Introduction

In the ever-evolving world of currency trading, swing trading has emerged as a favored strategy for those who seek to capitalize on short- to medium-term market momentum. In 2025, with increased volatility driven by global inflation cycles, interest rate decisions, and shifting monetary policy across major economies, traders are turning to high-performing forex pairs like GBP/USD and AUD/USD for consistent swing opportunities.

This in-depth analysis explores the underlying trends that are shaping the forex landscape and highlights why GBP/USD and AUD/USD stand out as leading candidates for swing trading. From understanding trend strength and identifying trade setups to evaluating macroeconomic triggers and technical indicators, this article offers comprehensive insights into two of the most traded and watched currency pairs in today’s forex market.

Understanding Swing Trading In The Forex Market

Swing trading is a trading strategy designed to capture short- to intermediate-term price movements in a financial instrument. Unlike day trading, which involves entering and exiting positions within a single trading session, swing trading typically involves holding positions for several days to weeks, depending on the strength of the market trend.

In forex markets, swing trading is particularly well-suited due to high liquidity, frequent price fluctuations, and 24/5 accessibility. Successful swing traders rely heavily on both technical and fundamental analysis to identify optimal entry and exit points. Key tools include moving averages, trendlines, Fibonacci retracements, support/resistance levels, and candlestick patterns. Moreover, economic news releases, central bank policies, and geopolitical developments often act as catalysts that swing traders monitor closely.

Why Market Trends Matter In Forex Swing Trading?

In swing trading, identifying a trending market is half the battle. Trading in the direction of the trend increases the probability of success, and understanding when a trend begins or ends can determine the difference between profit and loss. A trend in forex is defined as a directional price movement over time—either bullish (uptrend) or bearish (downtrend). Traders assess trend strength through various methods, including:

Trend Strength Indicators: RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), ADX (Average Directional Index).

Chart Patterns: Channels, breakouts, flag formations.

Volume Analysis: Confirms trend momentum.

Fundamental Context: Policy divergence, macroeconomic data, political sentiment.

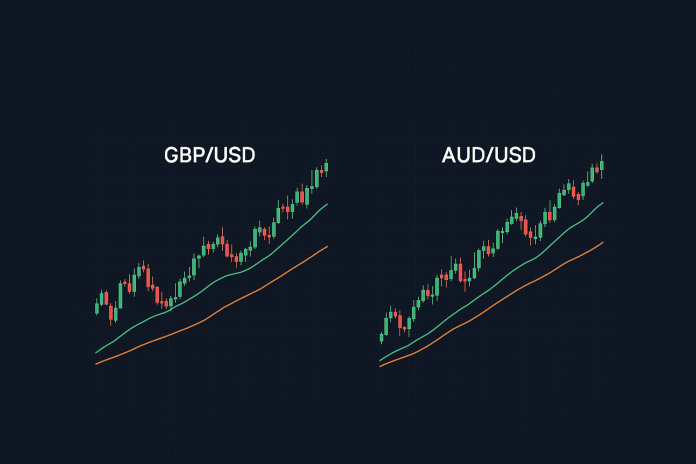

GBP/USD and AUD/USD are among the most actively traded currency pairs globally. Their consistent volatility and responsiveness to economic drivers make them ideal for swing trading, especially in trending conditions.

GBP/USD: A Swing Trader’s Perspective In 2025

The GBP/USD pair, often referred to as “Cable,” is a benchmark for traders globally. As of mid-2025, the pair has displayed a consistent upward bias, underpinned by diverging monetary policies between the Bank of England (BoE) and the U.S. Federal Reserve. While the BoE has shown signs of maintaining a slightly hawkish tone amid persistent UK inflation, the Fed has signaled a possible rate cut cycle due to weakening job numbers and slowing consumer demand.

Technical Overview

Technically, GBP/USD has been forming higher highs and higher lows since late Q1 2025, establishing a clear bullish channel on the daily chart. Recent resistance near 1.2820 is being tested, with support forming around the 1.2630–1.2660 zone. Indicators like RSI and MACD confirm bullish momentum, with the RSI holding steadily near 60–65 levels, suggesting there’s room for further upside.

Swing traders looking at this pair are closely watching for breakout patterns or pullbacks to rejoin the trend. Strategies such as buying on dips near the 21-EMA or using Fibonacci retracement levels (38.2% or 50%) have proven effective in recent setups.

Fundamental Triggers For GBP/USD Trends

The currency pair’s recent moves have been tied to:

UK Inflation Trends: The UK’s CPI has remained stubbornly high, driving expectations of a delayed BoE pivot, thereby supporting the pound.

U.S. Economic Slowdown: A softening in U.S. labor data and subdued GDP growth has added pressure on the dollar, increasing the relative strength of GBP.

Risk Sentiment: Broader market risk appetite has favored higher-yielding currencies like GBP over the USD during equity market rallies.

For swing traders, the ideal setup involves aligning long entries with macro support, such as favorable CPI data or dovish Fed commentary, while managing risk below key support levels.

AUD/USD: Riding The Commodity And Sentiment Wave

The AUD/USD pair is another favorite among swing traders, primarily due to its high beta with global risk sentiment and strong correlation with commodity prices, particularly iron ore and copper. The Australian economy’s performance is also closely tied to demand from China, making AUD/USD reactive to Asian market developments.

Technical Profile of AUD/USD

As of May–June 2025, AUD/USD is trading within a rising wedge pattern on the 4-hour and daily charts. The pair recently broke above a key resistance near 0.6710, with momentum pushing toward the psychological 0.6800 handle. A successful break and retest of this level could open room for a swing toward 0.6930.

Indicators like Bollinger Bands are widening, suggesting increased volatility, while MACD is above zero, indicating bullish momentum. Traders are also watching the 50-day SMA (Simple Moving Average) as dynamic support for continuation trades.

Macro Drivers for AUD/USD Swing Trades

Several fundamental themes are supporting AUD strength:

China’s Stimulus Plans: Renewed Chinese government stimulus to support infrastructure and housing has boosted Australian export demand.

Commodity Price Rally: Iron ore and copper prices have surged, improving Australia’s trade balance and supporting AUD appreciation.

RBA Policy Outlook: The Reserve Bank of Australia has remained neutral to slightly hawkish, citing upside inflation risks, in contrast with a more dovish Fed.

These factors combine to create a favorable environment for swing traders looking for bullish setups on AUD/USD. Entry opportunities may appear on bullish engulfing patterns after minor retracements or when price bounces from trendline support.

Swing Trading Strategies For Trending Forex Pairs

To maximize opportunities in these trending pairs, swing traders should apply systematic strategies backed by technical and fundamental confluence.

1. Breakout and Retest Strategy

Identify consolidation zones or resistance levels. Enter after a confirmed breakout and retest of the former resistance as new support. Works well for GBP/USD above 1.2820 or AUD/USD above 0.6800.

2. Fibonacci Pullback Strategy

Apply Fibonacci retracement on a recent trend leg. Look for long entries at 38.2% or 50% levels if overall momentum remains bullish.

3. Moving Average Crossover

Use a 21-EMA and 50-EMA crossover strategy for confirmation of trend resumption. Combine with candlestick signals (e.g., bullish engulfing) near crossover zones.

4. Event-Based Swing Setup

Monitor economic calendar for CPI, GDP, or interest rate decisions. Use price action before and after events to build position bias.

Risk Management And Position Sizing In Swing Trading

Swing trading offers greater reward potential, but also exposes traders to overnight risk and broader market movements. Risk management is non-negotiable.

Position Sizing: Never risk more than 1.5–2% of your account on a single trade.

Stop Losses: Place below recent swing lows in uptrends or above swing highs in downtrends.

Reward-to-Risk: Aim for at least 2:1 reward-to-risk ratios.

Trade Journaling: Maintain logs to track winning patterns and optimize setups.

Conclusion

As we move through 2025, swing trading remains a viable and strategic approach to forex trading—especially for pairs like GBP/USD and AUD/USD, which offer strong trend behavior, predictable volatility, and clear technical setups. With fundamentals like central bank divergence and commodity tailwinds shaping these markets, traders equipped with disciplined strategies, technical awareness, and macroeconomic context can capitalize on medium-term moves with confidence.

Both GBP/USD and AUD/USD will continue to offer high-probability opportunities for traders who understand the balance between risk, timing, and market drivers. Whether you are trading breakouts, riding retracements, or aligning your trades with key economic events, these two forex pairs deserve a top spot on your watchlist.