[ad_1]

Block Society, the startup that went viral when it became the first ever cryptocurrency-focused SEC-Registered Investment firm has just concluded its first month of operation. In that short period of time, the firm has hit some pretty incredible goals.

Interest in the firm’s services has been astonishing and growth in membership has been exponential. The organization reports over 100k unique visitors on their site in the past month with peak daily of 10k. Speaking with current members it is clear to see an extremely high level of satisfaction with Block Society’s services. Block Society operates the Academy of Technical Analysis, a TA-focused training program that is available to Gold and Platinum members. Feedback of the academy has been overwhelmingly positive and, according to Block Society’s public forum, three students have already passed the first two levels of testing. Students report being extremely satisfied with both the content of the training and their personal portfolio growth.

By the numbers

When it comes to analyzing investment firms, numbers are key. Let’s take a look at some of Block Society’s recent statistics*:

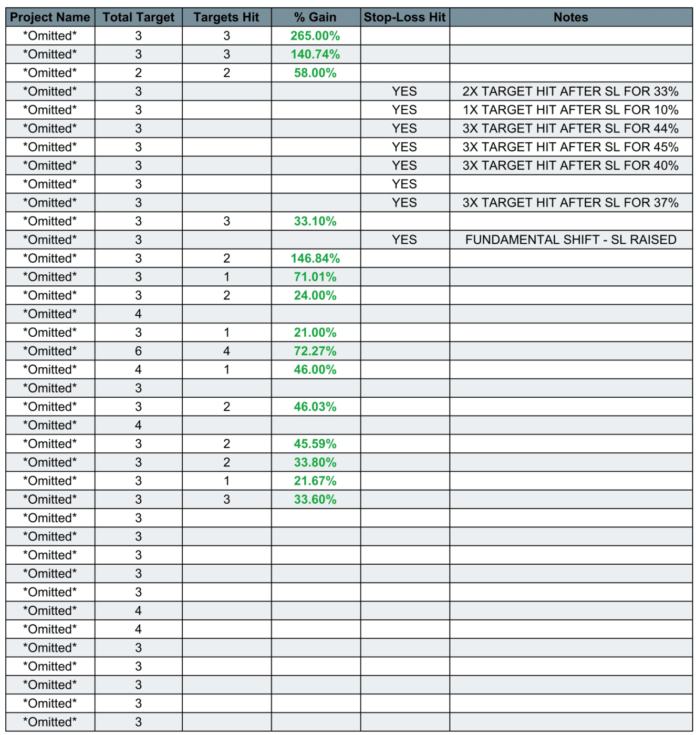

- In the month of March, Block Society published 17 trade signals with 53 total targets. 11 targets have hit for a total of 167.76% gains. Only one project was stopped out and that was a result of Stephen Harano, the Chief Operating Officer and Lead Analyst, pushing out a change advisory indicating investors to get out of the trade due to a shift in project fundamentals. The stop-loss was raised to the entry point and investors were urged to get out of that project resulting in only a loss of the exchanges’ trading fee.

- Additionally, four signals that were published prior to March 1st have hit all 11 of their targets for an aggregate 533.1% total gain — 265% via ENJ, 140.74% via THETA, 58% via IOST, and 33.1% via CND. Although those projects went for significantly higher gains, Block Society’s strategy is to mitigate risk by securing profits at a specified point while leaving the excess profits on the table due to the inherent volatility risk.

- Since the establishment of Block Society’s trade signals in December (made available to Early Adopters), there have been a total of 38 trade signals published for a total of 122 targets. 32 targets hit with an aggregate 1058.65% in total gains. Block Society enjoys a 78.95% success rate based on trades; 80.33% success rate based on targets. Eight of the 38 trade signals hit their stop-losses, thereby triggering sell orders to get out of the trade. Each stop-loss is set such that only 2% of a person’s portfolio is risked in the trade. At the absolute maximum, a person would’ve lost just 16% of their entire portfolio from the stop-losses of all eight trades – a negligible amount considering the offsetting gains of other suggested trades. Of note, those eight trades had a total of 24 targets; 15 of those targets were hit after the stop-loss for what would have been a total of 209% gains. This indicates that the trade probability was still very high, but that the stop loss was set tight in an effort to help mitigate risk.

An analysis of the firm’s recent trading signals yields the following results:

Trade Signal Performance

Block Society currently has 25 active trade signals with 67 targets remaining to be hit. The percentages below show their current status. The percentages in red are newly published trade signals that are still in the available entry window as most of Block Society’s trades are published with advice like: “Enter this trade below XXXX price.” As such, the green percentages are the minimum gains members would have had they entered the trade at the highest possible cost. However, many members enter the trades well below the maximum entry point and therefore enjoy higher returns than what is listed here.Current Trade Signals

*Disclosure: all percentage gains are reflective prior to deduction of any third party exchange trading fee and the Block Society monthly subscription fee which is flat rate and not dependent upon the number of trades taken, profits, losses, or associated transactions. There are no hidden fees outside of the monthly subscription levels. In keeping with Rule 206(4)-1 “The Advertising Rule” under the Investment Advisers Act of 1940, the below trades are not cherry-picked and include all wins and losses for the outlined time period ensuring no misleading performance results.

This is a submitted sponsored story. CCN urges readers to conduct their own research with due diligence into the company, product or service mentioned in the content below.

[ad_2]

Source link