[ad_1]

The rise of the blockchain is revolutionizing the way

society interacts financially. Despite the substantial influence that

traditional services have, every new day serves to establish DLTs and the

cryptocurrencies as a robust and reliable substitute to fiat-based solutions,

to the point that there are already influential players who recognize the

increasing influence of these technologies.

On the 26th of March 2019, the World Bank published an article praising blockchain technologies and stressing that DLTs have the potential to positively impact the lives of millions of individuals, specially in countries with little economic development.

DLT-based cross-border payments potentially offer a promising pathway to dramatic improvements in the lives of millions of people in emerging economies. DLT could improve the traceability of remittances and reduce compliance costs for MTOs and supply chain payments, stimulating economic activity in destination countries.

The problem with traditional remittance systems is that they

are not at all efficient. The World Bank states that in the regions where

these services are most required, the costs are way higher:

Remittances are more expensive precisely in the corridors where they are needed most. Sub-Saharan Africa remains the most expensive region to send money to, with an 8.97% average cost.

Cross-border payment innovations can help reduce operational costs for remittance service providers.

The Blockchain is Changing The Remittance Business and Ripple is Leading That Revolution

The global remittances business reached about 642 billion dollars in 2018. In certain countries such as Nepal and Haiti, it even accounts for about a third of gross domestic product. The need to improve this service is a major issue.

The World Bank explained that certain technologies are

already being developed; however, it seemed particularly optimistic

about Ripple. According to the institution, the progress of xRapid (a Ripple

solution powered by XRP) is a successful experience, lowering the costs

associated with money transfers by up to 70%.

In 2018, Ripple, a FinTech company, piloted xRapid, a DLT-based cross-border payments solution, along the very competitive U.S.-Mexico corridor. Financial institutions involved in the pilot saved 40%-70% in foreign exchange costs, and the average payment times was just over two minutes. The transfer of funds on xRapid took two to three seconds, with most of the processing time explained by domestic payment rails and intermediary digital asset exchanges.

The figures provided by the World Bank are neither isolated nor subjective. As reported by Ethereum World News, a recen study by Blockdata also reached the same conclusion, explaining that a transaction with XRP is hundreds of times faster and cheaper than the most efficient means of remittances today.

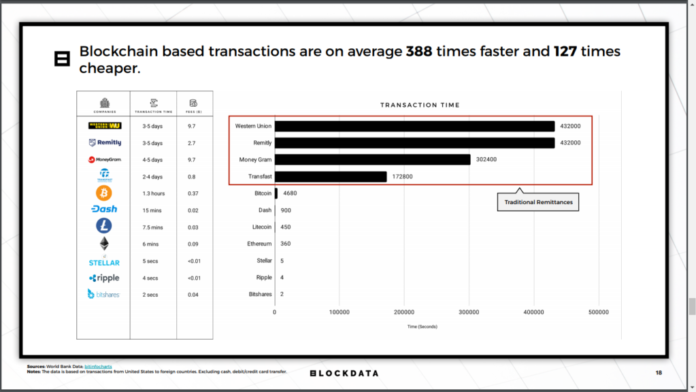

The study showed that comparing the best fiat-based remittance services against any cryptocurrency transaction, “blockchain based transactions are on average 388 times faster and 127 times cheaper than traditional remittances”

[ad_2]

Source link