[ad_1]

By CCN.com: The Reserve Bank of India (RBI) has published its official document on a draft framework for fintech regulatory sandbox entitled “Draft Enabling Framework for Regulatory Sandbox.” The document explicitly excluded crypto assets like bitcoin, demonstrating a lack of intent to regulate the local crypto market.

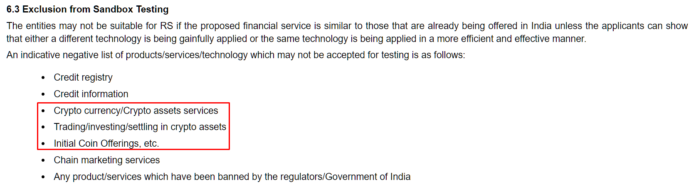

“The entities may not be suitable for RS (regulatory sandbox) if the proposed financial service is similar to those that are already being offered in India unless the applicants can show that either a different technology is being gainfully applied or the same technology is being applied in a more efficient and effective manner,” the document read, listing crypto assets, crypto trading, and ICOs as excluded areas.

The draft framework essentially eliminates crypto-related businesses and bitcoin exchanges from the fintech market, which the government of India has expressed its intent on supporting.

Will Bitcoin Legalization in India Ever Happen?

The current stance of India on bitcoin and crypto regulation is unexpected given that many major governments in Asia including the likes of Japan, South Korea, Singapore, Hong Kong, and others have taken the approach of regulating the crypto market.

The central bank of India has prohibited local banks from working with cryptocurrency exchanges, eliminating fiat-to-crypto trading in the local market.

The policy of the RBI has left the overwhelming majority of crypto businesses in India in disarray, most of the entities involved with crypto either shutting down their services or moving out of the crypto market of India.

A relatively large number of governments in Asia have regulated the crypto market to prevent money laundering and to place a lid on speculation to protect investors.

South Korea, for instance, had been reluctant towards introducing cryptocurrency regulations for an extended time frame because the government feared that the introduction of regulatory frameworks may lead investors to accept the cryptocurrency market as an acknowledged, regulated, and legitimate sector.

Ultimately, the authorities of South Korea and other countries like Japan ended up regulating the crypto market to ensure investors can invest in a safe environment wherein exchanges are licensed, user funds are protected, and the market can operate in a transparent manner.

It is more difficult to prevent money laundering and the usage of cryptocurrencies in an unregulated market than a strictly overseen market because most major cryptocurrencies like bitcoin are not anonymous by nature.

Why India is Taking Such a Hard Stance on Crypto

The RBI’s exclusion of crypto from its regulatory sandbox framework clearly demonstrates the lack of intent of the authorities in India to acknowledge cryptocurrencies as an asset class and as a payment system.

A central bank could consider cryptocurrencies a threat as they enable users to initiate peer-to-peer transactions and circumvent the services provided by banks.

However, in January, the Financial Stability Board, an inter-governmental body involving the government of India said that cryptocurrencies like bitcoin do not pose a threat to the global financial system.

At the time, Nischal Shetty, CEO of WazirX, an Indian cryptocurrency exchange, told Quartz that India most likely does not see cryptocurrencies as a priority and as an asset class that does not need regulation in the near-term.

“Sometimes, no regulation is not bad news. It probably means that the government of India does not see cryptocurrencies as a matter of immediate concern, or something that needs to be regulated right away. This at least means that fears of a ban are not imminent,” Shetty said.

An issue with the approach of the RBI is that if the government of India does regulate the crypto in the future, which still remains uncertain especially after the release of the draft regulatory sandbox framework by the RBI, it will be difficult for the local crypto market to recover and re-establish infrastructures that previously existed.

[ad_2]

Source link