[ad_1]

Fundstrat Head Proclaims Crypto Winter Over, Expects Bitcoin Rally

Forget the FUD, Tom Lee of Fundstrat Global Advisors is still decidedly bullish. In a CNBC “Futures Now” segment released prior to this recent news regarding the legitmacy of Tether and Bitfinex’s financials, the Bitcoin (BTC) permabull explained why he is still bullish on this asset class, and why he expects for BTC to see new highs in the coming 20 months.

Lee explained that there are “11 signs” that only take place in crypto bull markets, and some of those have been recently shown their faces. The analyst, who heads Fundstrat’s research division, looks to on-chain transactional volumes, which have purportedly turned positive on a year-over-year basis; Bitcoin crossed above its “big technical hurdle,” the 200-day moving average, and a golden cross was formed just days later, and over-the-counter (OTC) exchanges have seen an uptick in trading volumes. On the matter of the last point, he elaborated:

We surveyed OTC brokers, who are really important in facilitating institutional investors, and they’ve all talked about a 60% to 70% increase in activity/number of clients and trading volume per client. Fundamentals are improving; technicals are improving, and activity by HODLers too.

This, in the eyes of Lee, are signs that BTC could start to enter a state of “spring” after a brutal winter. He concludes that by 2020, Bitcoin is “likely” to see new all-time highs at last. But what will drive this move?

As Lee pointed out in previous mainstream media appearances and social media posts, the fact that “old whale wallets are buying Bitcoin” as “a lot of positive things take place” in the industry is a sign that $14,000 is fair for BTC.

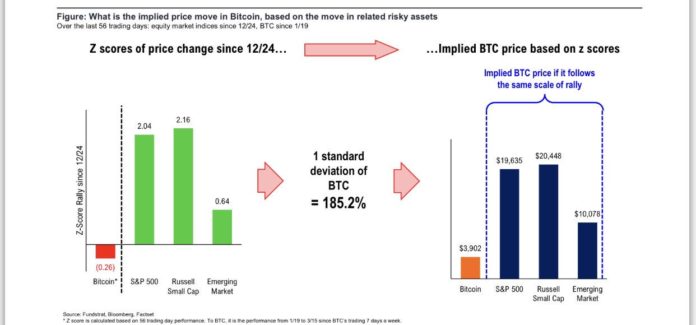

He adds that the MSCI Emerging Markets Index, pulled down BTC over 2018. More specifically, this specific index fell by 27% over 2018, as Bitcoin lost 70%. But with Fundstrat predicting emerging markets to outperform U.S. equities over 2019 and considering the seeming correlation, Lee wrote that if BTC “catches up” to macro markets, it could reach as high as $10,000 or $20,000.

Reasons To Still Be Bearish

However, some are sure that there remain reasons to be bearish on cryptocurrencies at large. For instance, the recent Tether and Bitfinex news, which revealed that the two entities are under investigation by the New York Attorney General’s office for purported “fraud,” shows that this market remains nascent at best, meaning that it might not be ready to see an influx of capital.

Technicals, too, aren’t looking all too great. Financial Survivalism recently explained that the recent action in the TD Sequential and Relative Strength Index (RSI) indicators looks almost identical to that seen in early-December, but entirely inverted.

Thus, if history is followed, Bitcoin could see a “prolonged period of consolidation,” which could happen between $4,200 and $5,800. He adds that if BTC falls under its 50-day and 200-day exponential moving averages (EMA) at $4,700, the golden cross would be deemed invalid, setting the stage for a potential move lower.

Title Image Courtesy of Dmitry Moraine Via Unsplash

[ad_2]

Source link