[ad_1]

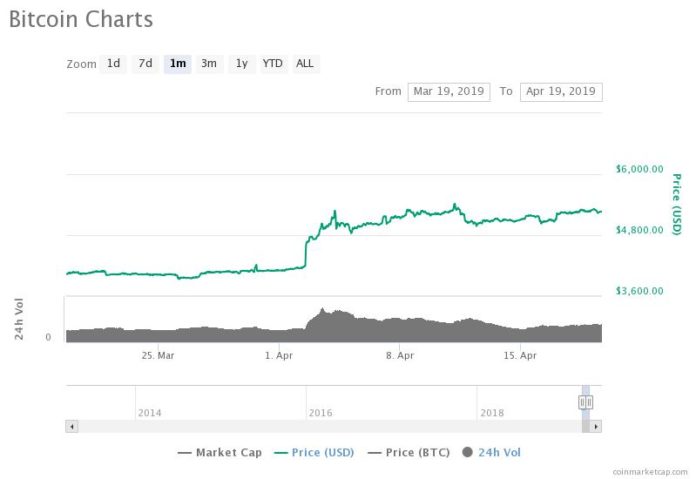

By CCN.com: Over the past 24 hours, the bitcoin price briefly surpassed the $5,300 mark in a short-term spike but retraced back to the $5,200 region.

In the past 30 days, as the bitcoin price gained 31.3 percent against the U.S. dollar, the valuation of the crypto market increased by $40 billion.

Strong performances of alternative cryptocurrencies such as Enjin Coin and Binance Coin, which recorded 404 percent and 266 percent year-to-date gains respectively, pushed the momentum of the crypto market further.

Technical Indicators Showing Bullish Trend For Bitcoin

For the first time since May 2015, a technical indicator called the 2-week moving average convergence divergence (MACD) indicated a positive trend for bitcoin according to a technical analyst.

“The 2W MACD has crossed in a buy signal on BTC. We opened at approx $4,000. The last time it happened? May 2015. Bitcoin opened around $240. We can still drop in accumulation, but the bottom is in ‘folks,” the analyst said.

As bitcoin cleanly broke out of $4,200, which was a crucial resistance level for the dominant cryptocurrency and recovered to $5,000, it reversed many technical indicators that identify long-term trends.

Year-to-date, since January, the bitcoin price has surged by 41.7 percent against the U.S. dollar, demonstrating strong momentum in a relatively short time frame.

The Rhythm Trader, a bitcoin trader, said that bitcoin has gone 123 days without retesting its low, which can be considered as a step towards a proper rally in the months to come.

Emphasizing that bitcoin is up 65 percent since December in about four months, the trader said:

“Bitcoin has now gone 123 days without a new low. It’s up 65% from December. Don’t get caught picking up a penny in front of the steamroller that is a bitcoin bull market.”

In the near-term, traders generally expect bitcoin to remain stable in the $5,000 to $5,200 range as it rests from a strong rally earlier this month.

Wouldn’t Stability be Bad For Bitcoin?

According to cryptocurrency investor Josh Rager, if bitcoin shows stability in its current range in the near-term, it would create a solid foundation to support the next upside movement of the asset.

Previously, when bitcoin was unable to break out of an important resistance level at $4,200 for more than 3 months, analysts were concerned about the lack of movement in the cryptocurrency market.

However, bitcoin has already surpassed key levels and it has been less than three weeks since BTC recorded a 20 percent increase in price.

“The longer BTC ranges between $5,000 to $5,200, the stronger support it becomes after the next push up Though this equally becomes a stronger resistance if a breakdown occurs in my opinion, Bitcoin likely stays in the price range of this chart for weeks to come,” Rager said.

The stability of BTC could benefit alternative cryptocurrencies in the short-term, especially assets like Binance Coin that have performed strongly against both BTC and the USD in the past month.

BEP2 is the new standard for you token.

Learn more: https://t.co/J0qvBEa0W4

— Viktor Radchenko (@vikmeup) April 18, 2019

BNB remains as the best performing cryptocurrency throughout the 16-month bear market, recording a mere 11 percent drop from its all-time high.

In contrast, Ethereum (ETH) has dropped 88 percent from its record high and Ripple (XRP) has dropped 90 percent from its all-time high.

BNB recorded another 5 percent increase in price on the day and its momentum likely stems from the launch of the Binance Chain mainnet on April 18.

[ad_2]

Source link