[ad_1]

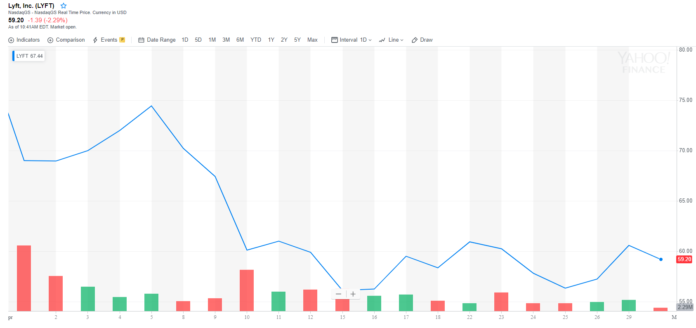

By CCN: Lyft’s stock remains stuck in the doldrums, trading 22% below its IPO price of $72. Yet, the company appears to have its proverbial head stuck in the sand about its stock market debut flop.

Lyft board member Maggie Wilderotter believes the Lyft IPO on the Nasdaq was “totally a success,” she told CNBC. She said the company has its “heads down,” but could it be possible that they’ve really got their heads stuck in the sand? What part of plunging shares does she not understand?

According to Wilderotter:

“I think it’s totally a success. I think we priced it right. I think we had very good momentum for the IPO. We raised the appropriate money that we were looking to do to keep the company healthy. And we look at this as a marathon, it’s not a sprint.”

Lyft investors aren’t buying it, as evidenced by the class-action legal battle that has surfaced among burned shareholders, blaming the ride-sharing company for “overhyping” the IPO.

.@Lyft Board Member Maggie Wilderotter on the

company’s IPO: it was “totally a success” & priced appropriately“We look at this as a marathon. It is not a sprint.” $LYFT pic.twitter.com/MyRI3HTo11

— Squawk Box (@SquawkCNBC) April 30, 2019

Lyft’s Stock Is a Disaster

The board member’s perspective is predicated on being a long-term investor in Lyft’s stock. It sure didn’t work out for IPO investors looking to capitalize on the momentum of a newly issued stock. That stigma is going to stay with Lyft for the foreseeable future. The company has another thing coming if they define a double-digit drop in the Lyft stock price as a success. Consider similarly recent IPOs Zoom and Pinterest, both of which had had a rock star reception on Wall Street, as the CNBC host alluded to. To say that Lyft priced its IPO right is doing a disservice to the investors who bought early and to the tech IPOs in the pipeline, such as Uber and WeWork.

Tech IPO Pipeline

Lyft’s larger rival Uber is next in the pipeline for its stock market debut, and the company seems nervous. Lyft set the tone not only for tech IPOs but that of ride-sharing plays on Wall Street. Uber has been feverishly attempting to distance itself from Lyft, and rightfully so. They want to be considered the next Amazon instead, which despite being a stretch goes to show that the Lyft stock is not a success, at least not yet. Uber has slashed its valuation from $100 billion to a range of $80 billion to $90 billion, suggesting that it might have further to fall. If the Uber IPO is overpriced similarly to Lyft, investors have other options with the Softbank-backed WeWork on the tech IPO horizon.

[ad_2]

Source link