[ad_1]

By CCN: Apple stock inched higher on Monday, lifting the Silicon Valley staple one step closer to a $1 trillion valuation ahead of the iPhone maker’s earnings report on Tuesday afternoon.

Apple Stock Sits on Brink of Dazzling 70% Rally

Based on AAPL’s recent price action, it looks like investors are cautiously optimistic that the Tim Cook-led company will join its FAANG peers in smashing analyst estimates.

However, even if Apple shocks Wall Street with a brutal quarter, Loup Ventures founder and Managing Partner Gene Munster has a simple message for investors: buy, buy, buy!

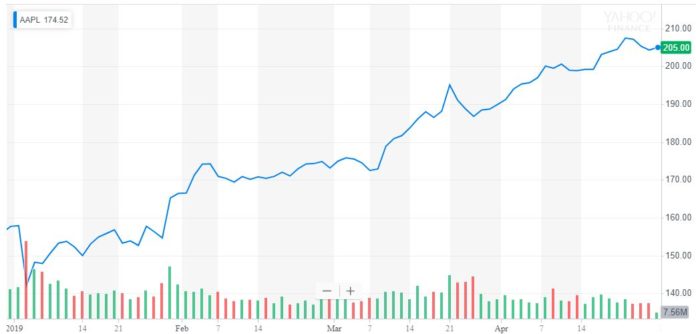

Gene Munster predicted that Apple stock will pound to a 70 percent rally over the next 24 months. | Source: Yahoo Finance

Previewing the Apple earnings call in an interview with CNBC, Munster revealed that he believes AAPL shares will surge as high as $350 within the next 24 months, yielding prescient investors a mouthwatering 70 percent return.

“There’s meaningful upside to the Apple story. I suspect that this year, Apple will be the best-performing FAANG stock,” he said. “I think this can be closer to $350 [a share]. … I know historically it has not gotten the multiple. But I think that will slowly change.”

Some analysts had previously turned bearish on Apple, fearing that a global slowdown in iPhone sales would roil the firm’s profitability.

Apple’s Consumer Staple Status Will Power it Past Red-Hot Amazon

Sluggish iPhone sales created headwinds for Tim Cook and company, but the firm’s “consumer staple” status will ensure future growth. | Source: Shutterstock

However, Loup Ventures predicts that Apple has evolved beyond its “tech stock” label to become a true “consumer staple” like Coca-Cola. In other words, the firm believes that the iPhone sales dip is a cyclical fluctuation rather than a canary in the coal mine for a more worrisome trend.

As Gene Munster and Loup associate Will Thompson wrote in a note on Monday:

“Apple has dependable, long-term customers. Stable businesses like Clorox and Coca-Cola earn their multiples because the underlying investment is less risky. The 2019 iPhone decline sets back the view that Apple’s business is as dependable as Clorox. That said, we expect iPhone to return to stability, and Services to slowly win investor confidence and a higher earnings multiple.”

Consequently, they wrote, Apple will prove to be the “best performing FAANG stock in 2019,” trouncing even Amazon whose red-hot rally has catapulted AMZN shares 30 percent higher and within spitting distance of $2,000.

[ad_2]

Source link