[ad_1]

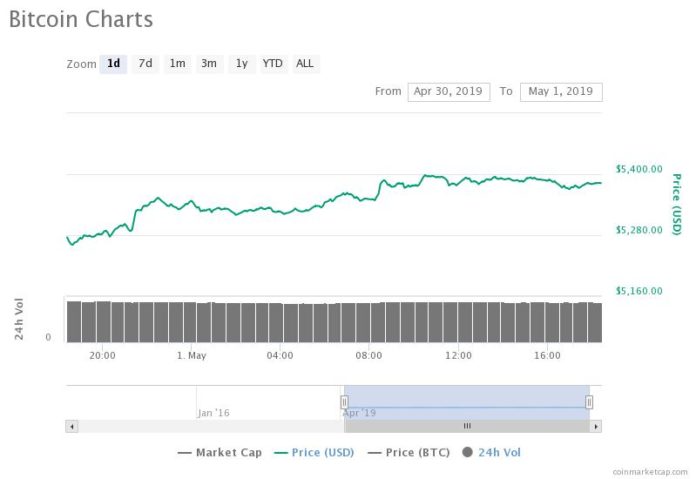

By CCN.com: The bitcoin price has increased from $5,173 to $5,297 on major regulated crypto exchanges including Coinbase in the past 24 hours, by 2.3 percent. Major crypto assets such as Litecoin and Bitcoin Cash spiked by 4 to 11 percent against the U.S. dollar.

The unexpected recovery of the crypto market overnight comes after the office of the New York Attorney General filed a lawsuit against iFinex, alleging Bitfinex of mismanaging the cash reserves of stablecoin Tether.

On April 30, as CCN reported, the general counsel of Tether stated in an affidavit that only 74 percent of Tether is backed by cash, sparking debates within the crypto community on the solvency of the most dominant stablecoin in the market.

Despite the Tether controversy, which one expert has said that it may evolve into “the most consequential regulatory intervention in the crypto-sphere” in the past three years, the crypto market has rebounded fairly strongly.

Why are Bitcoin, Bitcoin Cash, Litecoin, and the Rest of Crypto Market Surging?

After the release of the affidavit filed by the legal team of Tether, eToro founder and CEO Yoni Assia stated that the bitcoin price may positively benefit from it, at least in the short-term.

He suggested that if the confidence towards Tether as a stablecoin declines, investors would sell Tether for bitcoin, raising the volume and eventually the value of the asset.

“Are the news supposed to pump or dump BTC? Its bad news, but if $2B USDT get exchanged to BTC it actually increases its price… what a predicament. Tether Lawyer Admits Stablecoin Now 74% Backed by Cash and Equivalents,” Assia said.

While it remains uncertain which factors caused the overnight upside price movement of bitcoin, the slight increase in the value of BTC led the asset to break above a resistance level and close above it for the first time in a while.

DonAlt, a technical analyst, said:

This is the first time in ages that BTC has broken resistance & closed above it. We’ve finally got support below us that might actually hold, turning my big timeframe bias bullish. I’ll stick with swing longs until that support fails. Buys in green would be juicy.

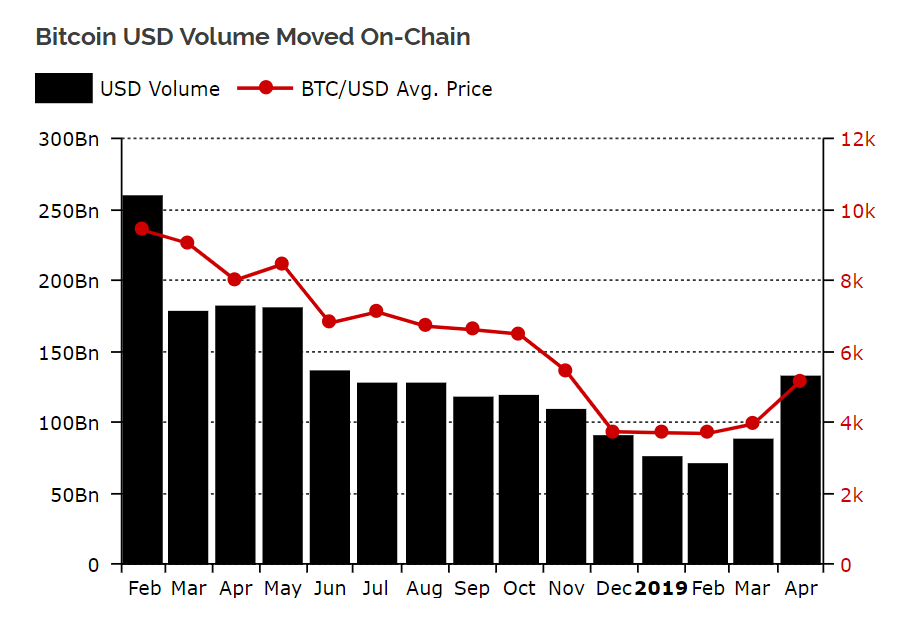

Another contributing factor to the recovery of the crypto market may have been a noticeable increase in the daily transaction volume of the Bitcoin blockchain.

Diar, a cryptocurrency research firm, reported that the bitcoin volume achieved a 10-month high.

“Still, however, monthly US Dollar value transacted on-chain has reversed the downtrend with April hitting a 10-month high. But this remains, in all likelihood, the cause of trading increasing due to Bitcoin’s recent price surge rather than actual use-case,” the report of Diar read.

The transaction volume of the Bitcoin blockchain is considered a fundamental factor for the long-term growth trend of the asset.

Can the Rally Sustain?

In two months, a key technical indicator for bitcoin flashed a sell signal as the scandal around Tether and Bitfinex led BTC to essentially flash crash within minutes.

George McDonaugh, chief executive officer at KR1 Plc, told Bloomberg:

When Bitcoin jumped significantly a few weeks ago, the volume was big enough to push up through major resistance levels into a potentially new trading range, Current movements are natural market cycles within a trading range and it’s just the market searching out the lower bounds.

In the near-term, bitcoin would need a strong stimulus for the crypto market to sustain its current momentum.

With GTI Vera Convergence Divergence indicator and the RSI bear divergence both having flashed sell signals earlier this week, traders are more cautious on the short-term price movements of cryptocurrencies.

Click here for a real-time bitcoin price chart.

[ad_2]

Source link