With the rise of online trading, many individuals are looking for ways to participate in the financial markets. Now that numerous trading platforms are available, it isn’t easy to choose a reliable one. However, this in-depth broker review can help you with that. We reveal critical aspects of The Revenue Center Pro trading brand based on our experience, and you can read to consider whether it’s worth working with.

Product selection

One of the key advantages of using the platform is access to a diverse selection of tradable assets. The firm allows you to choose between multiple markets to trade, including forex, crypto, stocks, commodities, and indices. This asset diversity enables you to create a comprehensive investment portfolio and explore different trading strategies. Whether you prefer traditional asset classes like stocks or interest in cryptocurrencies, you can find TheRevenueCenterPro a good solution to accommodate.

Trading conditions

You can access The Revenue Center Pro trading terminal by clicking on the Investment Portfolio section. The broker doesn’t require clients to log in when exploring its functionalities, which lets new traders check if it has the tools or features they are looking for.

To trade btc cfds, you must open an account on the official website. Payment methods accepted for you to top up your balance are credit cards, e-wallets, and wire transfers. When it comes to withdrawal, you use the same option you used to deposit funds.

Trading accounts

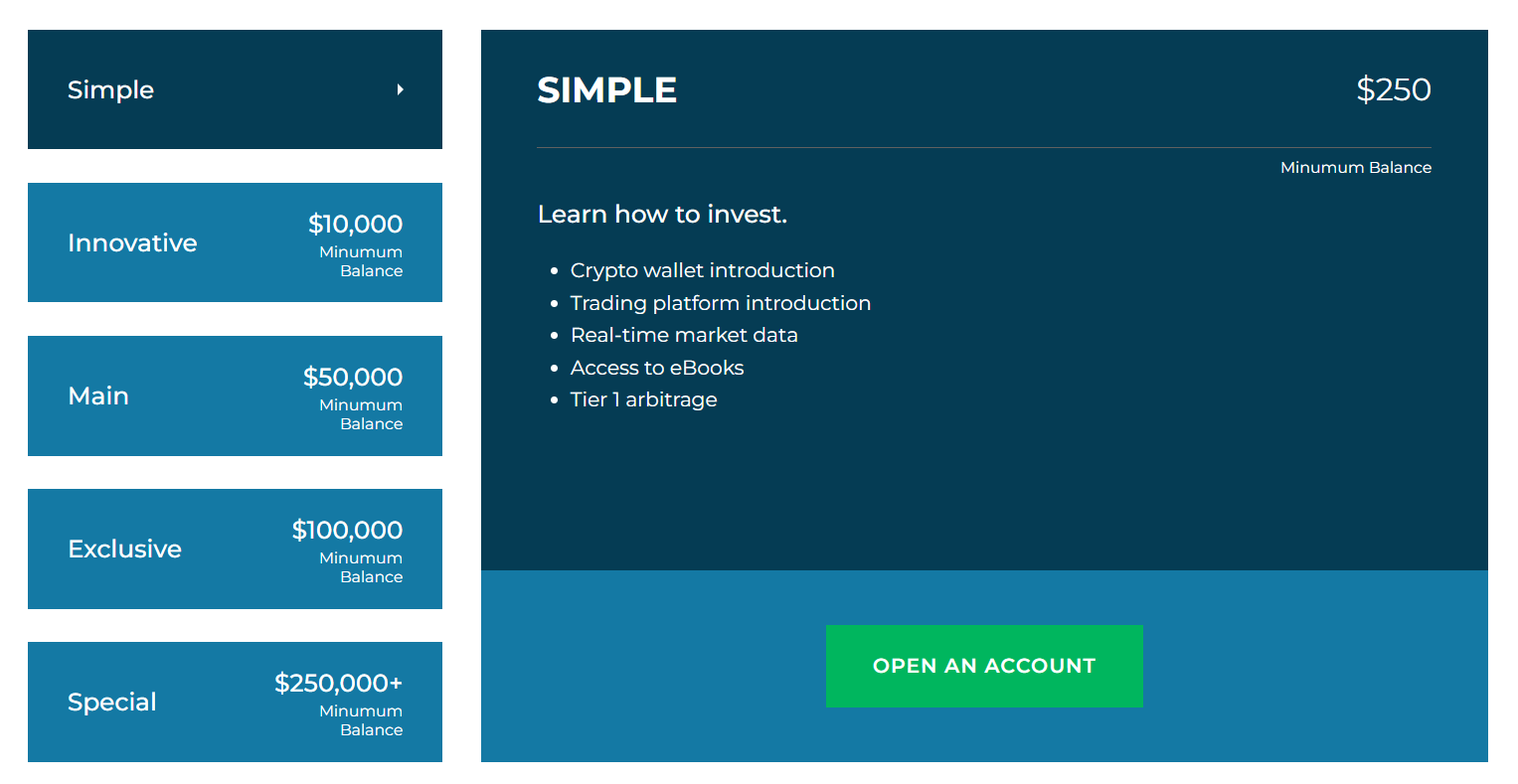

TheRevenueCenterPro provides five different accounts that are categorized by the minimum balance size.

With Simple, traders must deposit $250 to receive a crypto wallet and trading platform introduction, live market data, access to eBooks, and Tier 1 arbitrage. Meanwhile, Innovative requires a higher deposit amount of $10,000. In turn, it grants users support from a dedicated senior manager, access to video lessons, leverage up to 1:100, spreads from 1.6 pips, and tier 2 arbitrage.

Next, Main account holders can get monthly analyst sessions and engage in trade room analysis to gain deeper insights into market movements apart from higher leverage and tighter spreads. Exclusive starts from $100,000 and equips traders with more advanced trading tools and weekly webinars.

Finally, if individuals have at least $250,000 in the account, they’re eligible for Special, meaning they can participate in one VIP event, daily webinars, and many more.

Customer support

The Revenue Center Pro offers support through various methods, including online form, live chat, and email. You can reach out to them whenever you encounter trading platform issues or want to give feedback or complaints about their service.

However, note that they don’t run live chat 24/7. Following the information provided on the Contact Us page, you can only seek assistance through this method between 07:00 and 14:00 GMT Monday through Friday. Plus, two email addresses are available for support and legal purposes.

Wrapping up

TheRevenueCenterPro is an online brokerage platform providing numerous popular trading assets and diverse account options. With a $250 minimum deposit requirement, we believe it is affordable for most traders. If the company meets your current needs, don’t hesitate to experience it on your own.

The Revenue Center Pro Overview

Product Name: The Revenue Center Pro

Product Description: With the rise of online trading, many individuals are looking for ways to participate in the financial markets. Now that numerous trading platforms are available, it isn't easy to choose a reliable one. However, this in-depth broker review can help you with that. We reveal critical aspects of The Revenue Center Pro trading brand based on our experience, and you can read to consider whether it's worth working with.

Brand: The Revenue Center Pro

-

Trading Platform

-

Assets

-

Accounts

-

Customer Satisfaction

Summary

TheRevenueCenterPro is an online brokerage platform providing numerous popular trading assets and diverse account options. With a $250 minimum deposit requirement, we believe it is affordable for most traders. If the company meets your current needs, don’t hesitate to experience it on your own.