[ad_1]

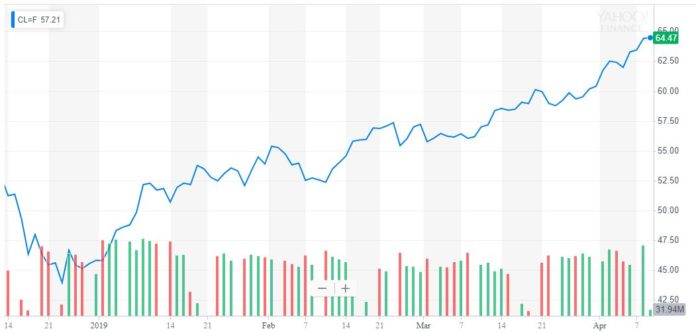

Donald Trump has been doing his best to wage war on the rising oil price, but the president is struggling with the fact that strong US growth is a natural boost to crude.

However, there is another thorn in his side – Saudi Arabia-led OPEC, who have been keen to limit supply. Given that state-owned Aramco is gradually opening to global investors, it seems unlikely that Mohammed Bin Salman and Khalid Al-Falih will want to let oil production off the leash anytime soon.

Saudi Arabia’s Aramco Triumphs in Blockbuster Bond Offering

The US might be the world’s biggest individual producer, but Saudi Arabia still casts a large shadow over the bulk of the crude supply. Aramco’s recent bond sale is part of the crown prince’s efforts to gradually open up the Saudi economy. It was a tremendous success, raising around $60 billion.

Due to the need for an audit to raise debt, Aramco is now officially the world’s most profitable company. The rabid demand for the bond could spur Saudi Arabia to accelerate its plans for the long-awaited Aramco IPO.

While Aramco is slowly prepping for that IPO, the oil price surge couldn’t be better for the Saudis – or worse for Trump.

President Trump would love for oil prices to fall to help support his agricultural voter base and juice the economy with additional economic stimulus. However, Aramco has no incentive to open the taps. Analysts rave about the raging success of the bond sale with oil above $60 a barrel. Imagine how much money Aramco would be worth in an IPO if crude prices continued to rise from here.

Trump might eventually succeed in his bid to reduce the cost of oil, but Aramco will likely massage prices until an IPO date is chosen. Given that this might not be until 2021, he might be waiting a while – and might not even be in office when it happens.

If President Trump intends to lower the oil price, he would be better served encouraging Saudi Arabia to move up the IPO. Until the kingdom secures the funds for Aramco’s sale, they would be crazy to do anything to dent crude. Only time will tell if Trump’s upgrades to US pipeline infrastructure will be able to keep WTI under wraps.

Trump’s Iranian Policy Is Bullish for Oil Speculators

Prices continue to soar, and it doesn’t look like OPEC will be “increasing the flow of oil” anytime soon. The fact that Trump keeps ramping up policy attacks on major oil producer Iran is just compounding his problem. Middle East disruption and the liberal flow of crude do not go hand-in-hand.

[ad_2]

Source link