[ad_1]

By CCN: Will you or an S&P 500 index fund investor you love retire within the next decade? Blessed with a beefy 401(k) and hope for continued stock market growth to keep it that way? If the answer to either of these questions is yes, you might want to start volunteering for Donald Trump’s 2020 presidential campaign.

That’s one controversial conclusion investors could draw from an election-focused stock market analysis published by Candy Matheson, which examines how the S&P 500 would respond if Joe Biden vanquishes Trump from the Oval Office.

Candy Matheson: Joe Biden Victory Would Force S&P 500 Back to Pre-Trump Levels

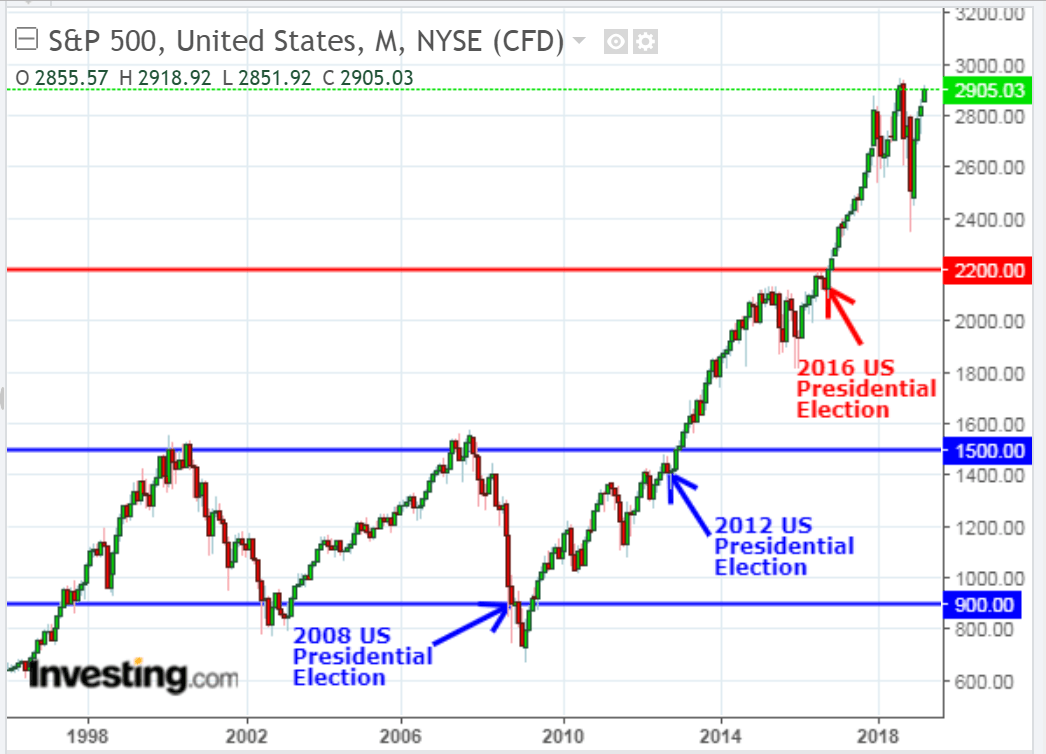

Writing over at Slope of Hope, Matheson, a retired day trader, said that a Joe Biden presidency would likely send the S&P 500 back to “pre-Trump levels around the 2200 level, or lower.”

She wrote:

“Were he to be elected, and if the old Obama policies were resurrected, we could very well see the S&P 500 Index return to pre-Trump levels around the 2200 level, or lower.”

A return to pre-Trump levels would cause the S&P 500 to sink 25% from its present mark above 2,900. | Source: Candy Matheson/Slope of Hope

At present, the S&P 500 sits just above the 2,900 level. A 700 point plunge translates into a decline of nearly 25 percent. An equivalent pullback across the stock market’s other two major indices would force the Dow Jones Industrial Average back below the 20,000 level and sink the Nasdaq to 6,000.

Staggering as those numbers may be, Matheson believes a Trump loss in 2020 could absolutely pummel the S&P 500 and its fellow stock market bellwethers.

“In the two years since President Trump took office, the SPX has gained around the same number of points as it did in the last four years of Obama’s presidency. Those gains are in jeopardy, as uncertainty will weigh on markets in anticipation of a possible return to a more socialist agenda under Biden, or an even more far-left leaning Democrat.”

And That’s a Best-Case Scenario!

If the Democrats retain the House of Representatives and take both the Senate and White House, the party’s radical wing could pressure the president to sign controversial policies such as the Green New Deal into law. | Source: Alex Wong / Getty Images / AFP

Remarkably, that might be the best-case scenario if a Democrat takes the White House. If the Democrats unify the government by taking the House and the Senate, the party’s ascendant progressive wing would likely pressure the center-left Biden to sign legislation that is far more radical than anything that ever crossed President Obama’s desk.

“Think about it,” Matheson warned, “the Democrats’ Green New Deal (et al) is only an election away…”

Even more alarming, by Matheson’s reckoning, is that Wall Street believes Joe Biden is the most stock market-friendly candidate in the entire Democratic field, according to a recent survey from RBC Capital Markets.

“Most expect Trump to win in 2020, but there’s still some nervousness around the event,” Lori Calvasina, RBC’s head of U.S. equity strategy, said. Sixty-seven percent “of our March 2019 survey respondents believe that Joe Biden is seen as the most acceptable Democratic candidate by the stock market for the White House. No other candidate got a significant number of votes.”

If Wall Street-friendly Joe Biden would trigger a stock market plunge, imagine what could happen on President Bernie Sanders’ watch. | Source: REUTERS / Yuri Gripas

So imagine what could happen if another candidate – Bernie Sanders, for instance – manages to wipe the all-American smile off Biden’s face and then beat Trump on his Rust Belt turf in the general election. By Matheson’s analysis, Wall Street’s temperature could quickly take a frigid turn.

Luckily for Matheson – and Donald Trump – 70 percent of Wall Street insiders believe that the former reality TV star will win reelection. In addition to the incumbency advantage – no president has lost his reelection bid since George H.W. Bush in 1992 – Goldman Sachs argues that the strong US economy will push Trump over the electoral finish line, no matter who appears opposite him on the ballot.

[ad_2]

Source link