[ad_1]

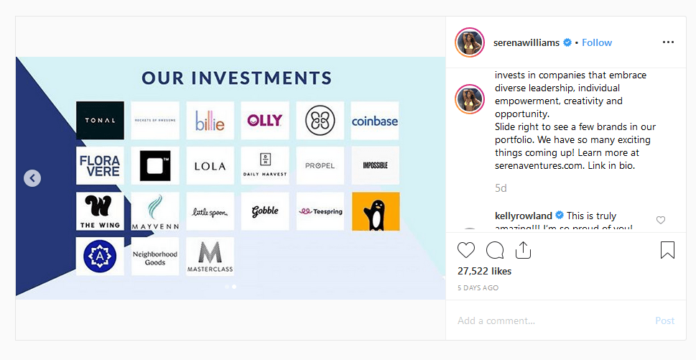

By CCN: The world learned recently of Serena Ventures, a fund owned and operated by Serena Williams, which has invested in companies like Coinbase and Masterclass. The star tennis player didn’t mention bitcoin in her Instagram post, which revealed her company for the first time, but she did list companies that the firm has invested in.

Investing in Crypto by Proxy

Investing in Coinbase is essentially an investment in cryptocurrency. Coinbase’s primary function is to sell crypto to retail investors, with a growing business in its professional trading solutions and institutional custody products. Coinbase is one of the largest crypto companies in the world by revenue, user base, and capitalization. If anyone in the space succeeds long-term, it will be them. They recently got into hot water for their acquisition of a blockchain intelligence firm which included founding members of HackingTeam, a firm which became famous when it was hacked and revelations of its work for authoritarian governments surfaced.

The source of all the crypto news articles surrounding Serena Ventures is an Instagram post by Serena Williams. However, investments are almost always publicly divulged due to regulations, and we could not find any record of investment into Coinbase by Serena Ventures or her other listed fund, the Serena Williams Foundation.

We reached out to Coinbase for comment, hoping to get the date of investment and the sum, and we’ll update this article when we receive a response. There’s an alternative narrative that perhaps the fund intends to invest in Coinbase, or invested privately. We’re trying to get to the bottom of this.

Serena Ventures’ most significant investment is $60 million into Mobli, an Israeli video and photo sharing platform. They have lead one round into a company called Olly, which they have also exited.

Williams is reportedly worth around $180 million at press time. Serena Ventures has invested more than $300 million, however, which indicates that “net worth” reporting websites probably don’t have a full scope of celebrity portfolios, if nothing else. Another explanation might be that Williams has only recently begun publicizing the existence of her fund, joking in her Instagram post:

“In 2014, (yes I know I can keep a secret) I launched Serena Ventures with the mission of giving opportunities to founders across an array of industries.”

Serena Ventures targets companies who “embrace diversity” and prefers to invest in the early stages of a company’s lifecycle. Coinbase’s initial funding round ran in 2012, and it’s had a follow-up round nearly every year since. Its most recent series was last October. Business Insider reports that Serena Ventures has invested in more than 30 companies, but the firm’s Crunchbase profile only talks about 22.

[ad_2]

Source link