[ad_1]

Since our last markets update, cryptocurrencies have been steadily moving sideways as traders are patiently waiting for the next big move. On Wednesday, Oct. 17, bitcoin core has been hovering between $6,400-6,550, while bitcoin cash has been coasting along around $425-500 per coin. The market capitalization of all 2,000+ cryptocurrencies hasn’t budged much over the last two weeks and currently rests at $213.4 billion.

Also read: Bizarro World: Federated Sidechain Technology Promoted Over Nakamoto Consensus

Stablecoins Show More Action Than Most Cryptocurrencies This Week

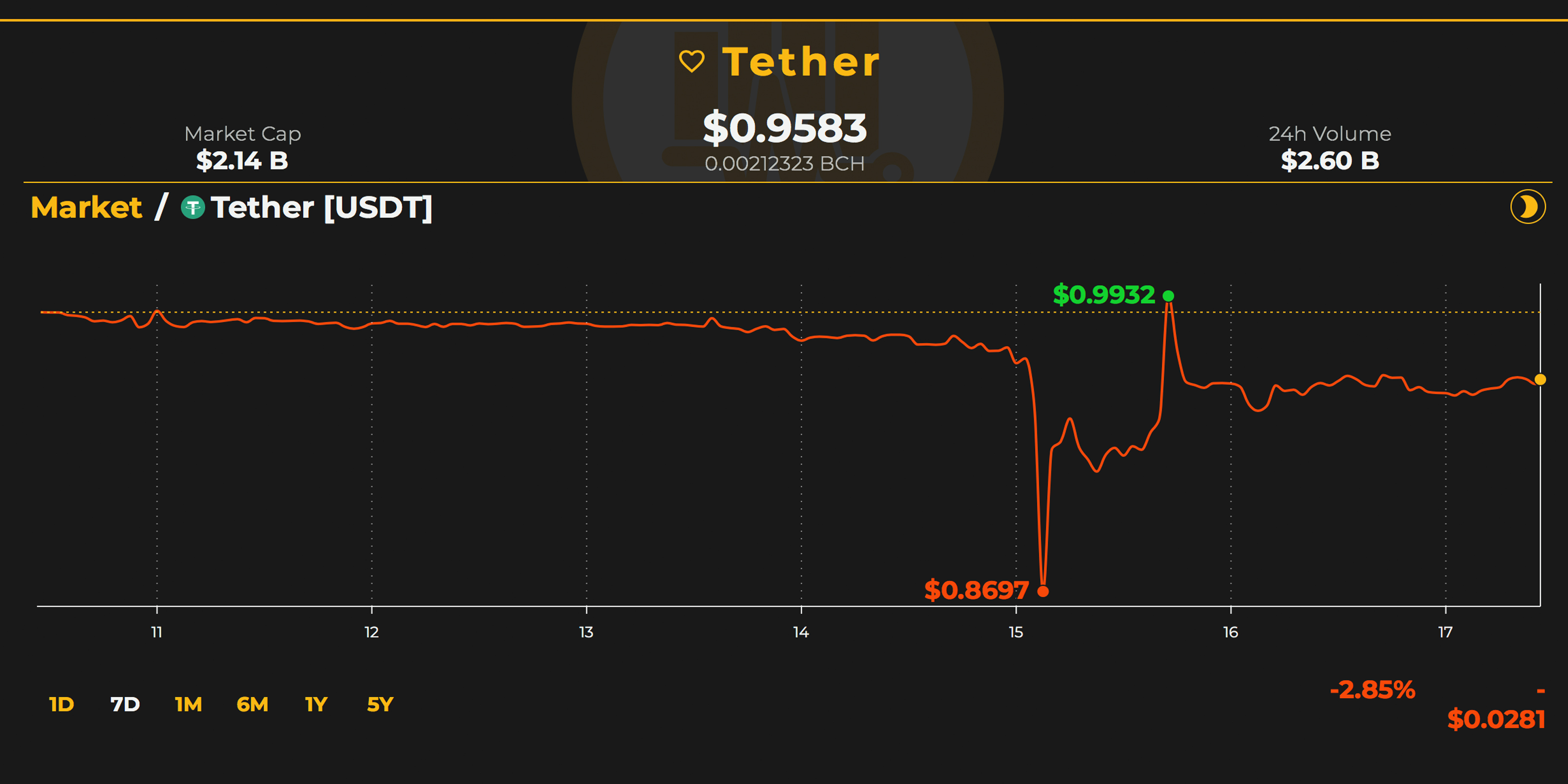

Markets have been trading in a triangular and consolidated pattern since the last big spike on Sunday, Oct. 15. That day, bitcoin core (BTC) spiked to a high of $6,760 on a few exchanges like Bitstamp, and bitcoin cash touched $501. Additionally, exchanges that use the stablecoin tether (USDT) saw BTC and BCH prices rise even higher than most spot markets and BTC values saw highs above $7,000. This market behavior was due to USDT dropping below the value of USD, hitting a low of $0.86 per token.

Other stablecoins like TUSD, GUSD, and USDC saw significant volumes this week as lots of money poured into these specific markets. On Oct. 16, Circle’s stablecoin USDC grew 2,000 % in seven days on partner exchanges and that day’s USDC volume surpassed the week prior’s.

During that time, other stablecoins like GUSD and TUSD rose above their dollar pegs while USDT dipped below. Following the jump in value, BCH and BTC prices have dipped a hair and USDT values have regained momentum.

The Top Cryptocurrency Markets

Bitcoin core markets are down today around 1% and one BTC is trading for $6,534 according to Satoshi Pulse data. Ethereum (ETH) prices are down 1.4%, as each ETH trades at $207 this Wednesday. Following behind ETH is ripple (XRP), which is up 1.8% over the last 24 hours. XRP prices are hovering around $0.46 at the time of publication. Lastly, EOS is down 0.68% today and the digital asset is swapped for $5.39 per coin. Overall, the top contenders are down between one to 13% over the last seven days of trading sessions.

Bitcoin Cash (BCH) Market Action

Bitcoin cash spot markets are seeing BCH trade for $451 per coin with the currency’s value down 1.7% over the last 24 hours. Percentages are down even lower for the week as seven-day statistics show BCH has dipped around 11.7% this past week. The top five exchanges swapping the most BCH this Wednesday are Lbank, Hitbtc, Binance, Okex and Huobi. BTC is the top trading pair exchanged with BCH, capturing 41.8% of all spot market trades. This is followed by the trading pairs USDT (27%), ETH (16%), USD (5.2%), and KRW (5.2%). Bitcoin cash has the sixth-largest trading volume, as $301 million worth of BCH trades have been processed in the last 24 hours.

BCH/USD Technical Indicators

Looking at the four-hour and daily Bitstamp and Bitfinex BCH/USD charts shows some serious sideways action since the last spike. Many other digital asset charts like BTC/USD are following similar patterns, as traders seem to be finding new positions over the last two days. Currently, the BCH four-hour relative strength index (RSI -40) oscillator is meandering in the midrange and not granting many clues. The two simple moving averages (100 & 200 SMA) indicate a change may be in the cards as the two look as though they will be crossing hairs soon.

Unless things change, the 100 SMA looks to be dropping below the 200 SMA trendline, showing the path toward the least resistance will be the downside. Order books show there are big hurdles for BCH bulls from now until $465 and another pitstop above the $500 region. If things change and the price heads south, BCH bears will be stopped at $415 and $390 respectively.

The Verdict: Uncertainty Is in the Air

The verdict this week depends on who you ask, but can be generalized with one word: uncertainty. Some traders believe a bearish-to-bullish change is imminent, while others think cryptocurrency prices may sink lower. BTC/USD and ETH/USD shorts are fairly high, but not as much as they were a few weeks ago. The consolidated tight pattern and lack of shorts this week show uncertainty in the minds of traders waiting for a breakout in either direction.

Where do you see the price of bitcoin cash and other coins headed from here? Let us know in the comment section below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pulse.

Want to create your own secure cold storage paper wallet? Check our tools section.

[ad_2]

Source link