[ad_1]

By CCN: The US stock market has enjoyed a tantalizingly-buoyant month. The Dow Jones Industrial Average and S&P 500 each climbed more than 3 percent, while the Nasdaq soared more than 7 percent on blockbuster tech earnings. One micro-cap stock, however, left Wall Street’s major indices in its dust, rising 275 percent to lead the market.

Even more amazing is that absolutely nobody has the foggiest clue why.

Yuma Energy Stock Soars 275% & Not a Single Person Can Explain It

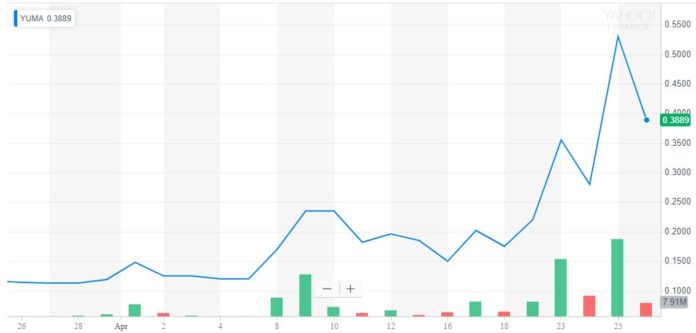

Yuma Energy stock (NYSEAMERICAN: YUMA) led the stock market over the past month after rising a parabolic 275 percent. | Source: Yahoo Finance

According to the company’s website, Yuma Energy is a Houston-based oil and gas company with active drilling and exploration operations in southern Louisiana and Texas.

Judging by its mammoth stock rally, Yuma must have stumbled on a hidden oil reserve or developed a new breakthrough in energy production technology. Right?

Wrong.

The stock’s jaw-dropping rally caught everyone by surprise, including Yuma Energy itself. Perhaps anticipating regulatory scrutiny, the company published a statement on April 25 warning investors that there is absolutely no explanation for it stock market-leading performance.

“Yuma Energy, Inc. (NYSE American: YUMA) (“Yuma” or the “Company) announces that management is unaware of any material change in the Company’s operations that would account for the recent increase in market activity.”

In fact, the only notable announcement to come out of Yuma Energy this month is that Sam L. Banks resigned from the Board of Directors, less than a month after having been replaced as the company’s CEO amid a desperate restructuring effort.

Nor did a statement published on April 2 add to Yuma’s bull narrative. Instead, it revealed an alarming working capital deficit and advised shareholders that there is “substantial doubt about the Company’s ability to continue” (emphasis added):

“Generally, events of default under the Company’s credit agreement, declines in production, reduction of personnel, the failure to establish commercial production on our Permian properties, and our substantial working capital deficit of approximately $37.0 million as of year-end, as noted above, raise a substantial doubt about the Company’s ability to continue as a going concern.”

Suspicious Stock Price Rally Appears to Save Company from NYSE American Delisting

So it’s against this backdrop that the firm inexplicably assembled a 275 percent stock rally, one that seemingly helped rescue it from a devastating stock exchange delisting.

As recently as January, Yuma stock risked losing its place on the NYSE American stock exchange. At the time, the exchange warned that Yuma shares needed to sustain a level above $0.06 or it would boot the company from the platform on July 4. Following a banner April, YUMA shares trade comfortably above that mark.

But perhaps not for much longer.

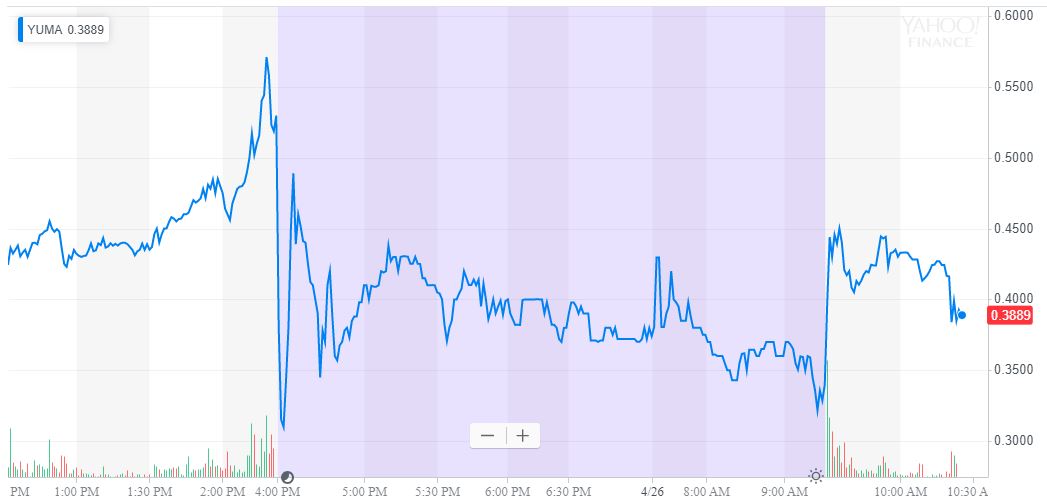

Yuma Energy stock plunged after the company admitted that it didn’t know what sparked the mammoth April rally. | Source: Yahoo Finance

Yuma stock plunged immediately following Thursday’s close, just minutes after the company conceded that there had been “no material change” to its business operations to justify its stock price increase.

By Friday, shares had crashed 27 percent to $0.3864. It looks like investors are finally coming to their senses.

[ad_2]

Source link