Intro to the company

TRADE.com is a trading brand operated by Trade Capital Markets (TCM), which is authorized and regulated in Cyprus by the Cyprus Securities and Exchange Commission and authorized in South Africa by the Financial Sector Conduct Authority (FSP number 47857). Livemarkets Limited, which is authorized and regulated in the United Kingdom by the Financial Conduct Authority, also operates TRADE.com.

This is a multi-asset brokerage offering very competitive FX CFD trading services, alongside coverage for other leading asset classes, such as stocks, indices, ETFs, bonds, commodities, and cryptocurrencies.

Trading CFDs with TRADE.com comes with attractive trading costs, flexible leverage, plenty of educational resources, and support for the popular Trading Central, one of the best technical analysis tools in the market, currently offered by many popular trading brands.

The services are available for retail traders around the world, yet it is important to note TRADE.com does not accept customers from Japan, Canada, Belgium, USA, and several other countries.

Why should traders start trading with TRADE.com? The current review will try to highlight the most important features of this broker. The focus will be on FX trading, but people need to know the services offered by the brand are much more diverse and also cover DMA, ETF’s, spread betting, IPO, and asset management.

Trading software

Even in 2021, numerous CFD traders rely on MetaTrader 4, a software developed by MetaQuotes. This is a platform available at TRADE.com in versions compatible with Windows and Mac OS. Also, the apps available for download on Google Play and App Store enable customers to use MT4 on mobile without any issues. Constantly upgraded over the years, this platform integrates technical analysis tools, support for expert advisors, advanced drawing tools, and over 350 available assets.

WebTrader is a proprietary solution developed by TRADE.com, offering access to all 2,100+ assets available with the brand. On top of that, it integrates Trading Central and other enhanced trading tools that are not available on MT4. In contrast, this platform does not require any installation since it is accessible via the browser on any device, regardless of the operating system.

Events & Trade, Traders Trends, and Trending Now are intelligent analysis tools built into the WebTrader, facilitating faster and more efficient market research. Traders can spot the hottest assets at any given moment and choose the right ones for them.

Trading features

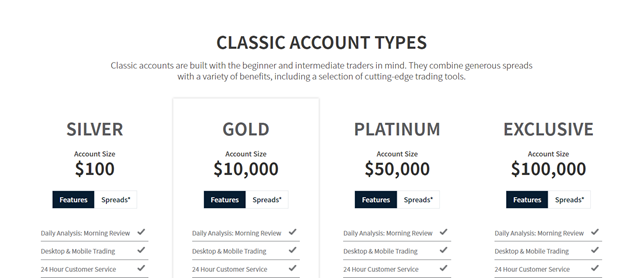

The TRADE.com accounts each include a different set of features. Choosing a Silver, Gold, Platinum, or Exclusive account determines the benefits traders are entitled to, such as tighter spreads, premium daily analysis, Trading Central, a dedicated account manager, and premium customer support.

Another benefit of trading with TRADE.com lies within the funding options since customers can make a simple payment using a credit/debit card, or use e-wallets like Skrill, Neteller, and PayPal. Wire transfers are also accepted, yet in this case, the process can take several days until funds reach the trading account.

FX trading conditions are advantageous in terms of trading costs, as TRADE.com offers flexible spreads and does not charge trading commissions. There are tens of different currency pairs covered, including majors, minors, and exotics. The maximum leverage depends on whether the trader is from the retail or professional sector.

Over 1,000 stocks, major stock market indices, a brand new section for ETF CFDs, commodities, bonds, and several large cryptocurrencies, are all part of the TRADE.com offer, creating numerous options for different types of traders.

Helpful resources

There are multiple helpful resources available, including an Economic Calendar, the Trading Central tool, TradingView charts, and other educational content provided by TRADE.com (depending on the account type chosen). All traders get access to tools like Daily Analysis: Morning Briefing and Events & Trade.

Trading Central is one of the most popular technical analysis tools and it is available for all customers, except for Silver account holders. The same applies to the dedicated account managers, who provide assistance whenever it is needed.

Summary

After evolving into a reputable multi-asset broker, TRADE.com is now among the most trusted brands internationally. It is serving a broad customer base and offers diversified trading services. Its CFD conditions are attractive in terms of trading costs, software, and tools provided for all customers.

Trading CFDs with TRADE.com is optimal for both beginner and experienced traders, proving the company has an inclusive approach. All these reasons combined make TRADE.com a broker to trust, one that should be on the shortlist of any retail CFD trader looking for a reliable trading partner.

CFDs and spread bets are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.8% of retail investor accounts lose money when trading CFDs and spread bets with this provider. You should consider whether you understand how CFDs and spread bets work and whether you can afford to take the high risk of losing your money.

TRADE.com Overview

Product Name: TRADE.com

Product Description: TRADE.com is a trading brand operated by Trade Capital Markets (TCM), which is authorized and regulated in Cyprus by the Cyprus Securities and Exchange Commission and authorized in South Africa by the Financial Sector Conduct Authority (FSP number 47857). Livemarkets Limited, which is authorized and regulated in the United Kingdom by the Financial Conduct Authority, also operates TRADE.com.

Brand: TRADE.com

Offer URL: www.trade.com

-

Trading Software

-

Trading Features

-

Resources

-

Customer Service

Summary

After evolving into a reputable multi-asset broker, TRADE.com is now among the most trusted brands internationally. It is serving a broad customer base and offers diversified trading services. Its CFD conditions are attractive in terms of trading costs, software, and tools provided for all customers.

Pros

- Multi-asset brokerage regulated across multiple jurisdictions

- Access to competitive FX trading services

- Proprietary WebTrader with multiple integrated trading tools

Cons

- TRADE.com does not accept customers from USA, Canada, and other countries

- MetaTrader 4 does not offer access to all 2,100 CFD assets

- Customer support service available 24/5