[ad_1]

The SEC received just seven comment letters from the public in response to a solicitation for feedback it had requested in February 2019. Of those, six urged the agency to reject the application. (That’s around 84%.) The industry’s enthusiasm for a Bitcoin ETF (exchange-traded fund) appears to be waning — if you judge that by the dearth of new comment letters to the Securities and Exchange Commission in support of the investment vehicle.

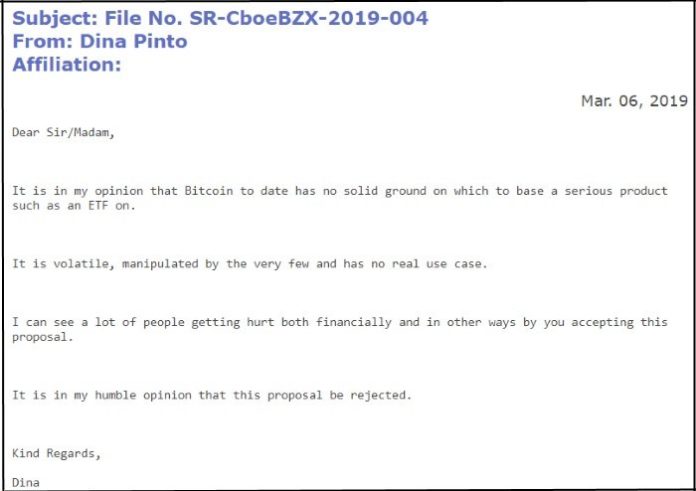

Commenter: Bitcoin ‘Is Volatile, Manipulated’

Dina Pinto wrote:

“It is in my opinion that Bitcoin to date has no solid ground on which to base a serious product such as an ETF on. It is volatile, manipulated by the very few and has no real use case.”

“I can see a lot of people getting hurt both financially and in other ways by you accepting this proposal. It is in my humble opinion that this proposal be rejected.”

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click here to sign up.

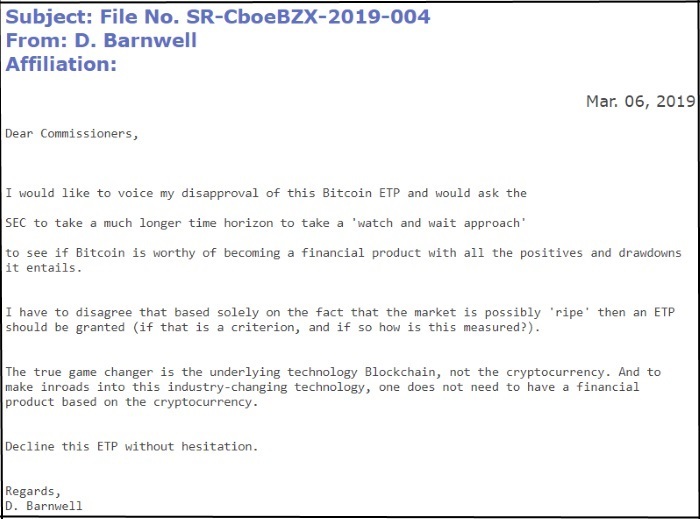

Commenter: ‘Decline This Without Hesitation’

D. Darnwell wrote:

“I would like to voice my disapproval of this Bitcoin ETP and would ask the SEC to take a much longer time horizon to take a ‘watch and wait approach’ to see if Bitcoin is worthy of becoming a financial product with all the positives and draw-downs it entails.”

“Decline this ETP without hesitation.”

Proponent: ‘Bitcoin Itself Is Revolutionary’

However, bitcoin ETF proponent Sami Santos wrote:

“Regarding the argument of the SEC that has not yet approved an ETF because of manipulation and mainly appreciates the protection of investors is contradictory, because without an investment fund, the investor is susceptible to buy bitcoins in deregulated exchanges and lose their investments (bitcoins).

VanEck already offers insurance to cover possible losses and as such, the investor will show interest in investing in an ETF fund. So I see no reason not to approve VanEck ETF and Bitwise.”

Approval Before Q4 Unlikely

In September 2018, the bitcoin ETF application for the VanEck SolidX Bitcoin Trust received more than 1,400 comment letters — of which 99% were positive. But that enthusiasm has since dwindled, presumably due to the ongoing Crypto Winter.

As CCN reported, the CBOE (Chicago Board Options Exchange) and VanEck resubmitted their bitcoin ETF application in late-January following a 35-day U.S. government shutdown.

The refiling came weeks after VanEck withdrew the application during the shutdown amid concerns that it could result in an automatic rejection.

When an ETF filing is withdrawn, that resets the clock. That means the 240-day deadline is set once again when a new filing is submitted. Given the SEC’s typical foot-dragging on approvals, it’s likely the agency will wait out the entire 240 days before making a final decision.

This means it’s unlikely that a bitcoin ETF will be approved in the United States before the fourth quarter of 2019.

SEC Chair Concerned About Market Manipulation

On March 14, SEC chairman Jay Clayton underscored that he’s not pro- or anti-crypto, but underscored that he has serious concerns about market manipulation. However, he says there definitely “may be a case where a bitcoin ETF could satisfy our rules.”

Clayton also expressed optimism that cryptocurrencies and blockchain — the technology underpinning bitcoin — show great promise.

“What I’m concerned is if it can be reasonably demonstrated that the underlying trading is generally not manipulated, it’s happening on reliable venues with good rules, and that custody is something we can feel comfortable about.”

“I think this technology has and is already demonstrating pretty significant promise. But it’s demonstrating significant promise in the places where it’s consistent with our approach to capital-raising in the past.”

[ad_2]

Source link