[ad_1]

The Fed just can’t seem to strike the right chord in the current economy.

Economist Mohamed El-Erian, who was reportedly considered for a Federal Reserve spot, has a bone to pick with central bankers. In just three short months, the Fed has done an about-face on the strength of the economy, giving investors around the world whiplash. Allianz’s chief economic advisor believes that the pendulum has swung too far in the direction of a cooling economy after previously swinging too far the other way.

He told CNBC:

“I think they went a little too far. In the fourth quarter, they certainly were too hawkish … and now I think they have swung too dovish.”

The former PIMCO CEO believes that the Fed’s tone is fueling volatility in the global markets.

Good morning. Wishing you all a wonderful weekend.

Here’s the clip from yesterday’s CNBC Asia interview. (And, in quite a departure for me 😱, I tried to do the interview with no tie and standing up. Won’t do that again 😀)https://t.co/xSAwjJs0RY #economy #markets #asia @cnbc— Mohamed A. El-Erian (@elerianm) April 12, 2019

U.S. GDP Will Grow As Much as 3%: El-Erian

The Fed can’t seem to get out of its own way. After raising interest rates for four times last year, they pulled back the reins in Q1 2019 amid slowing economic growth. Not only did the Fed hold tight but they signaled that there would be zero rate hikes in 2019. While the position has fueled investors’ appetite for risky assets, it’s also painted a picture of a U.S. economy that’s much worse off than it actually is, if you ask El-Erian.

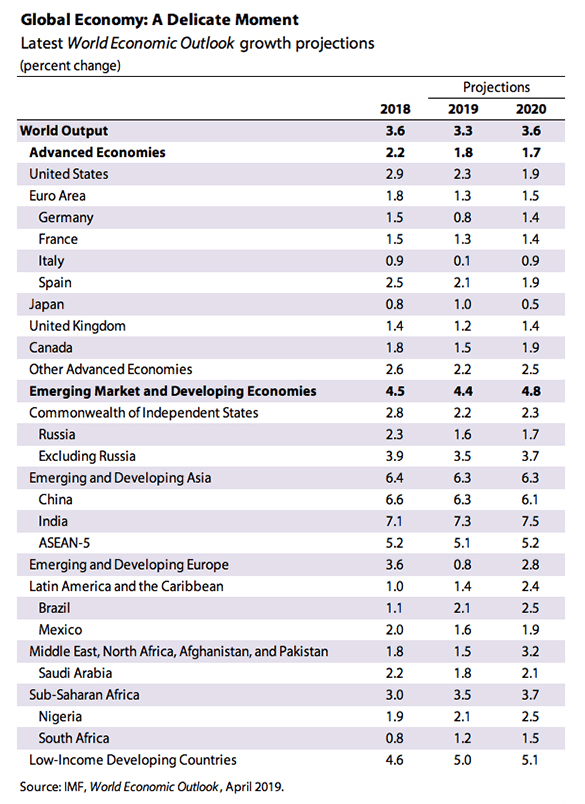

When times are good, the Fed tends to keep interest rates higher. But when times are bad, they either slash rates or leave them unchanged. The IMF has revealed that Europe’s economy is slowing, particularly across “Germany, France, Italy, and Spain.” Meanwhile, China’s economic growth is uncertain. The U.S. economy, however, is still operating on all cylinders. Allianz’s El-Erian is predicting GDP growth in a range of 2.5%-3% this year versus 2.9% in 2018.

Fat Chance of a Recession!

El-Erian believes that not only is the economy clear of an economic recession in 2019 but contraction isn’t threatening for 2020, either — unless the Fed screws it up. Many of his economic peers are spooked that the yield curve inversion in the bond market is predicting a recession. While El-Erian understands their fears, he’s not joining the chorus. Instead, he chalks bond market conditions up to “peculiar technicals in the market” fueled by a one-two punch of conditions in Europe’s economy and the Fed, not a reflection of the economy.

“This economy, unless it gets disrupted by a major policy mistake is on its way to 2.5% – 3% growth for this year,” he told CNBC in a recent interview.

He’s impressed by the job market and wage growth. And while the tax cut stimulus is waning, it’s being offset by a government and businesses that are spending money.

“This economy still has momentum for this year. There’s no way you’re going to get a recession.”

Hopefully, the Fed is listening to El-Erian.

[ad_2]

Source link