[ad_1]

Ethereum (ETH)–According to Etherscan data for Feb. 11, daily mining rewards for the second ranked cryptocurrency by market capitalization Ethereum have fallen to their lowest recorded levels.

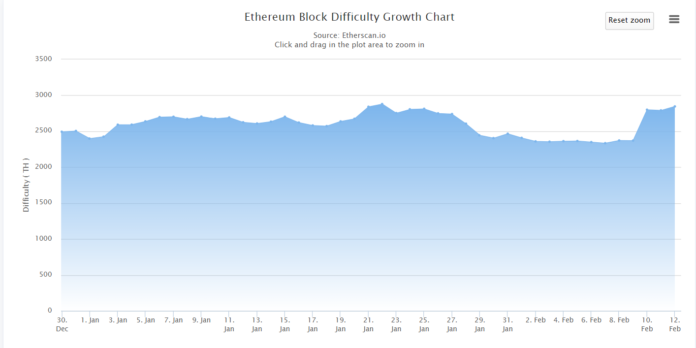

While ETH has rallied alongside the rest of top ten currencies, even propelling itself above XRP to reclaim the second largest market capitalization, the coin is now experiencing its lowest levels of new coin minting since the data was first tracked. On February 10th, 13,370 ETH was created, a substantial drop from new coin creation logged in December 2018 at over 20,000 ETH per day. For comparison, the all time high of ETH mined in a single day occurred on July 30, 2015 when over 39 thousand new coins were forged into existence. Etherscan data reveals that the sudden and severe drop in ETH mining is the result of an increase in Ethereum mining difficulty.

While investors and ETH miners have anticipated an increase in mining difficulty, and subsequent decrease in mining reward, the change comes as a bit of surprise. In August 2018, Ethereum’s primary developers concluded a meeting with the decision to increase the mining difficulty for the coin, dubbed at the time the “difficulty bomb” to be delayed until the launch of the long-awaited Constantinople hard fork. The intention of the difficulty bomb is to increase the Proof of Work mining required in obtaining an ETH reward, thereby reducing the daily amount of ETH being added into circulation.

Alternatively known as Ethereum’s Ice Age, the difficulty bomb accompanying the fork will require more computing power on average for similar payout in ETH, requiring miners to invest more resources while easing the inflation of ETH–a move that current investors will likely applaud. The move is also being implemented with the intention of preventing miners from obtaining ETH through the traditional method once the coin and its public blockchain switch to a Proof of Stake (PoS) algorithm. PoS, compared to Proof of Work favored by other large currencies such as Bitcoin and Litecoin, rewards investors and collectives for “staking” their coins on the network, thereby reaping the reward of dividends paid out in proportion to the number of coins staked.

However, some miners are continuing to labor on the ETH blockchain, anticipating even further delays of the Ethereum-based PoS integration which has already been postponed on several occasions. In order to further dissuade miners and encourage staking, Ethereum’s developers also intend to implement a “thirdening” with the Constantinople update, which will reduce ETH mining rewards per block from their current three coins to just two.

If Ethereum developers continue to push back the hard fork, PoS integration and “ice age” difficulty spike, the current ETH miners stand to benefit the most. A further delay in increasing ETH mining effectively makes the coin more profitable to mine at present, even if the updates are waiting on the horizon.

Ethereum, which has managed to hold the second largest market cap position for the most of the last year, saw a steep decline throughout 2018 with cryptocurrency’s ongoing bear market. While coin prices across the board suffered, ETH in particular fell on hard times as a result of the waning ICO market and decreased demand for ERC-20 based tokens. The Ethereum core development team and their community have responded, looking to improvements in the coin’s current operation as a way to make Ethereum a perennial contender in the digital asset space.

Title image courtesy of beatingbetting.co.uk

[ad_2]

Source link