[ad_1]

By CCN.com: Samsung, South Korea’s biggest conglomerate and one of the world’s largest brands, has invested $2.9 million in crypto hardware wallet manufacturer and custodial service provider Ledger in a high-profile deal.

The multi-million dollar investment in Ledger by Samsung comes less than a week after Samsung Ventures led a $4 million round in ZenGo, a startup developing keyless crypto wallets.

On aura toujours besoin de hardware wallets, mais pour accompagner une révolution crypto basée sur une souveraineté personnelle accessible à tous, le smartphone va effectivement jouer un rôle central.

— Eric Larchevêque (@EricLarch) April 24, 2019

The commitment of Samsung in the crypto sector is likely to act as a catalyst that recovers the confidence of investors in the long-term prospect of the market.

Why Samsung is Heavily Investing in Crypto Wallets

Earlier this week, CoindeskKorea, a crypto publication operated by mainstream media outlet Hankyoreh, reported that Samsung is reportedly testing Samsung Coin and an ERC20-based blockchain protocol on top of the Ethereum blockchain.

“Blockchain task force made several models and are evaluating [them]. There are already several platforms that are functioning after some internal tests,” a company insider told local publications.

If Samsung has planned to launch its own crypto asset all along, its relatively aggressive move to integrate a crypto wallet into the Galaxy S10 during a period in which most major smartphone manufacturers are cautiously observing the market becomes more sensible.

More to that, the focus of Samsung Blockchain Wallet on providing support to ERC20 tokens play along with the current plans of Samsung to launch an ERC20 token primarily for business-to-business (B2B) operations.

Samsung likely was initially compelled by Ledger’s popularity in the crypto space and its ERC20 compliant hardware wallets, which would benefit the users of Samsung Coin if and when it launches.

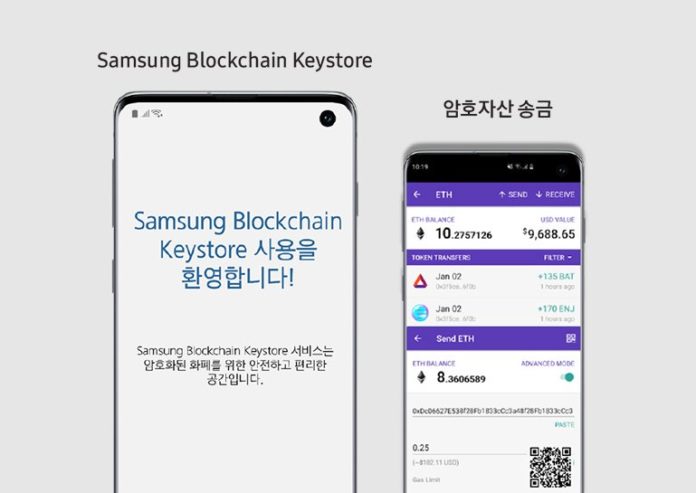

Photograph of Samsung Blockchain Keystore Released by T Store Featuring an Ethereum and ERC20 Wallet | Source: Tworld.co.kr

The South Korean electronics giant may have been convinced by the outlook of Ledger’s operations as the company moves towards serving both retail investors and institutional investors as a crypto custody provider.

“While countless retail hodlers trust Ledger to secure their crypto, companies who manage huge amounts of crypto, like institutional investors, family offices and exchanges are also starting to trust us,” Pascal Gauthier, the new CEO of Ledger, said in an email.

Last year, Ledger raised $75 million led by billionaire Tim Draper, Boost VC, and Draper Esprit. At the time, Ledger said that the funding round was “oversubscribed” and that it was the biggest Series B round in 2018.

The Series B funding round was secured by the company to improve its operations in hardware manufacturing and retail investor support.

“For the wallets, we integrated our operating system in a secure chip, and for the Vault, we are integrating it in a hardware security module. The idea behind it is to provide additional features and services, such as multiaccounts, multisignature or timelocks,” Ledger co-founder Eric Larchevêque said in 2018.

The new funding round led by Samsung is expected to further increase the potential growth rate of Ledger in a relatively new sector in crypto custody.

Expect More Deals

Samsung is already heavily involved in the crypto market with its mining equipment manufacturing business, the Samsung Blockchain Wallet, and investment in various cryptocurrency-related ventures.

As the process of developing the mainnet of the conglomerate’s cryptocurrency approaches its final stage, the company may engage in more deals that could eliminate the boundaries between the cryptocurrency and mainstream users.

Based on the investment of Samsung in ZenGo and Ledger, it’s clear that the company is favoring startups that ease the process of using cryptocurrencies in day-to-day operations.

Ouriel Ohayon, the CEO of ZenGo, previously said that he was shocked by “how prehistorical solutions were” in crypto and the lack of efficient solutions could become a real roadblock when onboarding casual investors and mainstream users.

[ad_2]

Source link