[ad_1]

The founder of Omise — the company behind the OmiseGo cryptocurrency — denied reports that his Ethereum-based payments platform was acquired for $150 million by Charoen Pokphand Group, Thailand’s largest private company.

Omise Founder Demands Retraction

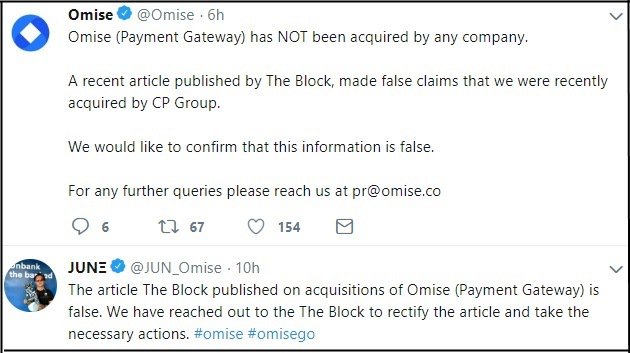

Jun Hasegawa issued an angry denial on Twitter, where he accused the crypto news website The Block of pushing fake news.

Hasegawa also threatened to take legal action if a correction/retraction isn’t issued. Hasegawa has not yet responded to CCN’s requests for comment.

In response to Hasegawa’s volcanic denials, The Block reporter who broke the story says he stands by his reporting and his “extensive sourcing.”

OmiseGo Recently Partnered With Korean Bank

The brouhaha erupted on March 29 after The Block reported that Charoen Pokphand Group had acquired Omise for $150 million, citing “several sources close to the deal.”

The Charawanon family — which owns the Charoen Pokphand Group — has a net worth topping $36 billion, according to Forbes Asia. This makes Charawanon’s the fourth wealthiest family in Asia.

Omise is one of Thailand’s top payment services providers. In April 2018, Shinhan — one of South Korea’s largest banks — entered a strategic partnership with Omise to accelerate the implementation of blockchain technology in South Korea and across Asia.

At the time, Jun Hasegawa said he believed that OmiseGo will revolutionize digital payments and help usher in a decentralized crypto economy.

Crypto Evangelists Slamming News Websites Is Routine

At this point, it’s unclear whether the reports of the Omise buyout are correct. But time will definitely suss out the truth — as it always does.

However, it bears noting that angry denials and Twitter clap-backs from cryptocurrency executives are par for the course in the nascent industry.

Surprisingly critical article from CCN, could this be a (positive) turning point in how the whole cryptocurrency industry is covered? https://t.co/Gfi533Re33

— Ryan Gorman (@GormoExJourno) March 26, 2019

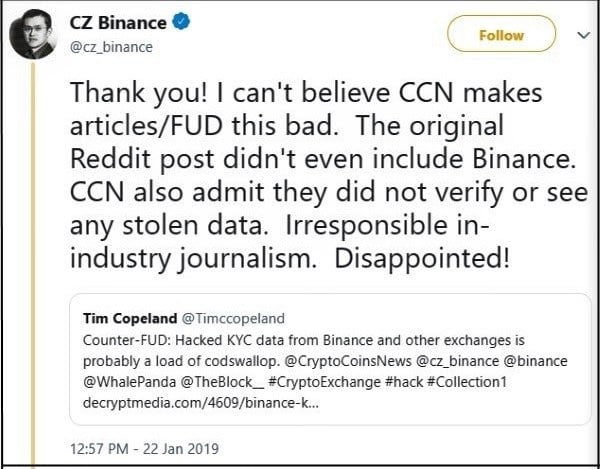

In January 2019, Binance founder Changpeng Zhao torched this website on Twitter.

Specifically, Zhao accused CCN of spreading FUD because we reported on a hacker’s claims that he had hacked customer data from several top crypto exchanges and was selling the data on the Dark Web.

Crypto Industry Has a Credibility Problem

This is a recurring problem in “trade journalism” — where market leaders expect positive coverage all the time. They expect reporters to shill on behalf of the industry instead of doing honest, critical analysis where warranted.

A recent report from BreakerMag noted that CCN was one of the few crypto news websites that refused to take bribes in exchange for positive coverage.

Thank you @BreakerMag for doing this story on the appalling pay-to-play schemes that crypto news outlets are willing to engage in, profiting as their readers unwittingly buy coins that have been misleadingly promoted: https://t.co/YqpACag0c8

— Laura Shin (@laurashin) October 25, 2018

However, sycophantic reporting erodes the credibility of the entire industry.

And credibility is especially important for a new industry, which is struggling to gain mainstream acceptance while being bombarded by an avalanche of unending scams and shams.

Bitcoin Adoption Crippled by Public’s ‘Serious Mental Barrier’ https://t.co/4vgEHRTkb3

— CCN.com (@CCNMarkets) March 28, 2019

[ad_2]

Source link