[ad_1]

By CCN.com: One of Japan’s largest online brokerages, Monex, may soon allow retail investors to buy bitcoin and other cryptocurrencies on its platform.

Monex claims the move into cryptocurrency will help claw back its diminishing market share.

Speaking to Bloomberg, Monex Securities president Yuko Seimei said:

“We’ve fallen a little behind — we can’t deny that… If we keep doing things the way we have, we may not be able to close the gap.”

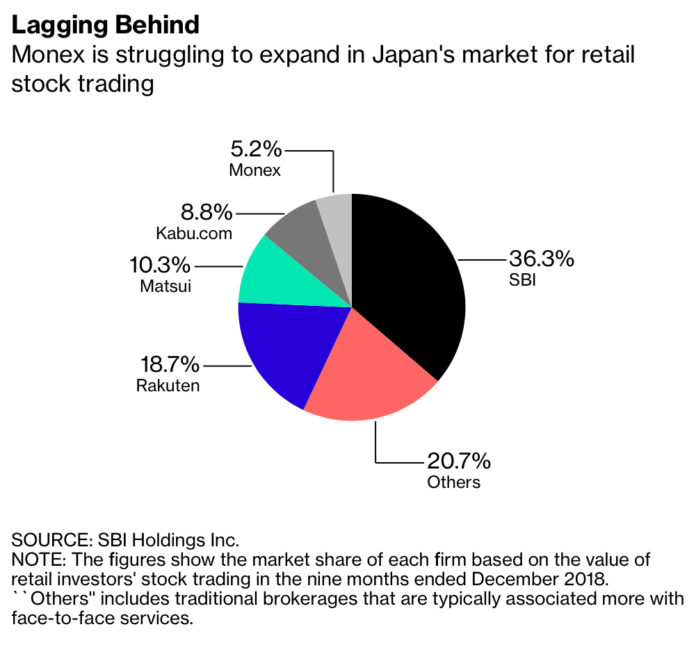

Monex has fallen behind its rivals SBI and Rakuten in market share of online retail investors. Source: Bloomberg

Monex: Banking on Bitcoin?

Monex was once the leading online brokerage in Japan, but its market share has been eaten away by rivals SBI and Rakuten, both of which have embraced cryptocurrencies in a big way.

Monex now commands just 5.1 percent of the Japanese digital brokerage market compared to SBI’s 36.3 percent and Rakuten’s 18.7 percent.

Seimei believes cryptocurrency may unlock a huge new user base for Monex, and help close the gap on its rivals.

Rivals SBI and Rakuten Surging Ahead With Crypto Adoption

Japan’s leading brokerage, SBI, has been closely involved with cryptocurrency in recent years, helping it eke out a lead in the nascent field. SBI launched its own cryptocurrency exchange platform VCTRADE in 2018, before announcing a foray into bitcoin mining this year.

Rakuten Wallet Launch Announced for March 30, 2019 https://t.co/x6aoMBus2b

— CCN.com (@CCNMarkets) March 25, 2019

Rakuten, the second-largest retail stock platform, has also embraced bitcoin. Rakuten purchased a crypto exchange in 2018 and recently announced the launch of a crypto wallet.

Monex: Powered by Hacked Bitcoin Exchange Coincheck

Monex’s manoeuvre into cryptocurrencies will be powered by its controversial acquisition of Coincheck. Coincheck was subject to one of crypto’s biggest ever hacks in 2018, when $500 million worth of crypto was stolen from the platform.

Coincheck’s exchange license was re-approved in January after Monex’s $33.5 million acquisition. Monex will now tap the Coincheck platform, possibly using the exchange to introduce retail investors to bitcoin.

Mainstream Crypto Trading Adoption Slow but Steady

Monex’s crypto initiative is yet another sign of “big money” testing the waters of bitcoin trading. As CCN reported, Nasdaq is expected to launch a bitcoin futures trading platform this year. We’re also expecting the New York Stock Exchange’s parent company ICE launch a crypto trading platform, Bakkt.

Having major names like Nasdaq, NYSE, SBI, and Monex behind crypto trading platforms will give retail and institutional investors some much-needed confidence in bitcoin after years of hacks.

[ad_2]

Source link