[ad_1]

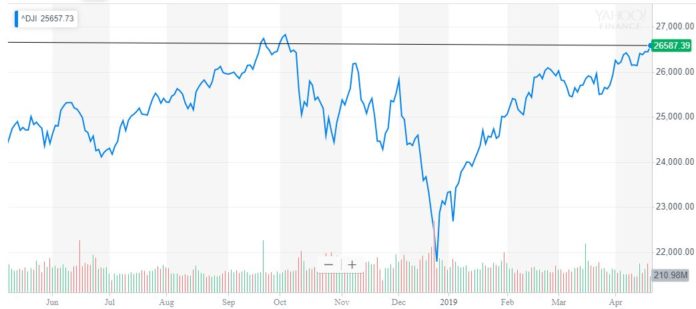

By CCN: As the Dow pounds within a few hundred points of its all-time high, it’s time for the bears to admit that there are sunny skies ahead for the stock market bellwether.

On April 18, the Dow Jones Industrial Average soared by nearly 140 points or 0.53 percent to 26,588.81. The index is now well within striking distance of its all-time high at 26,828.39.

With the U.S. unemployment rate at a 50-year low and significant progress being made with the U.S.-China trade talks, the momentum of the Dow is likely to be maintained throughout the medium-term.

Trade Gap is Reducing, U.S. Economy is in a Good Place, What Can Hold the Dow Jones Back?

Just ask Larry Fink.

This week, Fink, the CEO of BlackRock, the largest asset manager in the world, said that global equity markets are poised for a “melt-up” as the demand for stocks from investors rebound.

In one of its best quarters in over a year, BlackRock saw an inflow of a staggering $65 billion from January to March, increasing the firm’s assets under management to $6.5 trillion.

Considering the trend in financial and equity markets in general, Fink told the FT that people are underinvested and that there exists a significant amount of money on the sidelines.

“There’s too much global pessimism. People are still very underinvested. There’s still a lot of money on the sidelines, and I think you’ll see investors put money back into equities,” Fink said.

While investors remain fearful of the lack of potential catalysts of a proper rally in the U.S. equity market, it is possible that investors have largely dismissed fundamental indicators that prove the U.S. economy is in a strong position.

In February, National Holding chief market strategist Art Hogan said that a U.S.-China trade deal is crucial for the ongoing equities rally and that if progress is made, it could act as a catalyst for the stock market.

“To make further gains from here, we have to get concrete evidence coming out of talks with China that look like we’re actually making progress, and get signs of consistent growth,” Hogan said.

WSJ: U.S. & China Close to Trade Deal

The U.S. and China will ramp up trade deal negotiations next month, which should prove bullish for the Dow. | Source: AP Photo / Andy Wong, File

According to the Wall Street Journal, that trade deal could soon materialize.

On Wednesday, the publication reported that the U.S. and China are in the process of establishing two rounds of in-person discussions, taking a step towards securing a comprehensive trade agreement.

The report indicated that U.S. trade representative Robert Lighthizer would travel to Beijing in the last week of April and China’s Liu He would visit Washington in the first week of May.

Previously, reports revealed that the negotiators of the U.S. and China had come close to clearing two significant hurdles in the trade discussions: the enforcement method of the trade agreement and the changes to China’s industrial policies.

In consideration of many factors including the optimism of the U.S. government surrounding the trade deal, Amherst Pierpoint Securities chief economist Stephen Stanley said that the U.S. economy is generally expected to perform better in the months ahead.

“There’s good reason to think the U.S. economy should be doing better,” Stanley said.

[ad_2]

Source link