[ad_1]

By CCN: Millennials bask in knowing they are far more ahead of the technology curve than older adults. This is why their demographic has been more willing to embrace bitcoin as a long-term investment. But what about the stock market?

Their proclivity toward crypto has led many to abandon good old fashioned stock market investing. This may prevent them from reaping the long-term gains inherent in buying the Dow Jones Industrial Average, S&P 500, and Nasdaq.

Millennials’ Love Affair with Bitcoin

There are no bigger champions of bitcoin than people who are under the age of 35. Harris Poll conducted a survey on behalf of Blockchain Capital. The poll spanned April 23–25, 2019 across more than 2,000 adults. Blockchain Capital General Partner Spencer Bogart shared the survey’s findings in a Medium post.

By popular request – here’s the breakdown of people that responded to the Harris Poll survey.

Will share more interesting results in the coming days/weeks 🙂 pic.twitter.com/oBUKdB7t9a

— Spencer Bogart (@CremeDeLaCrypto) April 30, 2019

When it comes to bitcoin, millennials comfortably check off the following boxes:

- Awareness

- Familiarity

- Perception

- Conviction

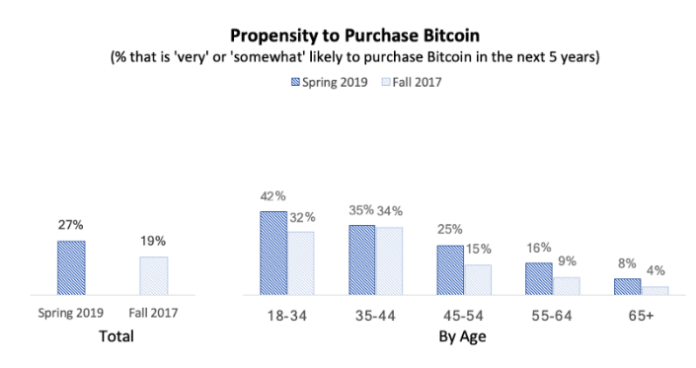

What’s more telling is their propensity and willingness to buy bitcoin. Despite the crypto winter, the percentage of people indicating they are ‘very’ or ‘somewhat’ likely to buy bitcoin in the next five years rose by nearly half. The survey found that 27% of respondents would prefer bitcoin to stocks as of April 2019 vs. 19% in the bull market of October 2017.

Bogart points out:

“The only area where older demographics matched younger demographics was awareness: Regardless of age, the vast majority of the American population has heard of bitcoin.”

BTC Over Blue Chips

If they had $1,000 to invest, a good chunk of those who are aged 18 to 34 said they’d buy bitcoin.

Specifically, 27% said they prefer owning $1,000 worth of bitcoin instead of stocks. That’s unchanged since the October 2017 survey.

Since the 2017 survey, there was an increase in appetite for bitcoin instead of other assets besides stocks. The survey explored other assets including gold, government bonds, and real estate.

When asked which they’d prefer to own $1,000 of:

- 17% preferred bitcoin to stocks — up from 14% in October 2017

- 21% preferred bitcoin to government bonds — up from 18% in October 2017

- 14% preferred bitcoin to real estate — up from 12% in October 2017

- 12% of people said they would prefer bitcoin to gold — up from 8% in October 2017

Why Millennials Are Dissing Stocks

One of the reasons people under the age of 35 seem to be skittish about investing in the stock market relates to their perceptions that it is too volatile and risky. This sounds nuts to older people who say the same about bitcoin.

No matter, millennials have said they have no problem socking away their money for 10 years or more. Many want no part of the stock market after seeing the devastating effects their parents suffered from the 2008 financial crisis.

Bitcoin is the currency for screwing over financal crisis-scarred millennials a second time! https://t.co/zzzZ2w1NWK

— Milena Rodban (@MilenaRodban) April 30, 2019

Also at play is the distrust millennials have about banks in general. This is mainly due to inefficient systems and outdated models that are not tailored to young investors. CCN previously reported several studies showing that millennials do not trust banks with their money.

To help put the millennial proclivity to bitcoin in perspective, Bogart stated:

“Only 37% of people under 35 are invested in the stock market so the data point that 20% of those in the same group own bitcoin is particularly surprising.”

It makes sense that Millennials like Bitcoin most:

1) found their way through 2008 crisis as young adults

2) grew up with P2P (BitTorrent, Limewire)

3) digitally native & familiar with open source (Linux, Wikipedia)

5) first investments in zero interest rate environment https://t.co/bQQLmwFk0u

— Michiel Lescrauwaet (@MLescrauwaet) April 30, 2019

[ad_2]

Source link