[ad_1]

By CCN.com: According to an affidavit filed with the Supreme Court of the State of New York by Stuart Hoegner, the general counsel to Tether and major bitcoin exchange Bitfinex, only 74 percent of Tether’s holdings are backed by cash.

“As of the date [April 30] I am signing this affidavit, Tether has cash and cash equivalents (short term securities) on hand totaling approximately $2.1 billion, representing approximately 74 percent of the current outstanding tethers,” the affidavit read.

The affidavit sparked debates within the cryptocurrency community. Some industry executives argued that Tether’s 74 percent holding could be considered relatively high and that it does not differ from the concept of fractional banking.

Bitcoin is trading at a more than $300 premium on Bitfinex amid speculation investors are exiting the Tether stablecoin https://t.co/msm05ZQWvx pic.twitter.com/UpWWDnxrEg

— Bloomberg Crypto (@crypto) April 30, 2019

Others have said that it is not sensible to compare Tether to fractional banking as the offering of Tether is a stablecoin backed by the value of the U.S. dollar on a 1:1 ratio.

Tether is Not 100% Backed Anymore, Analysts Offer Contrasting Viewpoints

Several macro analysts including Alex Krüger, who previously defended Tether in late 2018, which was understandable given that Tether was said to have had a cash reserve equivalent to all Tether issued by November 2018, said that it is difficult to argue against Tether having an asset-liability mismatch.

“Confirmed, from the horse’s mouth. Tether is not fully backed by cash and cash equivalents. Tether has an asset-liability mismatch (i.e. liquidity concerns) and is possibly insolvent as well (i.e. liabilities > assets),” Krüger said.

First, Tether’s stablecoin was according to Tether’s terms, supposed to be backed 1-to-1 by currency held in reserves.

Yet in Nov 2018, and unbeknownst to the public, Tether moved $625M (then 35% of reserves) to shore up Bitfinex, its sister company, which had $850M missing. pic.twitter.com/5ZTN4f3g3V

— Alex Krüger (@krugermacro) April 30, 2019

In a memorandum of law obtained by CoinDesk, Zoe Phillips, an attorney at Morgan Lewis representing Tether stated that Tether does not have to hold $1 for every dollar of Tether to guarantee the redemption of users.

“According to the Attorney General, the line of credit needed to be frozen because it improperly impairs the reserves Tether would use for redemptions. The Attorney General appears to believe that Tether must hold $1 in cash fiat currency for every dollar of tether. These allegations are wrong on multiple levels,” Phillips said.

However, investors would likely expect Tether to be fully backed strictly at a ratio of 1:1 because the terms of service of the stablecoin stated that USDT is 100 percent backed.

Even as late as March 2019, speaking to CCN, Kasper Rasmussen, the director of marketing at iFinex, said that Tether is 100 percent backed.

“Tethers remain completely stable and 100% backed, so Tether’s reserves always equal or exceed the number of issued Tethers. The only change is that the composition of the assets that provide that backing includes a combination of cash, cash equivalents, and may also include other assets or receivables from loans issued by Tether,” Rasmussen said.

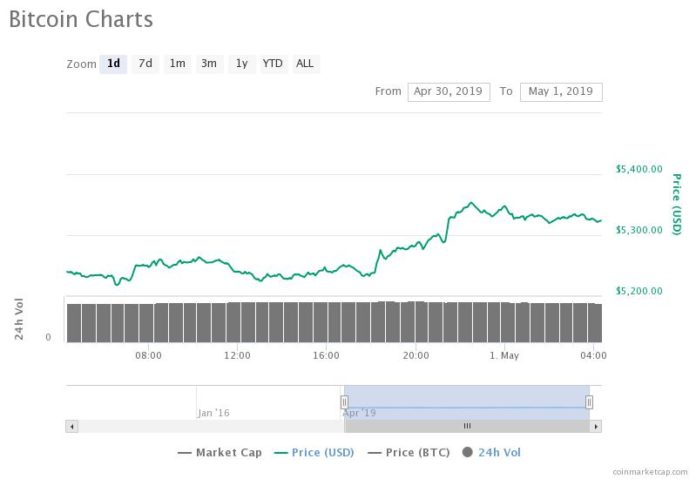

The admittance of Tether’s general counsel that the stablecoin is not 100 percent backed by cash had virtually no effect on the bitcoin price in the hours that followed.

How Would it Affect the Bitcoin Price?

Some traders and industry executives such as eToro CEO Yoni Assia and DonAlt stated that while the Tether controversy may deteriorate the public image of the crypto market over the long run, in the short-term, the bitcoin price could actually react positively.

“Are the news supposed to pump or dump BTC? It’s bad news, but if $2 billion USDT get exchanged to BTC it actually increases its price… what a predicament. Tether Lawyer Admits Stablecoin Now 74% Backed by Cash and Equivalents,” Assia said.

DonAlt, a cryptocurrency trader, said that the FUD around Tether may not lead to a further decline in the price o the dominant cryptocurrency, which may leave bears in a challenging position.

“BTC rejected by a daily resistance coupled with massive Tether FUD and price went down by 8% of which it already reclaimed half. Relying on FUD to drive price down hasn’t worked out too well historically. If I was a bear that coupled with funding would make me sweat, honestly.”

[ad_2]

Source link