[ad_1]

Image: Shutterstock

In order to continually improve the health of XRP markets globally, we will share regular updates on the state of the market including quarterly sales, commentary on previous quarter price movement and related company announcements.

Quarterly Sales

In Q1 market participants purchased $6.7MM directly from XRP II, LLC*, Ripple’s registered and licensed money service business (MSB). These buyers tend to be institutional in nature and their purchases include restrictions that help mitigate the risk of market instability due to large subsequent sales.

Market Commentary: A Quiet Start to a Raucous Ending

Though Q1 2017 began much in the same way as Q4 2016, quietly, it ended with a dramatic spike in market activity.

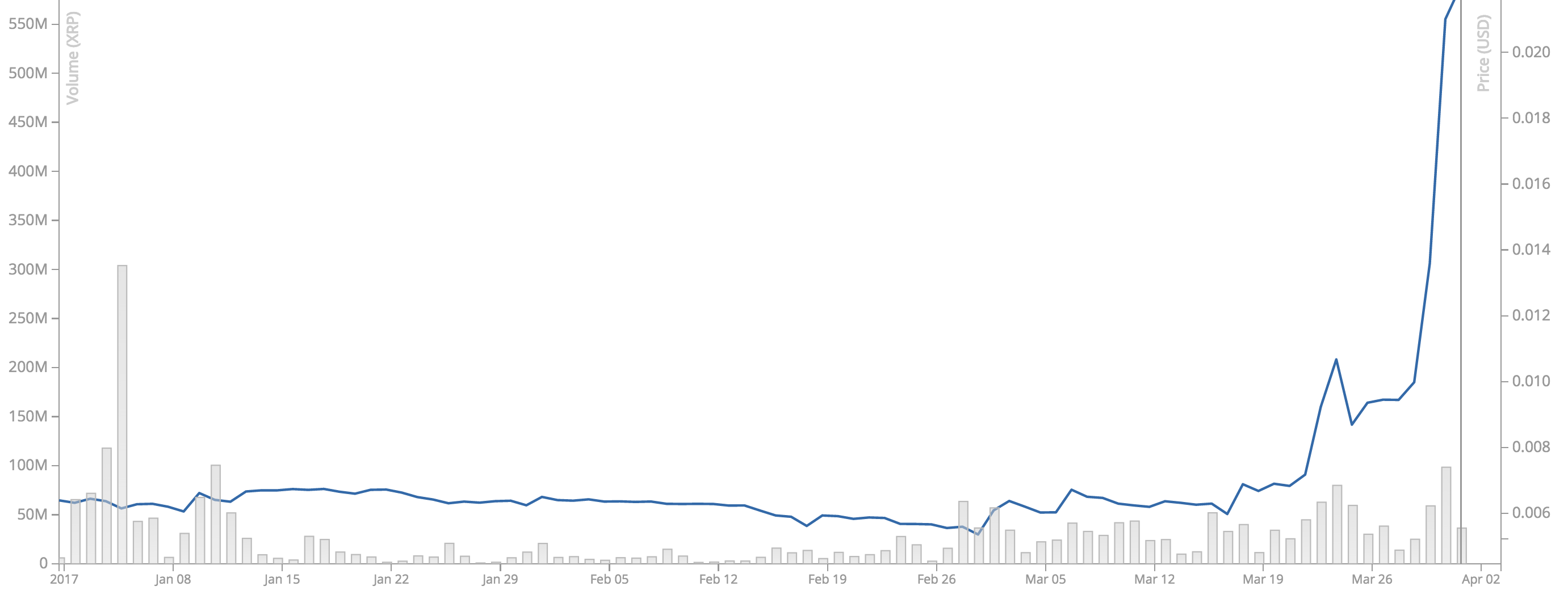

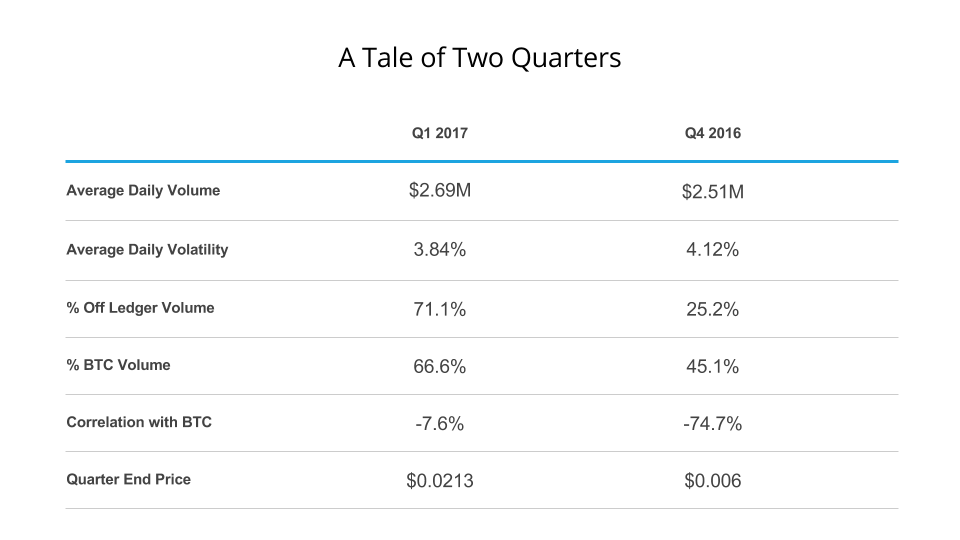

During January and February daily volatility** decreased to 2.47%, significantly lower than Q4’s already stable 3.26%. Average daily volume in those first two months fell to $1.22M, 55% lower than Q4 volumes, and the price slowly moved lower, briefly touching $0.00538 in early March, a level not seen since May of 2016. Much of the decrease in activity could be attributed to the temporary exit of a few prominent market makers, or relative demand for BTC driven by hopes of its ETF approval. Whatever the reason, Q1 2017 was one of the most challenging XRP markets in a long time.

A bright spot was Bitstamp’s successful launch of XRP for USD, EUR, and BTC currency pairs on January 16th. That alone was not enough to turn the tide however, and XRP markets failed to show much life until March 23rd, what was easily the most significant day of the quarter.

On March 23, XRP rallied from $0.0072 to $0.0112, a 56% price increase on an impressive $19.7M in volume, a 1103% increase over the average daily volume up to that point in Q1. Clearly something had changed, but why such a powerful shift in sentiment? Though always difficult to discern in real time, in hindsight, a few key developments may have had an impact.

- As the month drew to a close, the Bitcoin scaling debate raged on with no end in sight.

- Throughout the quarter, Ripple, became more vocal about its commitment to XRP and the Ripple Consensus Ledger (RCL) as part of its long-term strategy.

- Ripple announced a new relationship with BitGo to build an enterprise wallet, as well as Payment Channels and Escrow, important RCL features that increase transaction throughput to levels comparable with those of Visa’s network.

- Ripple continued to sign up banks to commercially deploy its enterprise blockchain solution and join its global payments network. Announcements included the addition of MUFG, the world’s third largest bank, 47 banks in Japan and network expansion into the Middle East and India through NBAD and Axis Bank.

The last point is particularly important. Markets are clearly connecting the dots that banks which join the Ripple network today are prospective users of XRP liquidity in the future. Growing bank membership of the Ripple network creates opportunities for Ripple to deepen those customer relationships and cross-sell liquidity solutions built on XRP, all of which should be beneficial to the asset.

Lastly, there are a few data points which warrant close monitoring going forward. The percentage of off-ledger trading was only 25.2% in Q4, but that leapt to 71.1% in Q1. Interestingly, and very much related, the percentage of XRP flows that originated from BTC in Q4 was only 45.1%, and that grew to 66.6% in Q1. The data suggest most of the growth in trading volume is coming from off ledger BTC/XRP activity, which supports the theory that the rally in Q1 was driven by market recognition of Bitcoin’s risks, as well as XRP’s advantages.

Why is this significant? In Q1 2017, XRP grew substantially in both price and volume due to off-ledger inflows via Bitcoin. In order for any asset to be successful it needs ample liquidity, something XRP attracted during the quarter. This was a reassuring sign of progress towards the eventual fiat liquidity XRP requires to ultimately be successful for payments, its natural use case.

Q2 2017

We’ve put our ear to the ground and have been listening to important feedback from the XRP community. This includes the need for greater visibility and transparency into Ripple’s vision, strategic use cases for XRP, and plans to increase liquidity and decentralization. To that end, we plan to increase our communications cadence to address this feedback. We also look forward to having a large presence at Consensus in New York in May.

In addition, you may want to watch out for specific announcements in Q2 regarding potential ways to use RCL’s new Escrow feature, as well as our plan to implement a systematic markets operation program designed to add liquidity to the market especially during volatile periods.

Sign up to receive monthly XRP updates.

*XRP II, LLC is licensed to engage in Virtual Currency Business Activity by the New York State Department of Financial Services.

**Volatility calculated using standard deviation of daily lognormal returns.

(function(d, s, id) {

var js, fjs = d.getElementsByTagName(s)[0];

if (d.getElementById(id)) return;

js = d.createElement(s); js.id = id;

js.src = “http://connect.facebook.net/en_US/sdk.js#xfbml=1&version=v2.3&appId=1419450551711438”;

fjs.parentNode.insertBefore(js, fjs);

}(document, “script”, “facebook-jssdk”));

[ad_2]

Source link