[ad_1]

By CCN: The bigger they are, the harder they fall. This has certainly been the case for cannabis stock Tilray, which was all the rage in 2018 but has had the wind knocked out of it lately. Tilray’s stock has shed approximately one-fifth of its value in April alone. The longer-term performance is worse, with the stock suffering declines of 28% year-to-date. A new cannabis ETF with the trading symbol YOLO – You Only Live Once – could change the Tilray stock’s plight sooner than later.

When it’s hot, it’s hot and when it’s not, it’s not. The Tilray stock was riding on the tailwinds of an overhyped IPO in 2018. After California regulators gave the company approval to test medical marijuana in the state, the shares were feeling the love. Tilray CEO Brendan Kennedy got caught up in the hype and predicted that the company will achieve a market cap of $100 billion. After boasting a market cap of $21 billion in Q3 2018, Tilray is worth $5 billion today. But given robust demand it could just represent a buying opportunity, depending on how regulation plays out in the cannabis space.

Cannabis ETF: You Only Live Once

If you’re wondering the best way to play the cannabis sector, a hot new ETF has just hit the market. The AdvisorShares Pure Cannabis ETF made its debut last week, and it’s only the second fund of its kind for investors to choose from. The fund just added another stock, Greenlane Holdings, which is a play on cannabis that is in the smoke shop business. AdvisorShares says the stock was pricey for the IPO but they were able to buy the dip afterward. That’s how cannabis stocks roll – they are fast moving and if you can spot an opportunity you don’t want to pass it up.

$YOLO update, delivering on our active mandate, we’ve added $GNLN Greenlane, $ARNA Arena, and $NTEC Intec Pharma see the video update #cannabisinvesting #cannabisstocks see the video below (link to video) full holdings https://t.co/GYsnVZw1uC pic.twitter.com/dzaQ6rbifr

— AdvisorShares (@AdvisorShares) April 23, 2019

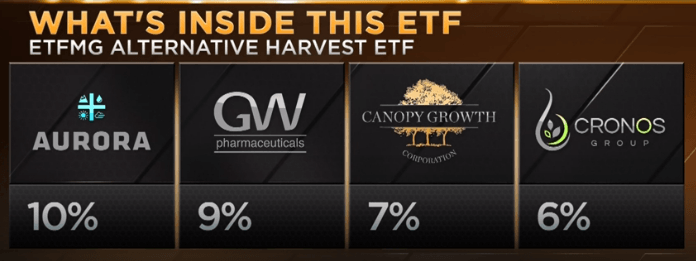

Other cannabis stocks including Aurora Cannabis and Canopy are up 72% and 65% year-to-date, respectively. Both of those stocks are components in another marijuana product, the ETFMG Alternative Harvest ETF, which has advanced close to 40% year-to-date. A rising tide lifts all boats and Tilray should be able to capture some of that demand, eventually, especially considering it appears to be a component in the YOLO ETF.

Where’s the Good Stuff?

The problems that Tilray is facing, however, appear to be very short term in nature. The Canadian cannabis company hasn’t been able to find enough quality weed to satisfy demand. That’s actually a good problem to have because it would be worse to earn a reputation for peddling bad weed. The Tilray CEO expects the supply issue will be resolved by 2020.

The haters will hate, and two of Tilray’s executives including Kennedy and chief revenue officer Woody Pastorius sold a combined nearly $10 million worth of shares this month. Turns out, however, that the stock sale was scheduled beforehand and was set to trigger when certain incentives were met. The company reportedly maintains that they didn’t come close to liquidating their Tilray portfolio, which is more than Charlie Lee, the creator of cryptocurrency Litecoin, can say.

Cannabis Stocks and Bitcoin Are Distant Cousins

Equities and cryptocurrencies are completely different asset classes with a negative correlation to one another. Yet they also have some features in common. Both are navigating new terrain in a murky regulatory environment. Both bitcoin and Tilray were said to be overhyped, but demand isn’t going anywhere for crypto or cannabis stocks, both of which are hot sectors. It may not be smooth sailing all the way but not much has changed to justify sustained pressure the Tilray stock. Similar to bitcoin making slow and steady gains in 2019, the Tilray stock should get its groove back.

[ad_2]

Source link