[ad_1]

By CCN: They may both belong to the billionaire club, but there’s no love lost between hedge fund manager David Einhorn and Tesla CEO Elon Musk. Einhorn, whose hedge fund Greenlight Capital recently saw its assets under management fall below $3 billion, is no fan of Musk. The hedge fund trader presented at the Sohn Investment Conference in New York where he discussed the fund’s current positions. Einhorn is short TSLA and he would probably be short Elon Musk too if he could. Quoting Napoleon, he stated:

“Never interrupt your enemy when he’s making a mistake.”

Einhorn played a video montage with some of Musk’s most outrageous promises over the years, some of which have failed and others of which time will tell. After a slide quoting Musk saying “it is financially insane to buy anything other than a Tesla,” the hedge fund manager reportedly quipped:

“That’s a bunch of horses**t.”

Am considering taking Tesla private at $420. Funding secured.

— Elon Musk (@elonmusk) August 7, 2018

Einhorn’s disdain of Tesla’s stock is well known considering the hedge fund has been short TSLA shares for the past few years. In fact, it was that short position that caused Greenlight Capital to crash and burn in 2018 in its worst annual performance in the fund’s history. No wonder Einhorn is so mad. He was betting against the electric vehicle maker and Tesla’s stock had a better year than the sophisticated trader could have guessed.

This year, Greenlight Capital’s shorts are working more in his favor, with Tesla’s stock down 17% so far in 2019. But if Musk has proved anything, it’s don’t count him or his company out. The Tesla CEO has a way of charming his way out of most anything while keeping his followers waiting with bated breath for his next move. And it’s not just stock market investors, it’s the crypto community, too, ever since Musk expressed an interest in certain lucky coins.

Greenlight Capital’s Long Position is Beating the Dow

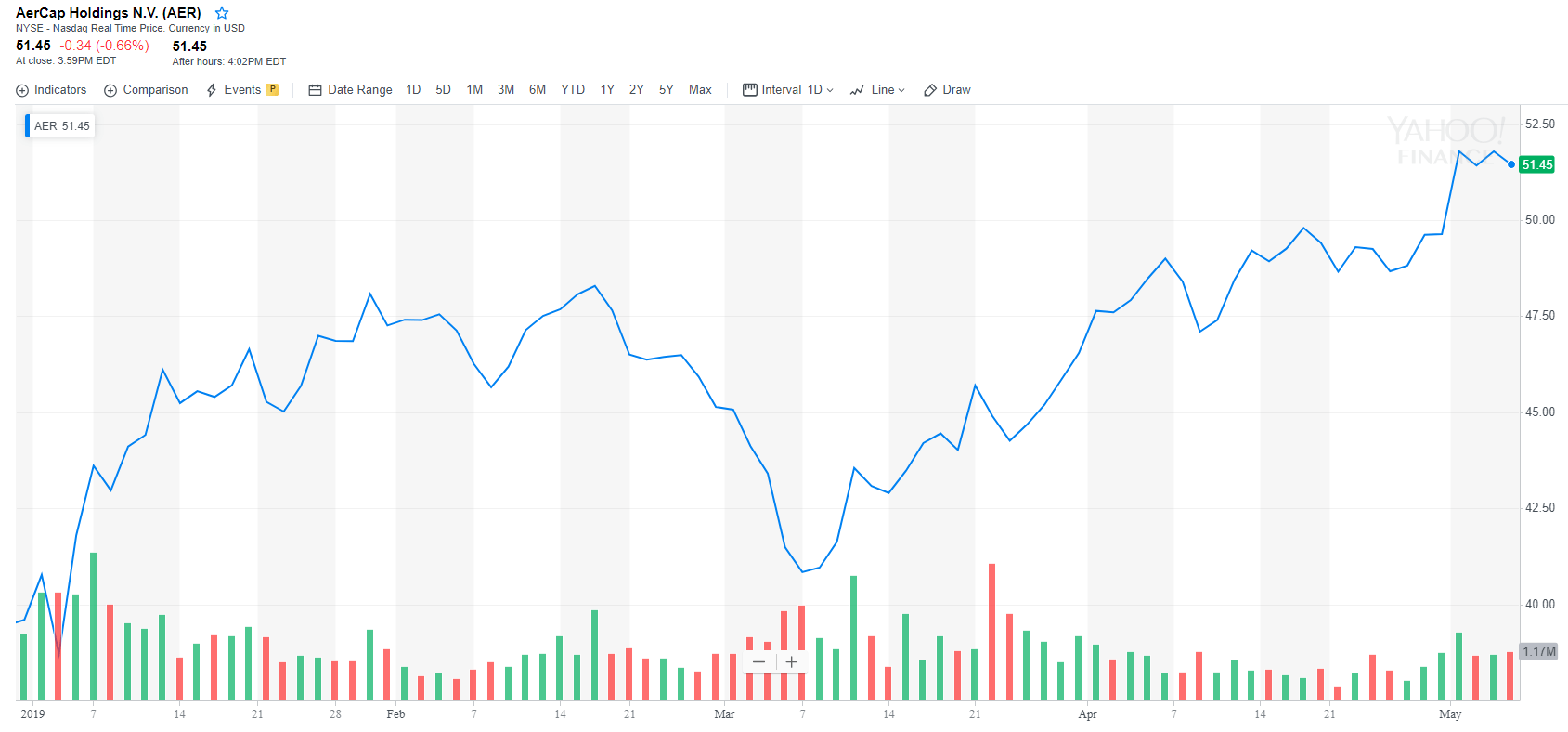

Einhorn is having a better 2019. In addition to betting correctly on Tesla’s stock so far, he’s spotted a winner that’s beating the Dow. Einhorn has managed to do it by investing in AerCap Holdings, which is a play on aircraft leasing. It’s also a way to avoid the aerospace industry considering the dismal performance of Dow component Boeing.

AerCap’s stock has rallied 30% year-to-date, which is approximately double the returns that the Dow has been delivering.

As for his short position on both Tesla and Elon Musk, Einhorn has a lot to prove. He’s clearly not going to quit while he’s down.

[ad_2]

Source link