[ad_1]

By CCN: U.S. equities still have some runway left for gains, and tech is leading the way. Facebook, Amazon, Netflix, and Google’s parent company Alphabet – otherwise known as FANG stocks – are the cat’s meow once again. After shunning the FANG stocks in Q4 2018, investors welcomed the tech leaders back with open arms in Q1 2019, bolstering the market caps of these companies and fueling gains in the S&P 500.

Now it seems that the party in FANG stocks will continue throughout the second quarter. Even though the Dow doesn’t include any of the FANG stocks, it does consider Microsoft and Apple among its components, which positions it to benefit from the ongoing rally in tech.

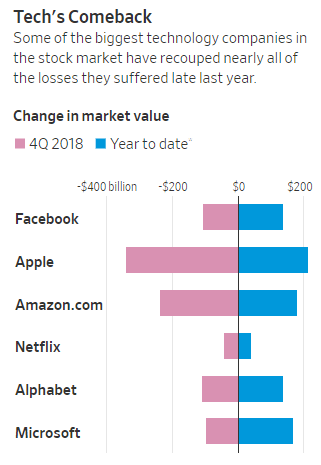

The S&P 500 index has advanced 14% year-to-date, thanks in large part to FANG stocks. These tech leaders plus Microsoft and Apple, the latter two of which also trade in the Dow Jones Industrial Average, have seen their combined value expand by more than $872 billion year-to-date, almost completely offsetting the $945 billion in market cap that was shed at year-end 2018, the Wall Street Journal points out. In addition to a robust backdrop for tech, the stock market has been buoyed by a combination of attractive interest rates and a U.S. economy that refuses to quit, despite what the bears say.

Tech Bull Favors Netflix, Holds Other Tech Stocks

Janus Henderson Portfolio Manager Denny Fish is a tech bull whose investments include Microsoft as well as a couple of the FANG stocks. He told the Journal:

“The climate couldn’t be any more different from last year. Investors are now thinking through a more positive outcome, whether it’s China or the Fed.”

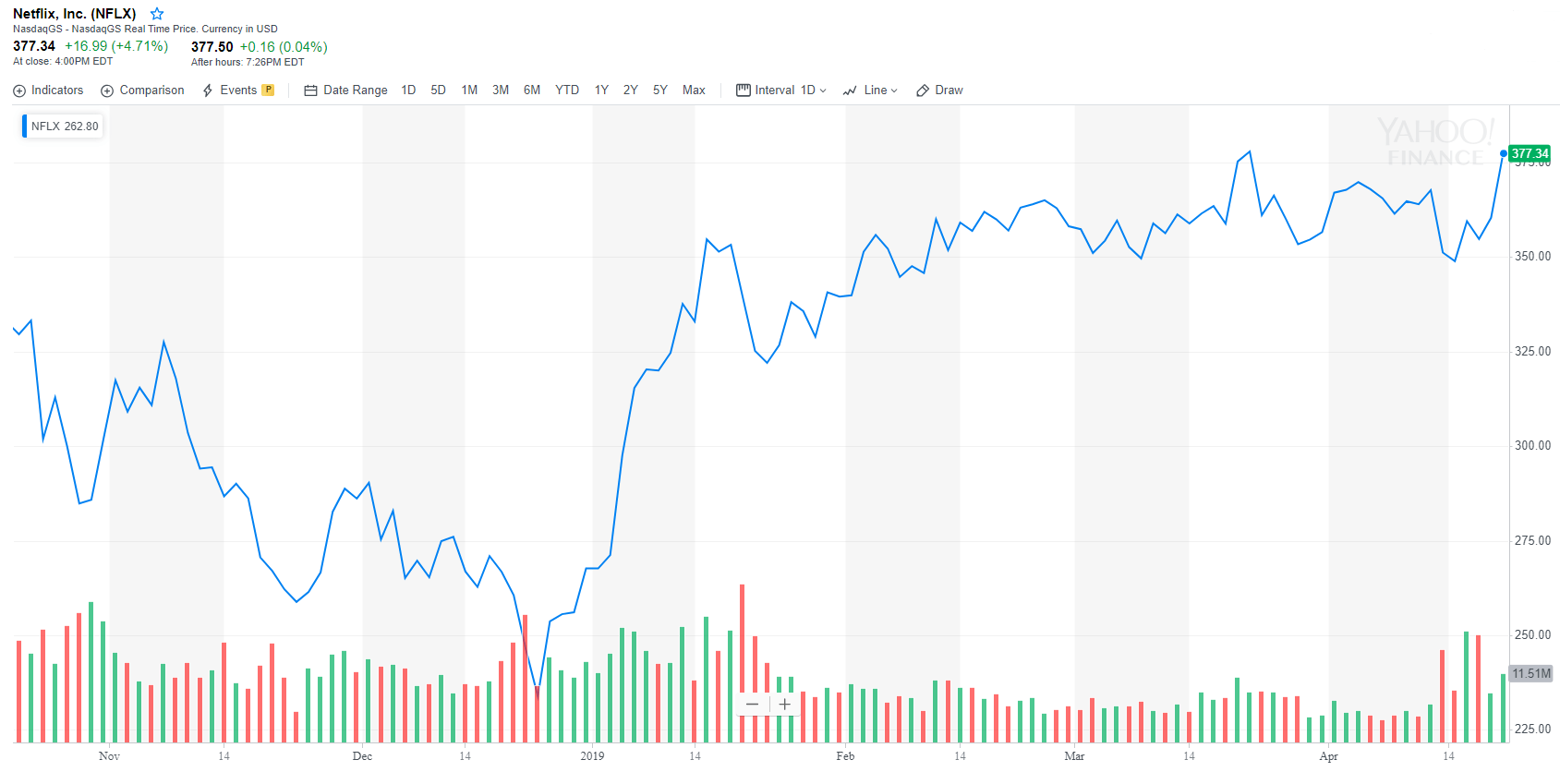

Fish especially likes Netflix even though shares are already up more than 40% year-to-date.

Second Quarter Expectations

.@Nasdaq #TradeTalks: U.S. Equities Show Relative Strength @DorseyWrightDWA @JillMalandrino https://t.co/TUZwHuajFy

— TradeTalks (@TradeTalks) April 11, 2019

Dow and S&P 500 to Benefit

Technical analysis research firm Nasdaq Dorsey Wright is touting U.S. equities as the place to be in 2019. Jay Gragnani, the firm’s head of research, says he “[continues] to see growth as a dominant theme in the market” including individual tech stocks, not to mention the Nasdaq 100. He goes on to say that the tech sector has now “eclipsed its 2018 highs.” Nonetheless, there appears to be more runway for tech to move even higher.

Investors might want to thank the Federal Reserve for the expected rally in tech stocks in 2019. With fewer places to hunt for growth and income, tech stocks are especially appealing, which bodes well for both the S&P 500 and the Dow if pressure from non-tech related stocks doesn’t get in the way.

[ad_2]

Source link