[ad_1]

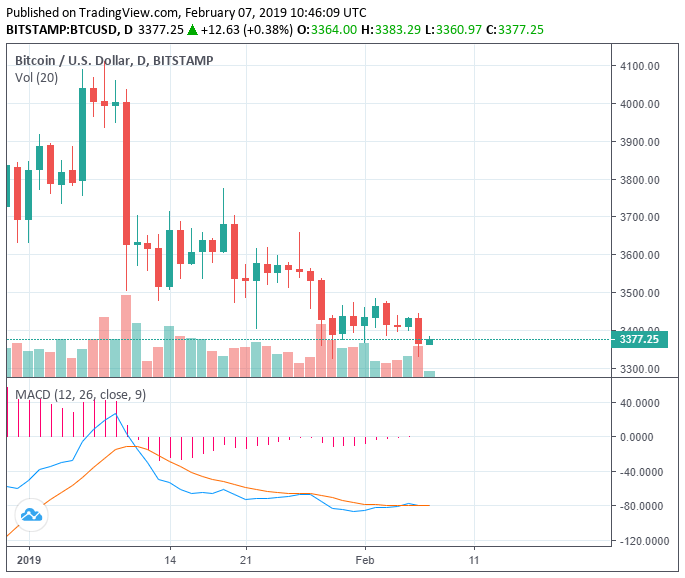

In the last 24 hours, the valuation of the crypto market slightly recovered from $100 billion to $102 billion while the Bitcoin price declined below $3,400.

In a span of two days, the price of BTC fell from $3,445 to $3,377 by around 2 percent against the U.S. dollar.

Based on the lack of momentum in the price trend of the dominant cryptocurrency, traders expect the market to face more bloodbath before engaging in a strong recovery.

$2,000 Before a Big Rebound For Bitcoin

According to Murad Mahmudov, the Bitcoin price is likely to drop below the $3,000 support level and to the low $2,000 region in the short-term.

The cryptocurrency analyst suggested that a proper bottom for BTC has not been established just yet and in consideration of its historical performance, BTC will continue to show volatility in a low price range until May.

The only chart you need.

My rough view on what I believe is going to happen.

Break that trendline before we can even think about having bullish discussions.

Patience is Virtue. pic.twitter.com/mb5y3Xh3cK— Murad Mahmudov 🚀 (@MustStopMurad) February 6, 2019

The 1-month period between May and June has been emphasized by traders because historically, Bitcoin has tended to show signs of recovery 1 year before a block reward halving occurs.

A block reward halving in Bitcoin refers to a 50 percent decline in the reward given to miners when they mine blocks on the blockchain. It decreases the potential circulating supply of BTC as it nears the 21 million BTC fixed supply of the asset.

Similarly, on Tuesday, a cryptocurrency trader with an online alias “The Crypto Dog” said that investors have to expect BTC dropping to the low $2,000 mark or even to $1,800.

He said:

“$1800 BTC and $50 ETH wouldn’t surprise me. I don’t know for any certainty we’ll see those prices, nor do I mind if we reach them or not. If you’re in BTC for the long haul, DCA. If you’re learning to trade, just survive. Keep your risk low, gains will be easier someday.”

However, not all traders are bearish on the short-term outlook of the market. DonAlt, a cryptocurrency technical analyst, said that Ethereum could perform well in the short-term, which would only be possible if other major assets like Bitcoin recover in the same time frame.

“Bought quite a bit of $ETH just above $100 targeting $200. I could see us break down to $90 which would be my dream entry. That said I’d much rather have a position than taking the risk of missing the move entirely. If it breaks below $90 I’d guess we’re going for the shitter,” DonAlt added.

Why are Traders Bearish?

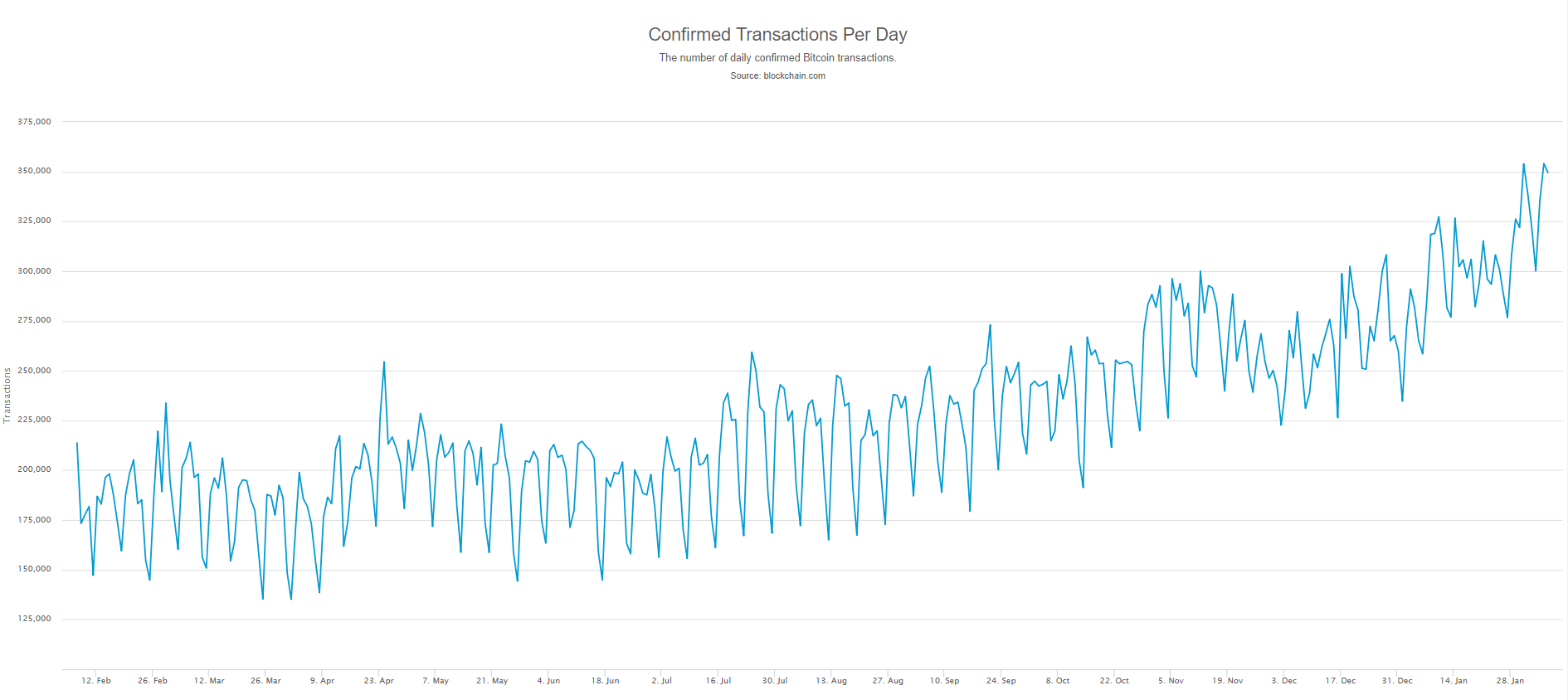

Fundamental factors indicate that the Bitcoin blockchain network is stronger than ever before. Its transaction volume has tripled since February 2018, its hash rate has become distributed among more miners, and overall user activity has increased.

Companies within the cryptocurrency sector such as Kraken and ErisX have been able to secure funding from high-profile investors such as Fidelity and Nasdaq.

Last week, Kraken said that it is set to achieve a valuation of $4 billion in the worst bear market in the history of the cryptocurrency sector.

But, in the short-term, despite the positive developments in the digital asset industry, analysts expect the prices of major crypto assets to decline.

$BTC volatility testing a fresh demand zone.

B I G M O V E I N C O M I N G. pic.twitter.com/u1YqmSy42k

— Hsaka (@HsakaTrades) February 5, 2019

Throughout the past few months, cryptocurrencies have failed to defend key support levels in a continuous steep sell-off.

Mark Dow, for instance, a trader who shorted BTC from its all-time high, said in late December that if BTC fails to recover from its low range of $3,000 to $6,000, it could face deep trouble.

“Still a beautiful chart. If bitcoin can’t bounce to at least $5k – $6k soon, it’s a really bad sign for the cyberbulls. And if it breaks down thru the yellow line at any point, even the HODLers need to GTFO,” Dow said.

It remains to be seen whether Bitcoin could defend $3,000 support level or drop below it. But, analysts are focused on May and June, a time frame traders believe BTC will begin recovering.

Click here for a real-time bitcoin price chart.

Featured Image from Shutterstock. Price Charts from TradingView.

[ad_2]

Source link