[ad_1]

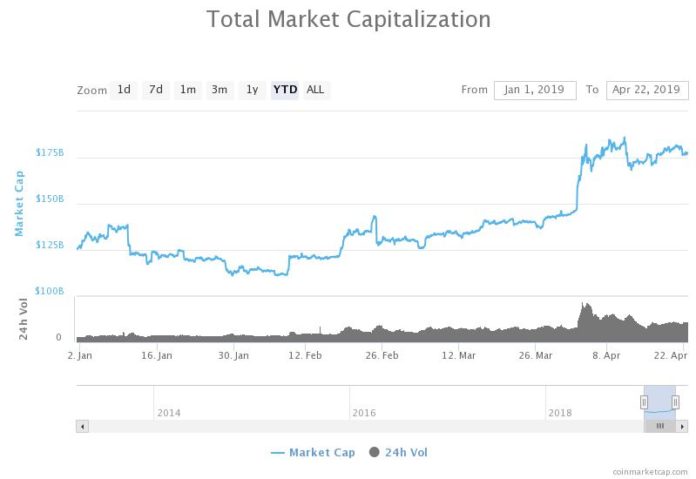

Since January, in less than four months, the valuation of the crypto market is up around $52 billion from $125 billion with the bitcoin price comfortably hovering above the $5,300 mark.

Historically, alternative cryptocurrencies, or altcoins, have performed particularly well when bitcoin demonstrates a sideways price movement or remains stable in a tight price range.

The valuation of the crypto market is up nearly $52 billion year-to-date, boosted by the positive sentiment around bitcoin (source: coinmarketcap.com)

While bitcoin has been relatively stable in the $5,200 to $5,300 range, due to the lack of upside momentum of altcoins, some traders have become less confident in the near-term prospect of altcoins.

Will Bitcoin Dominate?

According to a widely recognized cryptocurrency trader, the altcoin market failed to test a key resistance level during the weekend, unable to secure new momentum to extend last week’s gains.

“Both were rejected from resistance, altcoins a bit harder. A lot of my confidence in altcoins the past few days was predicated on smallcap dominance being able to break up. After this rejection, I’m significantly less interested in altcoins. Shifting my portfolio heavier skewed to BTC,” the trader said.

In the past 24 hours, many tokens in the likes of Basic Attention Token (BAT), Crypto.com Chain (CRO), Ravencoin (RVN), and Golem (GNT) have recorded losses in the range of 5 to 11 percent against both bitcoin and the U.S. dollar.

Other traders have also suggested that as the momentum of altcoins slows down, bitcoin could also retrace slightly in the upcoming days, purely based on technical indicators and the performance of bitcoin in the past week.

Hsaka, a technical analyst, said that a retest of the $5,160 support level is expected for bitcoin and that the short-term price movement of the dominant cryptocurrency remains uncertain at the current juncture of the market.

“Expecting a test of the 5160 level. Since it’s already been tested twice, will watch PA on the LTFs to determine whether I take a long or not,” the analyst said.

In consideration of the past performance of bitcoin and its current volume, another trader said that there exists a possibility bitcoin drops below the $5,000 level.

But, the trader said that a strong recovery is likely to follow the retracement, adding:

Fractals are more unreliable than usual patterns, but still shouldn’t be ignored. Typical correction for altcoins if this happens followed by a stronger recovery once price settles.

Based on this daily fractal we should get another chance to buy $BTC at $4600-$4800 levels before the next run to $6800.

Similarities in both candles and volume. pic.twitter.com/IGivErxz5Q

— Galaxy (@galaxyBTC) April 20, 2019

According to OnChainFX, the real volume of the bitcoin market measured by evaluating the daily volumes on eight exchanges identified by Bitwise Asset Management that includes Binance, Bitfinex, and Kraken, the volume of bitcoin remains fairly high at $315 million.

Last month, in its research presented to the U.S. Securities and Exchange Commission (SEC), Bitwise estimated the daily spot volume of bitcoin in March 4 to 8 to be $273 million.

4/ Total daily spot volume is about $270M—95% less than reported. pic.twitter.com/kILQcqOlQR

— Bitwise (@BitwiseInvest) March 22, 2019

“When you remove fake volume, the real BTC volume is quite healthy given its market cap. Gold’s market cap is ~$7T with a spot volume of ~$37B implying a 0.53% daily turnover. Bitcoin’s $70B market cap would imply a 0.39% daily turnover, very much in-line with that of gold,” the Bitwise team said.

Potential Variables

If the volume of bitcoin can be sustained in the upcoming weeks at over $300 million, it is possible that the asset manages to stay above $5,300 despite the presence of key resistance levels in the $5,000 to $6,000 range.

Some reports from major markets in South Korea also suggest that the confidence of investors in the medium to the long-term performance of the crypto market has increased in recent months.

[ad_2]

Source link