do not work as scientists agree windmill noise does not cause cancer.

[ad_2]

Source link