[ad_1]

By CCN: Lyft’s first earnings report was downright ugly, and not just because the company lost $1 billion in a single quarter.

Investors expected a less-than-stellar balance sheet, but it was the backhanded slap in the face a company executive delivered to investors that leaves questions about the rideshare darling’s transparency.

Hey Investors, Lyft Knows What’s Best for You!

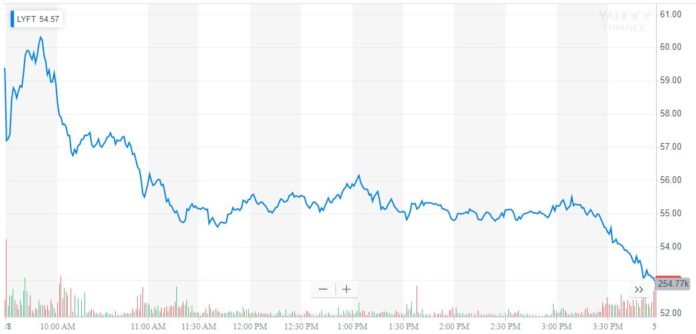

Lyft’s earnings didn’t inspire much confidence in the company’s stock price. | Source: Yahoo Finance

When asked about why gross booking trends weren’t included in the earnings press release, Lyft CEO Logan Green said:

“So, our historical business was virtually entirely a ride-sharing marketplace”

“We’re now aggressively investing in new areas including those where revenue equals bookings. So, we really want to try to avoid investor confusion. We believe it’s more appropriate for investors to use revenue as the best top-line growth metric since revenue drives our [profit and loss] across all initiatives.”

Don’t Assume Shareholders Need You to Dumb Down the Data

Implying that investors would be confused by the data smacks of elitism. Critics pounced on the company for not providing information on the total revenue generated that would help determine how much drivers were taking home.

In an opinion piece, a MarketWatch writer hit the nail on the head when it comes to Lyft’s logic:

“While Lyft suggested that investors’ poor little brains just couldn’t handle a separate figure outlining the actual size of its business that certainly wasn’t the case with the bottom line.”

The writer was referring to Lyft breaking down the typically complex figures for GAAP and non-GAAP net income, GAAP and non-GAAP operating income, and adjusted EBITDA, “with vast differences in all those numbers.”

MarketWatch also pointed out that:

“Lyft even offered an extremely nontraditional ‘adjusted cash’ figure in supplemental materials, so that it could add in the IPO proceeds even though the company received them after the quarter was over.”

Lyft to Investors: Look at Our Shiny Revenue!

Considering its staggering losses, one could understand why Lyft wants to shift attention to other stats, such as those related to ridership. During the first quarter, Lyft had 20.5 million active riders, which was an increase of 46%. However, investors want to see more, such as bookings.

Lyft leadership focused on the company’s revenue and made clear that’s what they want investors to focus on, too. It reported Q1 revenue of $776 million, which was better than the expected $738.5 million. It was far better than the $397.2 million it reported in the first quarter of 2018. It boasted about the increase being 95% year-over-year.

Its Q1 adjusted loss per share was $9.02, which was narrower than the expected $10.53.

Lyft Stock Down a Jaw-Dropping 25% Since IPO

For Q2, Lyft anticipates total revenue to be between $800 million and $810 million. Adjusted EBITDA loss is expected to be between $270 million and $280 million.

Lyft shares fell 10.84% on Wednesday to close at $52.91. Since its IPO, its stock is down more than 25%.

[ad_2]

Source link