[ad_1]

Based in San Francisco California, Coinbase may have achieved the strongest brand recognition amongst cryptocurrency exchanges since its founding in 2012 by Brian Armstrong and Fred Ersham.

It has since grown from a small-medium enterprise (SME) into something much larger, employing more than 500 people and growing rapidly over its seven-year history, to where it stands today garnering an $8 billion valuation.

In this step-by-step guide, we will take a look at how to set up your account on Coinbase, how to purchase cryptocurrency using your fiat loaded funds and how to send/receive funds as well as the various key security features you should be aware of.

Signing up

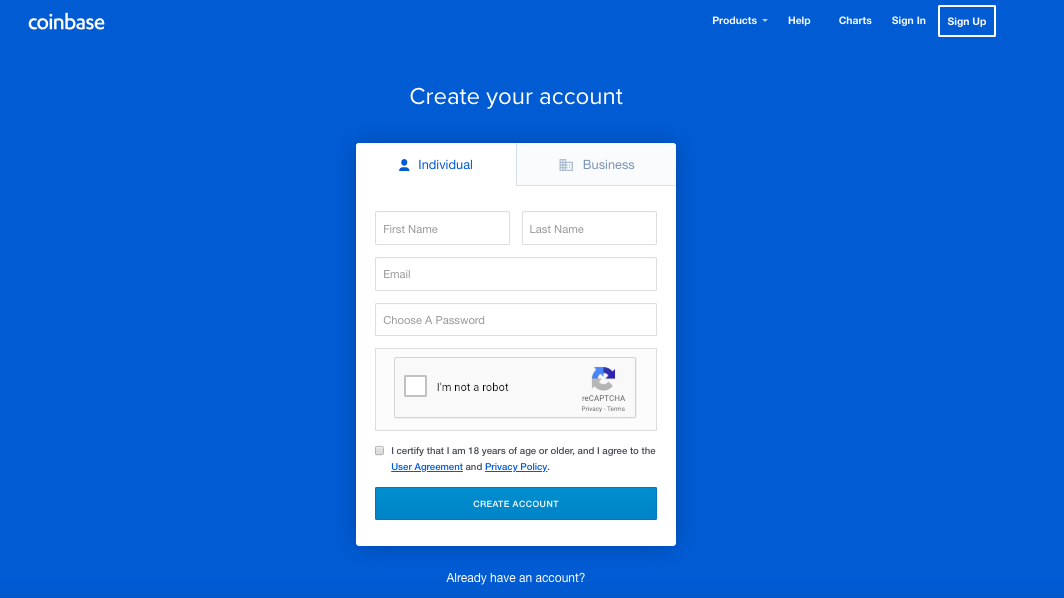

In the top right corner click on “Sign Up” and fill in your basic information such as name, email, and password then select “I’m not a robot” and “Create Account”.

Unlike Binance, which does not require a KYC verification, Coinbase specifically requests that you go through its identity verification process before making your first purchase.

Their user agreement specifies age limitation (18+), KYC requirements and fees, so be certain to check it out to ensure you meet their legal and policy standards.

Upon signing in for the first time you will be prompted to enter your desired payment method to start purchasing cryptocurrency from the exchange.

This is where you can link up your credit/debit card (don’t worry, you won’t be making any purchases just yet, nor will you be charged a fee) but it is good for now to get out of the way since the system prompts you to input your details automatically upon the first log in.

When you have finished entering your card details on the pop-up screen you’ll notice that the next section is asking you to verify two pending holds.

Log in to your banking application/website and view your transaction history to see how much is pending from “Coinbase UK“, then enter the two highest values in the pop-up screen to verify your card.

Once you have established your payment method, enter a mobile number as part of the security process for your account.

This is important because you need to send a verification SMS to your mobile phone in order to confirm your account and make important changes later on.

ID Verification

After you have set up your account and attached your payment method via the system’s automatic prompt, you will need to verify your identity before you can make a purchase.

This is set up in order to ensure maximum buyer protection and to help guard against identity fraud while increasing overall security.

It is important you take time setting up your other security features such as two-factor authentication (2FA) (more on this later).

The first time you click the “Buy/Sell” tab located directly next to the “Dashboard” tab you will be prompted to submit formal ID.

You can choose between your passport or drivers license; for the purpose of this guide, we chose to select a drivers license.

The system should be compatible with most countries’ automotive registries and thus verification via this method should take as little as 5 minutes.

Once you have been verified you will receive an email notification telling you that you are ready to start making your first digital currency purchase on the exchange.

Security

Under the “Settings” tab click “Security” located just below that and you will see a button labeled “Enable Authenticator”. Two-factor authentication (2FA) refers to an additional layer of security whereby the user is required to provide a code sent to their phone via SMS and/or an authentication app. Google’s well known “Authenticator” app located in the Google Play store and iTunes is free to download.

Upon clicking the “Enable Authenticator” you will be sent an SMS with a code to input.

Next, scan the barcode with your mobile with the aforementioned “Authenticator” app open.

A secret code will also be provided so be sure to store that on a portable storage unit, away from prying hands.

Once complete you will be sent a final SMS informing you that your 2FA has changed, from here on out, it will nigh impossible for individuals to crack into your fund.

Depositing Funds

Unlike certain exchanges which require a larger fixed lump sum payment each time you want to load funds to your account, Coinbase supports any specific amount you wish to deposit in your local currency (just be mindful of the fees involved).

The exchange also currently offers up to 9 different cryptocurrencies to choose from including bitcoin (BTC), ether (ETH), litecoin (LTC), bitcoin cash ABC (BCH), Zcash, BasicAttentionToken (BAT), USDC, 0x (ZRX) and ether classic (ETC).

To make a purchase head over to the “Buy/Sell” section, located by clicking the tab in the menu bar.

In this example, we used $100 to purchase bitcoin, which in turn gave us 0.02017936 BTC to trade or send to another address.

As simple as that you now own a fraction of bitcoin stored locally on the exchange which can be traded to various other wallet addresses.

The process for selling your crypto is the same as is buying, however, you will need to enter the specific cryptocurrency amount before you can convert all of your funds back to fiat.

The Dashboard

The “Dashboard” provides key information relating to your portfolio, recent activity as well as your total balance and is your ‘go-to’ page for viewing a quick summary of the markets.

The “Your Portfolio” section illustrates how much you currently hold including the total balance while the “Following” section up above, displays recent market activity.

The “Tools” section provides you with a collection of addresses. New addresses are automatically generated for each payment on Coinbase and stay associated with your account forever (so it is safe to reuse them).

Granted, a lot of the charts and additional information feels quite limited when compared to that of Binance or the Kraken exchanges but with Coinbase’ seamless approach and easy to navigate user experience (UX) it could be the one for you.

Limitations

As such, Coinbase does not currently offer the service to sell their crypto in particular countries so be sure to check out the list, because once you have purchased crypto on their platform you will be unable to convert back to your local currency if unsupported.

Withdrawal

A cryptocurrency on/off ramp is an exchange that provides a service to convert crypto back to fiat and vice-versa, whereby traditional fiat is directly credited back into your bank account at the press of the ‘sell’ button.

All you need to do is locate an exchange relative to your country that supports such a service and enter your wallet ID from that exchange. For example, Australians can use BTC Markets as a way to convert crypto back into Australian Dollars (AUD).

In the case of wanting to transfer funds to an offramp, you will need to locate the wallet address of that particular exchange.

This shouldn’t be too hard to find, provided you have an account set up and a wallet address to send to.

Once you have the address from the other exchange, navigate to the crypto you recently purchased, located under Coinbase’ “Accounts” tab in the menu header.

Enter the wallet address and click send and that’s it, you will now receive your funds via the other exchange with the ability to convert from your crypto back to your local currency.

Reminder: Transfers between exchanges can take anywhere between 1-10 minutes (depending on the crypto you’ve chosen)

Pros and Cons

Pros

- A simple and intuitive platform that features a beginner-friendly user design.

- Great for those just getting started in cryptocurrency and want as little fuss and hassle as possible.

- Coinbase supports any specific amount you wish to deposit, making dollar cost averaging attractive and easy.

Cons

- Coinbase does not currently offer the service to sell their crypto in particular countries. Once you have purchased crypto on the platform you will be unable to convert back to your local currency if unsupported.

- Higher fees than other exchanges on offer.

- Limited cryptocurrency trading options and assets.

[ad_2]

Source link