[ad_1]

In the last 24 hours, the price of Bitcoin Cash surged from $287 to $322 by more than 12 percent as the valuation of the crypto market increased by around $4 billion.

The 3 percent recovery of bitcoin led major crypto assets in the likes of Litecoin, TRON, and Ethereum Classic to record relatively large movements against the U.S. dollar.

Why are Litecoin and Bitcoin Cash Surging While Ethereum and Bitcoin Settle For Minor Gains?

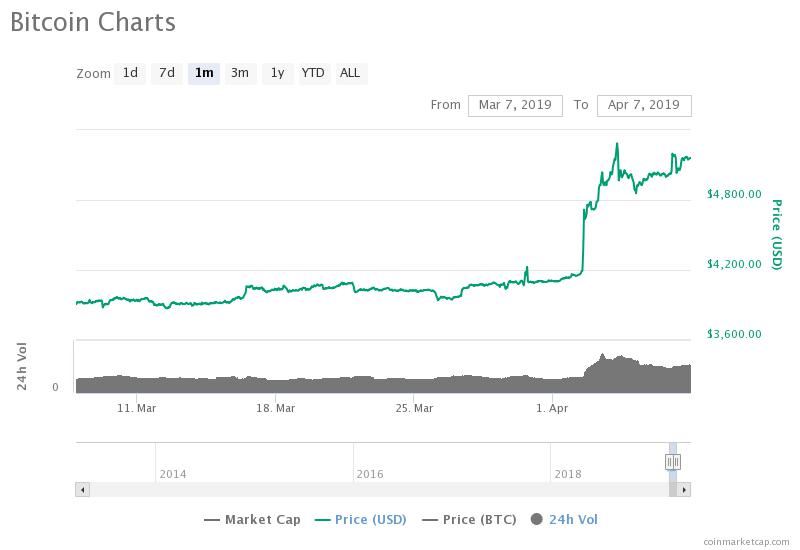

Bitcoin spiked by more than 20 percent in the past week which played a vital role in changing the sentiment around the cryptocurrency market.

But, relative to tokens and major crypto assets like Litecoin, bitcoin and Ethereum have seen lesser gains throughout the past four months.

According to economist and markets analyst Alex Krüger, the lack of large price movements of BTC and ETH has very little to do with fundamentals.

$ETH not moving higher at the moment as strongly as other coins such as $LTC or $BCH has little to do with fundamentals.

This is why 👇 (less fuel available) pic.twitter.com/aGg9gUBunz

— Alex Krüger (@krugermacro) April 6, 2019

Bitcoin is said to have increased in value by a large margin in the last seven days primarily due to the liquidation of around half a billion dollars worth of short contracts on exchanges like BitMEX.

When buyers first absorbed an $80 million sell wall and an investor reportedly placed three 7,000 BTC orders at three different exchanges worth $100 million, it led short contracts to be liquidated.

“There has been a single order that has been algorithmically-managed across these three venues, of around 20,000 BTC. If you look at the volumes on each of those three exchanges – there were in-concert, synchronized, units of volume of around 7,000 BTC in an hour,” Oliver von Landsberg-Sadie, chief executive of cryptocurrency firm BCB Group, told Reuters.

The liquidation of short contracts further fueled the rally of bitcoin, allowing the dominant cryptocurrency to rise rapidly as it broke the $4,200 resistance level.

In context, it took nearly four months for BTC to break the key $4,200 resistance level. Once $4,200 was broken, it took less than 3 days to hit $5,300.

So is Bitcoin Next?

Various fundamental factors are on the horizon that may fuel the price trend of bitcoin.

Historically, the block reward halving of bitcoin has had a positive effect on the price of bitcoin a year before it occurs.

“Before every BTC halving has begun there have been oversold RSI indicators on the weekly. Every year before the Bitcoin halving the price has recovered, and sometime after the halving, the price shoots past the previous ATH. This isn’t a coincidence. It’s an algorithm that works,” a cryptocurrency trader explained.

A year before the next halving of bitcoin is estimated to be May 2019 and if the halving has a similar impact on bitcoin as it did on previous occasions, bitcoin see an increase in demand halfway through 2019.

Another potentially positive fundamental indicator of bitcoin is the increase in the daily transaction volume of the Bitcoin network. The number of transactions per block is nearing an all-time high, demonstrating a high level of activity of users on the Bitcoin protocol.

Altcoin Season May Be Good For Bitcoin

Alternative cryptocurrencies like Litecoin rising with big volumes and interest on exchanges could increase the interest in BTC and if investors start to hedge their investments in alternative cryptocurrencies in BTC as May approaches, it could serve as a key stimulus for the asset.

Bitcoin Cash, Ripple, and Ethereum are down by around 88 to 91 percent against the U.S. dollar while bitcoin is down about 73 percent from its all-time high.

While other investments may present more risky opportunities for investors, it is possible that the extent in which alternative cryptocurrencies plunged during 2018 from their all-time highs is proving to be compelling for investors in the cryptocurrency market.

[ad_2]

Source link