[ad_1]

A few hours ago, the Trump administration issued a new set

of sanctions against Venezuelan banks, aiming to make it more difficult for the

people to mobilize their money and pay for goods and services.

In an official announcement published by the Treasury Department, it is possible to observe that Trump’s government added to the SDN (specially designated national) List a number of financial institutions that include the Banco de Venezuela and Banco Bicentenario.

Today, the Department of the Treasury’s Office of Foreign Assets Control (OFAC) is designating Banco de Desarrollo Economico y Social de Venezuela (BANDES), and any entity in which BANDES owns, directly or indirectly, a 50 percent or greater interest, pursuant to Executive Order (E.O.) 13850 as amended by E.O. 13857, for operating in the financial sector of the Venezuelan economy, following a determination by Secretary of the Treasury Steven T. Mnuchin, in consultation with Secretary of State Michael Pompeo, that persons operating in Venezuela’s financial sector may be subject to sanctions pursuant to E.O. 13850 as amended by E.O. 13857 …

In addition, the following entities have been added to OFAC’s SDN List:

- BANCO BANDES URUGUAY

- BANCO BICENTENARIO DEL PUEBLO, DE LA CLASE OBRERA, MUJER Y COMUNIAS (SIC)

- BANCO DE DESARROLLO ECONÓMICO Y SOCIAL DE VENEZUELA

- BANCO DE VENEZUELA

- BANCO PRODEM

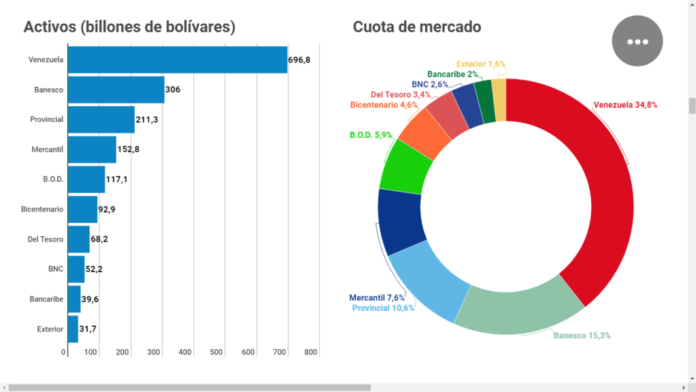

Banco de Venezuela is the largest bank in the country in terms of assets and number of clients. Banco Bicentenario is the sixth largest financial institution in terms of total assets; however, it fulfills a strategic function since it is the bank used by a significant part of public employees and by people over 60 years-old who cannot work and depend on state support in order to live.

United States Uses Its Power to Sanction Venezuelan Banks

These sanctions come after an announcement by Trump indicating that he was evaluating the possibility of putting pressure on Visa and Mastercard to prevent Venezuelans from using their platforms to pay for the goods and services they need to live. According to Bloomberg, the United States seeks not only to squeeze Maduro and his partners but also a small group of wealthy residents with political connections.

“The aim is to squeeze Maduro and his allies in the military, as well as other connected, upper middle-class Venezuelans who have access to bank accounts and credit cards.”

This argument, however, obviates that said sanctions harm several million citizens. According to a report published by Banco de Venezuela in 2014, the number of users with bank accounts in this institution exceeds 8 million people:

“At the end of June, Banco de Venezuela’s customer service network totaled 406 branches throughout the country, serving a customer base of 8,208,784 clients.

Venezuela May Use Crypto to ‘Fight Back’

Faced with this imminent threat, SUDEBAN, the supreme regulatory body for the financial system, announced that it began a series of meetings to look for alternatives that allow locals to make payments in a traditional way without having to depend on the United States.

The first session focused on the creation of a national

debit card service that interconnects banks as international networks do.

However, after this, a new announcement turned out to be

even more promising. As stated by SUDEBAN

on its official accounts, the government is evaluating the possibility of

officially implementing alternative means of payments which include electronic

processors, e-mail payments and the use of cryptocurrencies.

The results are yet to be identified as they are just exploring the grounds. It is also not known whether the study of crypto payments exclusively refers to the Petro (the official cryptocurrency of the country that has not yet been launched) or if they are considering the implementation of a payment system using other commercial cryptos.

[ad_2]

Source link