[ad_1]

March has been a positive month for the cryptocurrency market on the whole. The 31-day period saw the cryptocurrencies’ combined market capitalization dropping to as low as $125.09 billion, and rising to as high as $146.39 billion.

A majority of the crypto-assets performed exceptionally well while a handful of them lost significant value. Below are the best and the worst crypto performers, measured by their market performance, spanning from March 1, 00:00 UTC, to March 31, 23:59 UTC, and as well as their volume distribution, liquidity, and market fundamentals.

Best Performing Cryptocurrency: Tezos (XTZ)

XTZ, a native token of the Tezos blockchain, closed March at $1.031, which was circa 152% up from its month’s open. At the same time, the project attracted almost $472 worth of investments to its overall valuation from both crypto and fiat markets. XTZ surged as much as 120% against the leading cryptocurrency bitcoin in March.

Meanwhile, US-based Kraken crypto exchange noted considerable volumes from the euro and the dollar markets coming into XTZ. The coin’s upside action proved that a majority of these trading activities were long positions, meaning investors were extremely bullish on XTZ this entire month.

A major part of traders’ bullish sentiment came from Coinbase. As CCN reported, the San Francisco-based regulated crypto firm announced that it was launching a block staking program on Tezos. The new service promised that it could generate up to 6.6% returns annually if investors stake their XTZ tokens via Coinbase Custody to support Tezos’ proof-of-stake blockchain. Coinbase also confirmed that it would keep the clients’ XTZ assets in secure cold storage while staking its XTZ holdings on behalf of investors. The move made Coinbase staking service attractive to the institutional investors’ class.

[Special Mention to Ravencoin’s RVN, which surged more than 240% in March, despite moderate fundamentals.]

Worst Performing Cryptocurrency: Bitcoin SV (BSV)

Yes, other cryptocurrencies performed worse than Bitcoin SV. But a majority of them were underdogs, with lower market capitalizations and lower daily volume. We tried to assess the worst cryptocurrency which didn’t perform well despite its inherited fruitfulness, i.e., high market capitalization, significant market presence and social media hype, and decent reported volume.

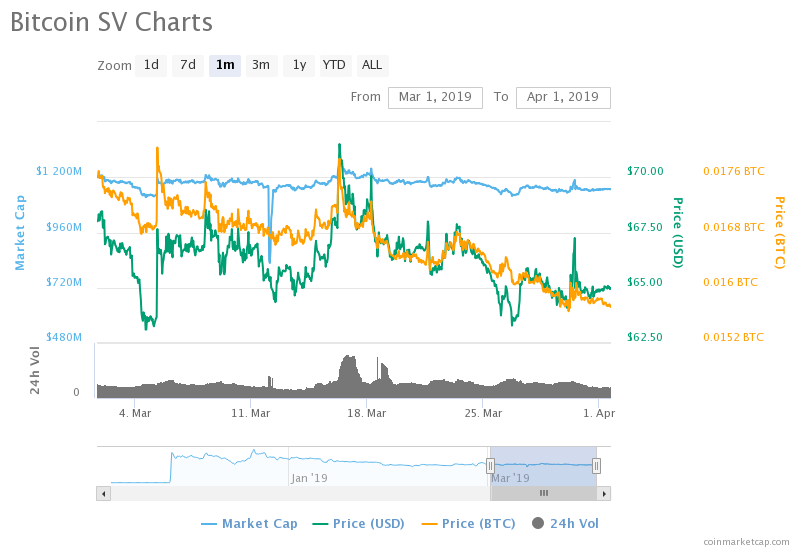

Bitcoin SV’s BSV lost as little as 1.86% in March, but its losses against bitcoin were higher – nearly 9% at the month’s close. Constant trolling other blockchain projects could be the reason why a majority of investors maintained their distance from the BSV market.

Atop that, Dr. Craig Wright, the brain behind the Bitcoin SV project, ragequitted Twitter and threatened lawsuits against people who didn’t accept him as Bitcoin creator Satoshi Nakamoto. He even went a step further and claimed that he could destroy privacy coins like Monero and ZCash. He added that he would help the Feds cracking down on privacy coin users.

Just at the end of March, the Bitcoin SV mining community reported that they had mined a 128 MB block. The BSV market noted a hiccup-like spike right around that time, which woke and settled down on intraday levels.

[No So Special Mention to Edgeless’ EDG coin which dropped the maximum this March – about 38.66% against the dollar and 43.31% against the BTC.]

[ad_2]

Source link