[ad_1]

There is this unfounded believe that Bitcoin would die in the future while altcoins would flourish. However, market experts are coming out, proving otherwise that the ultimate “death” of Bitcoin would drag altcoins with it.

Bitcoin Decides the Direction of The Crypto Market

As it is, Bitcoin was the first cryptocurrency created, and it is still the leading digital currency dominating market share as well as being the most capitalized. If anything, price fluctuation usually determines the flow of most altcoins. That’s exactly what a Twitter user, The Crypto Monk is trying to put across: “If you think $BTC will never recover, don’t expect your $alts to do so. I’ve seen many newcomers over the past months thinking $BTC could die while their alts with “new super technology” would resist and skyrocket. Whatever the tech is behind, $BTC is the king in this town.”

The bold trader pointed out that despite the progress made by other cryptocurrencies in terms of technology and adoption, Bitcoin remains the king in the crypto space and it usually decides the directional movement of the altcoins.

Read: Altcoins Start to Dump, Is

Bitcoin Ready to Make a Big Move?

This point was supported by

Chakradhar Reddy, a computer science engineer, and a tokenization expert who

stated that despite the progress made by altcoins, Bitcoin is still the leading

cryptocurrency. He added that use cases are necessary to sustain any token.

There are some crypto enthusiasts who

believe that altcoins such as XRP have the potential to overtake Bitcoin as the

leading digital currency. But even if it is a possibility, it will be an uphill

task considering the deep gulf in market valuation and perception between the

two. Presently, Ripple (XRP) is struggling with security and centralization

claims but Bitcoin has been given a clean bill of health. The Crypto Monk supports

this view, saying: “There are still “large accounts” thinking that alts can

decouple and BTC can die without impacting their alts. $BTC is still the king

in this town. If you still don’t understand this, quit trading crypto and stick

to legacy market.”

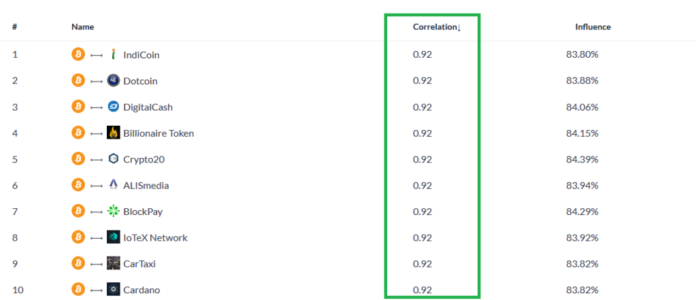

The Direct Correlation Effect

The point made by The Crypto Monk is

very valid as data pulled from Coinpredictor shows that there is a high

correlation between the cost of Bitcoin and other cryptocurrencies. A look at

the platform indicates that Bitcoin has a relationship of over 80 percent

against virtually all other cryptocurrencies.

This is an indication that the Bitcoin price affects the prices of altcoins 80 percent of the time. With such a huge correlation, it is clear that it would be tough for other cryptocurrencies to achieve significant price increase without the help of the leading digital currency.

There have been many reports written

regarding the correlation between BTC price and that of altcoins, with

different reasons given for this connection. The primary reason given was that

Bitcoin is the most liquid cryptocurrency at the moment, with a market

dominance of over 50 percent. For this reason, Bitcoin is still the most

attractive cryptocurrency for investors.

Also Read: Bitcoin (BTC) To Stagnate In

$5,000 Range If History Repeats Itself. And That Isn’t Bad

In addition to that, most

cryptocurrency exchanges have BTC as the most popular cryptocurrency trading

pair. With that in mind, trading cryptocurrencies involve traders using BTC to

buy a digital currency and vice versa. In this regard, Bitcoin currently plays

the role of US Dollars in the cryptocurrency space.

Bitcoin has established itself as the

most dominant cryptocurrency, and despite the progress made by the altcoins

over the years, BTC would still be considered as the primary trading pair, and

it would even affect the prices of the other cryptocurrencies. At the moment,

the other leading cryptos do not have the popularity to challenge Bitcoin in

these aspects.

[ad_2]

Source link