[ad_1]

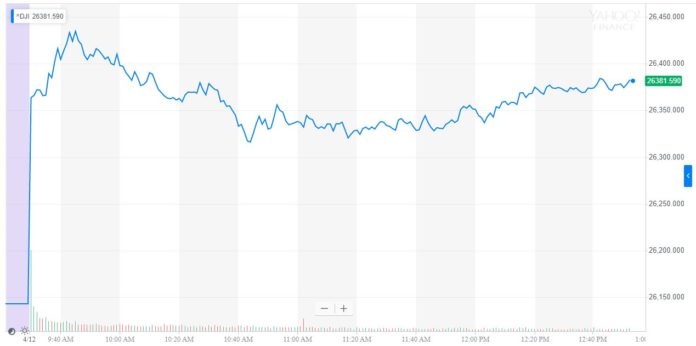

The Dow Jones Industrial Average assembled a monster rally on Friday, surging 250 points to place the index within striking distance of its all-time high.

Astonishingly, the DJIA managed this feat even as major index component Chevron tanked on reports that it would acquire Anadarko Petroleum in a blockbuster $33 billion deal. As the index scrambles to reverse what had otherwise been a dismal week for the US market bellwether, five key stocks – Disney, JPMorgan, Dow Inc, Goldman Sachs, and Boeing – are fueling the Dow Jones recovery.

The Dow surged around 250 points on Friday to end the week on a bullish note. | Source: Yahoo Finance

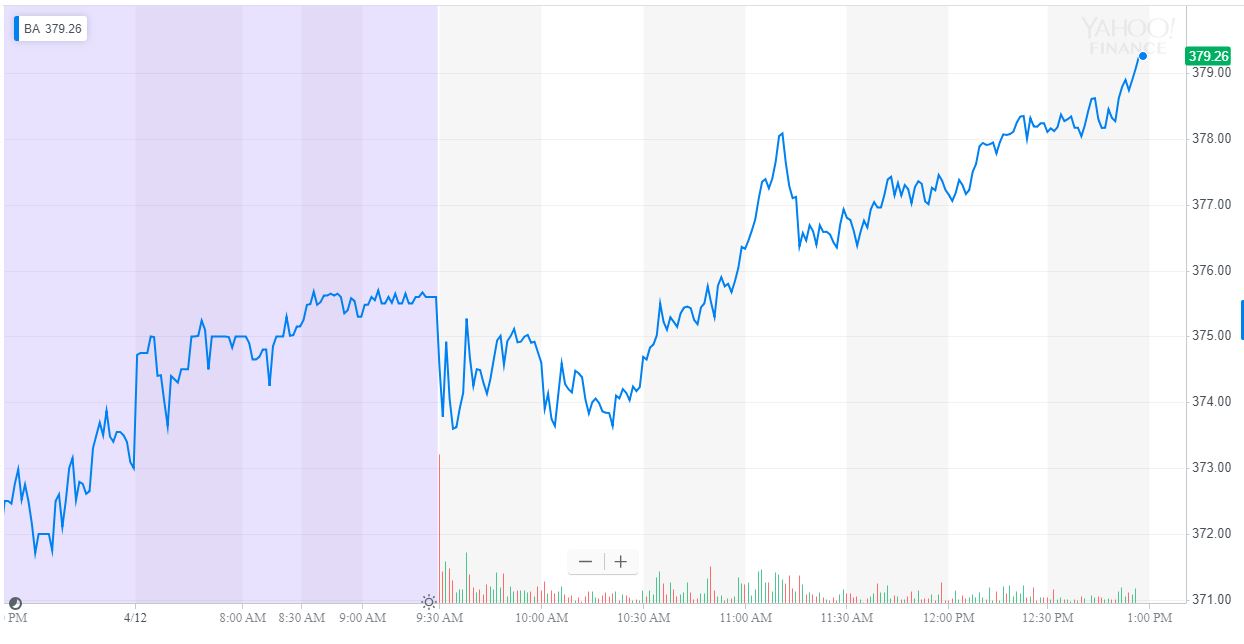

1. Disney Stock Explodes to 52-Week High

All eyes were on Walt Disney Co CEO Bob Iger as he debuted the 95-year-old entertainment conglomerate’s long-awaited streaming service, Disney+, and the House of Mouse did not disappoint.

With a subscription rate of just $6.99 per month or $69 per year, Disney+ is more than 20 percent cheaper than Netflix’s basic plan. While roughly in line with what analysts had predicted, confirmation of that price point sent bulls into a frenzy, and they mashed the buy button throughout the morning session.

Disney stock surge by more than 10 percent as investors vindicated the firm’s streaming plans. | Source: Yahoo Finance

By early afternoon, Disney stock had surged to a 52-week high. DIS shares last traded at $128.87 for a session gain of 10.5 percent.

Even more tellingly, the announcement struck fear into the hearts of Netflix investors, who dumped NFLX shares at such a rapid clip that Netflix stock fell 4 percent to post the worst performance in the Nasdaq.

2. JPMorgan Shocks With Earnings Beat

JPMorgan CEO Jamie Dimon suggested that the Dow’s bull run could continue for years. | Source: REUTERS/Mike Blake/File Photo

Were it not for Disney’s meteoric rally, JPMorgan Chase & Co likely would have dominated the headlines. The investment bank reported record first-quarter profit and $29.9 billion in revenue, shattering analyst estimates ahead of what’s expected to be a poor earnings season for corporate America.

JPMorgan stock climbed 4.6 percent to $111.12.

Even more bullish: CEO Jamie Dimon continued to pound the table on the decade-long bull market, arguing that the US economy could continue to expand “for years” and that a recession likely won’t occur before 2022.

“There’s no law that says it has to stop. We do make lists, and look at all the other things: Geopolitical issues, lower liquidity. There may be a confluence of events that somehow causes a recession, but it may not be in 2019, 2020, 2021.”

That should give the Dogs of the Dow something juicy to chew on.

3. Dow Inc Bounces Back

Dow Inc has been incredibly volatile since it replaced DowDuPont in the DJIA. | Source: Yahoo Finance

Dow Inc has been incredibly volatile since it joined the DJIA last week, and that trend continued on Friday. Shares in the material science company jumped at the open and continued to grind higher throughout the morning.

DOW shares last traded at $57.93 for a gain of more than 5.5 percent.

4. Goldman Sachs Brings Out the Banking Bulls

A slew of tech IPOs could bolster investment banks like Goldman Sachs. | Source: REUTERS/Lucy Nicholson/File Photo

Goldman Sachs Group Inc reports its quarterly earnings on April 15, and investors clearly feel optimistic following better-than-expected results from both JPMorgan and Wells Fargo.

However, earnings season may not be the only factor pumping Goldman stock. As first noted by TheStreet, Goldman Sachs stands to reap a windfall from the avalanche of tech IPOs scheduled to debut in 2019.

“With the low interest rate environment, with the investment banking side with Lyft (LYFT and Uber, they’ve [banks] still managed to be profitable and grow profits,” John Ham, associate adviser at New England Investment and Retirement Group, told publication. “If Goldman Sachs can hold up well on the trading and investment banking side, it would lead me to believe they’re the best in breed on that.”

At last check, Goldman Sachs stock had jumped 2.4 percent to $207.69.

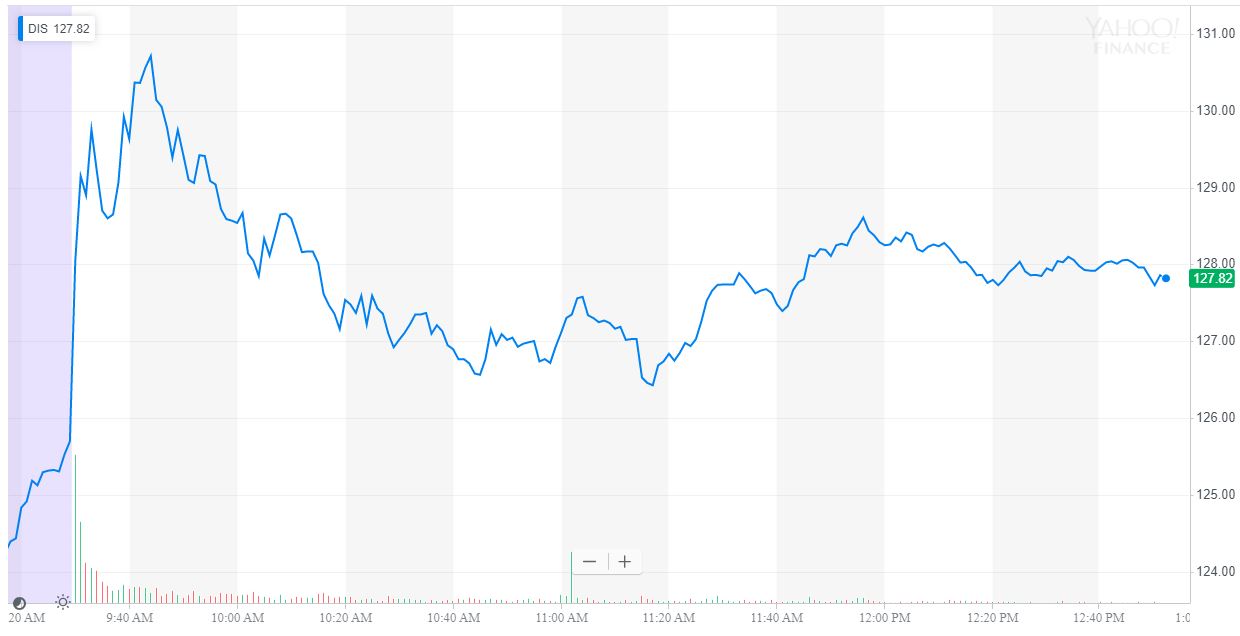

5. Boeing Stock Soars after CEO Touts 737 MAX Progress

Boeing stock soared on news that the controversial 737 MAX had logged nearly 100 flights with a crucial software patch. | Source: Shutterstock

Boeing Co rounded out the Dow’s top performers on Friday, as the embattled aerospace giant revealed that it had made significant progress toward seeing the Federal Aviation Administration give its controversial 737 MAX aircraft line the green light to once again fly the friendly skies.

According to CEO Dennis Muilenburg, Boeing has already completed 96 737 MAX test flights totaling 159 hours of airtime using the software patch designed to correct a safety issue that could have played a critical role in the fatal Lion Air and Ethiopian airlines crashes over the past six months.

Boeing stock, which had been battered over the past month in the wake of mass 737 MAX groundings and plunging commercial demand, climbed 2.34 percent to $378.81.

[ad_2]

Source link